Public opinion seems to be split into two factions: Electronic money watchers are a bubble that just breaks and those who view it as the future of the global financial system. In fact, the revolution that electronic money brings is not at the transaction value or short-term earning opportunities for cryptocurrency players but in the underlying technology behind it: blockchain. @Blockchain generates electronic money, but electronic money is not all that blockchain can produce. Considered one of the greatest inventions in decades, what's so special about this technology?

Before going into complex explanations of blockchain and electronic money, imagine a simple situation below to better understand the origin of bitcoin - the first product to use blockchain technology.

You do business everyday with paper money, and holding the money in your hand makes you believe that it is real and can be exchanged for goods and services. However, if someone sends you money and says that you have transferred, do you believe in the transaction without getting hold of the money?

That is when you have to depend on intermediaries, such as banks, online payment portals, ... to confirm credibility. These banks, payment gateways, etc., store detailed information of all transactions and additionally deduct the full amount for the parties involved. But this form will become extremely costly as millions of transactions are made every minute. According to estimates by the Economist, banks around the world have raised $ 1.7 trillion in forex trading in 2014 - equivalent to 2% of global GDP!

Learn about blockchain - the birth of electronic money: a bubble or a revolution - Photo 3.

And yet, since the gold standard came to an end in the early 1970s, the power was centered on the government and the central bank because only they were able to print paper money. The banking system benefits from an increase in the amount of money issued (causing inflation) as well as the need to convert foreign currencies of people and businesses. And when financial crises hit, governments used taxpayers' money to rescue inefficient banks. Although this is a move to prevent the collapse of the entire financial system in the country, it has also caused many dissatisfaction, including Satoshi Nakamoto, the father of bitcoin. a person or a group of people). The droplet of water is the great crisis of 2007-2008 with many scandals, financial scandal scale was exposed. It is no coincidence that bitcoins appeared right at this time. The genesis block that Satoshi explores remains the message that reflects the reason behind its birth: "The Times January 1, 2009 The previous finance minister decided to rescue the bank twice. two, "is also the same headline article in the @London Times.

Bitcoin was created to deal with these same problems with the belief that a superior currency not controlled by any organization, with almost zero global inflation and transaction costs, would break out. the dominance of the banking world as well as the change of the entire financial system today. Instead of just sending transaction information to certain banks, blockchain leverages millions of PCs on the internet to handle and store them. All transactions are recorded and cross-verified between each computer in a transparent and secure "passbook" system.

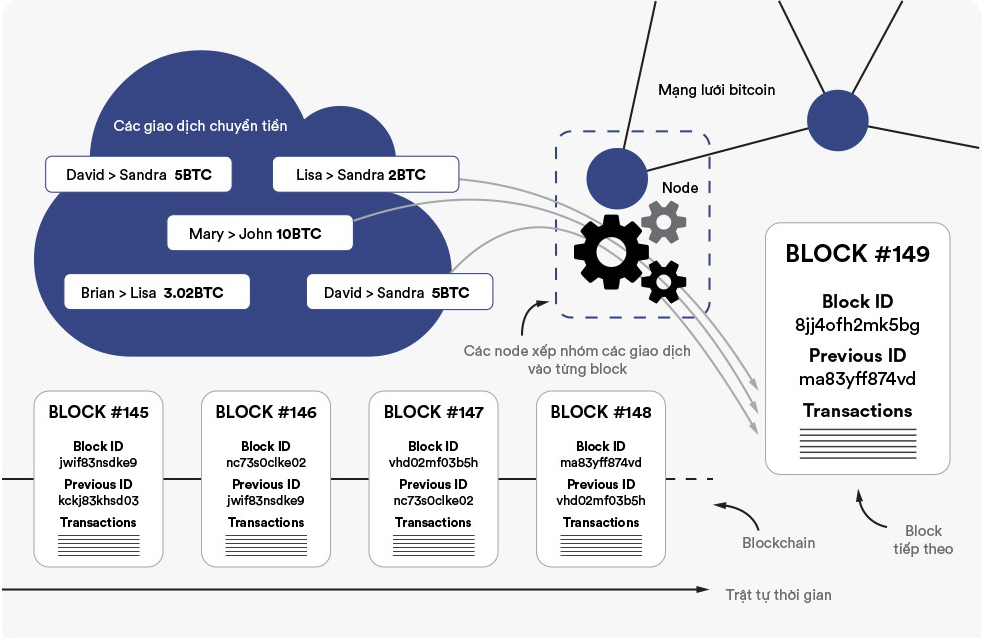

Whenever someone wants to transfer a bitcoin to another account, that transaction will be blocked into a number of other transactions and sent to all the participating computers (or nodes). The network to wait is authentic. These computers authenticate the transaction of the same sender's status (whether that's the owner of the money) by running software that solves complex system-generated problems.

The engine of the transactional computer (also known as the "digger") is nothing else but bitcoin mining. The excavators will compete against each other for transaction confirmation. The first block (or group of machines) to receive the "reward" is a certain amount of bitcoin.

Once verified, the transaction information will be saved into a new data block. The data block will be added to an existing blockchain, or an online ledger, where each computer participating in the digging network holds a copy of the public (imagine such a Common Google Docs share documents) updated continuously in real time.

