Global Monetary System

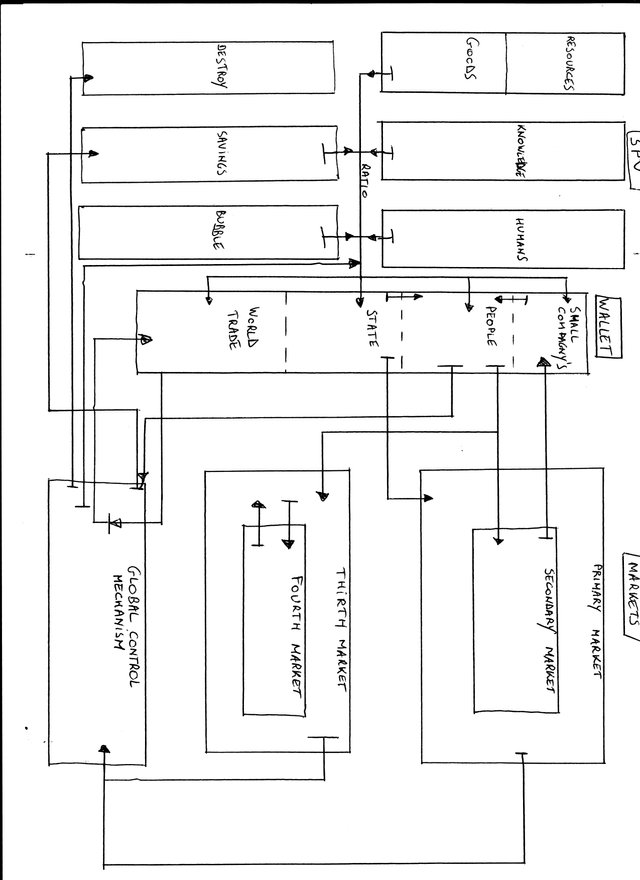

(a block diagram/flowsheet of this global crypto monetary design)

(a block diagram/flowsheet of this global crypto monetary design)

Objective

Purpose of this monetary system is to create a ‘inflationary and deflationary’ monetary system , with real executed {like : ‘Open Market Operations’ (OMO) , which are never executed now} for deflation. We need new value’s (re-valuate things) to achieve this goal. Creating ‘Special Purpose Vehicle’s’ ( a box , store of ‘old and new’ values. https://en.wikipedia.org/wiki/Special-purpose_entity Summary : Putting , what we agree are , valuable assets in a vehicle and use them as collateral to create money. Inverse way actually , we don’t make assets (structured products) from money but create money with these assets as collateral. is the collateral (counterpart) for money that will be printed. I made 3 sorts of SPV’s to get a dynamic monetary system.

One fixed SPV , which can only print money in a ratio of 1/1. (this is the commodity/good SPV) , fixed assets , they ‘re limited and barely change in number.

Two semi fixed SPV’s : saving SPV (personal saving account of humans/people) and another one : human SPV (without people there is no economy , they are the economics driving force , so ‘new’ value here , these number is also the global inflation target , not growing beyond our economic possibility’s)

Tree variable SPV’s : knowledge SPV (only inflation) (this will be used to create money for Research and Development and Education) , a (inflation) Bubble SPV (used for loans : backed by other SPV’s (guided by the Global Inflation Target) and a (deflation) Destroy SPV (used for destroying money (aka coinburning))

Description

Global money (Money) will be created by these SPV’s in a ratio , according the needs of regions/country’s and using global population as inflation target. Structure of all SPV’s : 1. it’s content 2. Divided in country’s 3. Country’s divided in a.their compagny’s and b.their people. (big circle 1 , 2 in 1 and 3.a and 3.b in 2) Then will be devided among wallets ( country , compagny’s (small and big) and humans). Note that all wallets are global decentralised and not stored within traditional banks. Worldtrade compagny’s should have different wallets , to ease the trade and these taxes (in form of exchange fee’s) should flow directly to the ‘Global Control Mechanism’. This massive global storage of savings can be used as collateral , because of this ‘massive’ decentralised amount , a tradional ‘bankrun’ is highly unlicky. All people get a basic income but forcing this basic income to spend every month it will be an ecomic stimulans. This basic income cannot be saved , put onto your savings account , it’s for survival/basic needs. (all savings will be collected in the savings SPV , using it as collateral , but these savings/ money can be used by the owner at any time … I don’t see any problem here because normally this it is a transfer from one savings account to another , therefore a recalculation in a zero-sum game inside the savings SPV , so (global) collateral for the Bubble SPV stays intact. A current account , where this basic income and paycheck will be deposited , has a maximum amount of money equal to this basic income (see it as cash on hand). The excess of money will be changed (swapped) automaticaly to it’s corresponding savings account/wallet exceeding a certain amount/treshold , the other way around , you’re able to reload your current account from your savings account under a certain amount/treshold. This swap will be done by the Global Control Mechanisme , the collect this ‘inflation’ coins and this could be used for dividing them among people instead of printing new money out of the human SPV.(always exchange fee’s) By keeping this current account within limits (cash on hand) , there should always be enough liquidity available in this global ‘savings’ SPV as collateral for the ‘bubble’ SPV (if needed maybe even leverage). But again , this savings account can be used at any time by the owner for big expenses , than there is money circulation , (probably) within this ‘savings’ SPV. And collateral for the ‘bubble’ SPV remains the same , it should be a zero sum operation within this ‘savings’ SPV. This way it is needed to work and build up savings , if one wants to do ‘big’ spendings , so workforce will hardly change. Than your income will be divided in : basic income and paycheck. This opens the door to reduce (deflate) paychecks significant. As long as there is no loss of money at the end of the month , for working people , I don’t see any ‘union’ problems either. This could be a ‘win-win’ deal for all employers and employees. The knowledge SPV could be used as financing method for Research and Development , schools and education , ... Western country’s with lack of resources should benefit from this SPV. All childern till 18 years old , should have compulsory schooling (wether it’s in class , wether it’s on a cell phone on the internet) and a coin from this SPV should allow them to study (+/-obligated , according their own wishes and capability’s). Education should be possible and free for all students around the globe.