Each transactional information block is associated with the preceding blocks, so the entire block chain will contain information seamlessly throughout the transaction history of the chain. Once recorded on the block, the transaction information can not be deleted or changed. Blockchain will also be constantly updated so that the information on the ledger of each person in the network are identical, so every computer can confirm who owns any coin at any time.

This decentralized data diffusion technology also makes the existence of intermediary financial institutions superfluous. Not only that, blockchain also has high security. Attacks on centralized data systems (such as banks) will be very difficult to implement for blockchain networks. For example, to hack information in a particular block, a hacker would have to hack not only that block but also all the blocks in front of it, on millions of logs in the network at the same time.

The @blockchain system is spread on millions of computers around the world, so it is virtually immune to "collapse" or interference, controlled by a single individual or organization. In general, the higher the blockchain density, the higher the security.

Blockchain specifically promotes its strength in managing and trading all types of online assets that are most commonly present in copper bitcoins.

Because of the limited amount of capital (21 million bitcoin), the demand for @bitcoin as an alternative asset for gold, foreign exchange, stock, and so on has increased dramatically. galloping since the beginning of this year. Uncontrolled by the government, without inflation and mining as gold, this currency is the lifeblood of Venezuelan super-inflation - where people barely can afford anything with their home currency. owns the largest bitcoin mines in the world. However, bitcoin also has a dilemma that the community that owns it is still debating the solution.

Currently, the bitcoin network can only handle 7 transactions per second, which is too modest compared to the 47,000 transactions VISA network can reach. The reason is that the bitcoin father has conventionally block size of 1MB so anyone can join the digging, making the bitcoin system is "decentralized", when mining is in the hands of all. everybody.

Learn about blockchain - the birth of electronic money: a bubble or a revolution - Photo 8.

But this size limits the ability to meet the ever increasing demand of individuals and businesses. As the demand grows, but the volume does not increase, the bitcoin system will be in a state of congestion due to too many pending transactions; Transaction costs will also be high. The only way to increase the size of a block is to make a bitcoin hard fork on a new block of @currency (like @Bitcoin Cash with a larger block size just released in August this year). This means that the computing power used to dig the bitcoin will also increase, leading to the tendency to concentrate and expand the mines, because only mines with capital and resources will be able to participate. . The next scenario will be that the bitcoin network falls into the dominant circle of a minority and is vulnerable to the risk of being attacked, contrary to its own viability.

The good news is that the cryptocurrency market has a flexible block size like @Ether (ETH), which is considered to be of more intrinsic value than bitcoin, because the Ether is not simply a virtual currency. It is the lifeblood of the @Ethereum platform - the brightest name in the blockchain world today.

Many argue that one of the reasons why blockchain application has not become popular is because it is too new and difficult to receive. In fact, only a small group of experts can design tools and libraries for developers to build applications based on. As James Prestwich, the CEO of startup blockchain Storj, says, as well as the way artificial intelligence can be "outsourced" through existing services, most developers will use the platform, library available to create. Own product without too deep expertise on blockchain.

The company is at the forefront of infrastructure construction today is Ethereum. Before the Ethereum appeared, blockchain applications were only designed to perform a limited number of tasks, such as bitcoin or a variety of electronic money that only served as a means of replacing money. paper. To create new blockchain applications, developers must either extend the features of bitcoin and the available applications (very complex and time-consuming), or build new applications with new block chunks. go with. Soon to recognize this inadequacy, founder Ethereum Vitalik Buterin has a more groundbreaking approach.

The @Ethereal Platform allows developers to build decentralized applications (DApp) such as social networking, hosting services, market forecasting applications, financial transactions, real estate, intelligent, ... easily and effectively with the Solidity programming language or more common languages such as Java, C ++, Python, etc. Instead of manually creating new thread strings for each new application, they It's possible to design thousands of applications on the same platform, and even turn applications from centralized to decentralized to take full advantage of the blockchain technology.

With @Ethereum, developers do not use bitcoin but use Ether (which can be hacked and traded similarly to bitcoin) to pay for these blockchain services. Up to now, more than 80 big organizations, including Toyota, Microsoft, Intel, Samsung, JP Morgan Chase, etc. have co-founded the Enterprise Ethereum Alliance to identify the new financial order for the world. Future. Members of the alliance will jointly develop enterprise software on the Ethereal platform.

The core of blockchain is "distributed" and "decentralized" - the distributed data network takes advantage of the power of the participating computer network to make the operations costly and inefficient under the operation of intermediaries. or the controlling party becomes faster, more economical and more democratic. With the introduction of the Ethereum blockchain platform, the technology is expected to generate a wave of exploration into hundreds of areas dependent on intermediaries such as banking, insurance, legal, healthcare health, public service, ... The article scope can only point to a few prominent applications as below.

Smart contracts are digital contracts written on a blockchain basis, which can be automated and allow parties to exchange virtual assets, services, stocks, etc. transparent way without the need for intermediaries or intermediary services.

Since it's a pre-installed program, smart deals can do everything themselves when the conditions are met. For example, if you rent my apartment and pay with a virtual currency, you will receive an online bill of lading indicating that only when you send money will I give you the unlock code. So, if I or you send a key or money before the date of the contract, the contract will automatically retain the key / money and transfer to the two parties on the date of appointment. Once everything is done, the contract will go away, and the code itself can not be modified by any other party. Intelligent contracts can be used in all services such as insurance, payment, debt financing, legal ... Large deals with bills of lading, papers and arbitration Prolonged management can be completely lost with automatic contracts in the future.