Then last we have a ‘destroy’ SPV. Whenever there is aging in a country , there should be deflation. It isn’t bad to deflate when population is going down. This spv should be seen as a ‘call option’. If a country fills this destroy spv , they get , a first in line , ‘call option’ for future growth (bubble spv loans) when i.e. their population changes. More voting power then other country’s for present (new) bubble spv loans or maybe even ‘knowledge’ SPV expenses. The more input in this spv , the bigger their global influence will be. Also selling of these ‘call’ options to an inflating region (bought with net ‘inflation’ profit) must be possible , strengths that deflating country’s financial balance.

These structure of SPV’s is made for loans , but no ordinary loans with interest , loans where the borrower pays back with profit-sharing. Because there will be a ‘controlled’ inflation , the excess of money needed to repay the loan is available (afterall a growing money supply is the definition of inflation)

Note : Markets (see further) starting from secondary market to fourth market have different coins , every time a different coin is needed , there will be a small exchange fee (change money into the needed coin). This will improve the velocity a lot , having a ‘deflationary’ effect and could be seen as paying tax.

All wallets should be decentralised. All people have a wallet for ‘basic needs’ in the form of a current account and this account is coupled on a corresponding ‘savings’ wallet. This is your personal wallet for the primary market. An owner of a small business has a small compagny wallet and this wallet is coupled on his personal ‘human’ wallet. For state wallets a budget (like country’s in Europe have to present a budget to Europe) will be calculated globally. Which has to match SPV share , population etc. Every state/country has it’s own coin/currency. This opens the door to global variable exchange rates and also for options to secure an exchange rate , therefore extra velocity into the system (also deflationary factor). For world trade compagny’s , I think it’s best to trade with global money to ease up worldtrade. But as mentioned , also here exchange fee’s are needed for deflationary reasons.

Markets

There are 2 markets for every country :

Primary market and secondary market. These are the so called ‘white markets’ , fully regulated.

Primary market is controled by a country’s Central Bank , they have to monitor the inflation/deflation of this country and report to the Global Control Mechanism , they are also responsible for the exchange of global money into that country’s coin/currency. Because the total inflow and total outflow of money is monitored at all times (money into ‘government’ wallets , people and compagny’s of that country) and outflow by monitoring all wallets 1 (see further) , savings account and government expenses , I think there is not so much room for fraude here.

Secondary market is the market for basic needs , these coins could be the same for every country, which implies prices should be more or less equal (counting in transportation cost) global but it’s not necessary. For every secondary market , a different coin is needed (much coins with exchange fee’s) , where the exchange is controlled by ‘commercial exchanges’ , (rebranding/new task for commercial banks). Because of the continu need for exchanging money into secondary market coins , this will increase velocity and exchange fee’s. Whenever the amount of these coin(s) exceeds a certain amount in a wallet , these coin(s) will be swapped into money and put on the corresponding savings account of this wallet. (treshold up and down)

Thirth market is a global market. Internet business (regulated on global scale). Money inflow comes (basically) from human wallets. This is not a basic need , so money inflow exchange rate will be low but higher than the exchange fee within the primary and secondary market. The money outflow exchange fee’s should be higher than the incoming fees. Coins in this market are for private compagny’s in this private regulated market. Exchange (inside market) fee’s are for private exchanges Also in this market all kind of global exchanges should be situated (crypto , stocks , bonds , …).

Fourth market is also a global market but this one is unregulated. This is a more ‘shady’ market. Compare with Nasdaq ‘pink sheets’. New created coins should start trading here. Risk is very high here (total loss of money is possible) , enter this market is on own risk , fee’s are highest here. Also I don’t think illuster activity can be banned out of the world , so let’s try to concentrate it. This is the (new) place where cybersecurity will operate. Seperate this market from the other markets , creating all kind of coins here , also means this a inflation ‘collector’ place of coins. One ‘legalised’ laundry day (with extreme high fee’s)

Taxes should be replaced by exchange fee’s and buying coin/currency exchange options.

Conclusion

Many issues need to be resolved first in cryptospace. Thinking on all kind of hacks. And probably the most important , the ability to process data and to exclude (D)DOS attacks. Back up systems for maintenance , scalability etc.

I tried to design a monetary process here , which I believe can work. Without perpeptual interest but with controlled inflation for growth and room for controlled deflation to balance out a sustainable system. Connecting ‘rich’ country’s and ‘poor’ country’s to equalise wealth better in the world. This is my imagination , but I’m fully aware of the Powers that Be and their control over our society’s. However the dreamer in me hopes this could be more than an Illusion.

Congratulations @stadsmanneke! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit