Introduction: SparkFi is similar to a mutual fund, however, it is driven by decentralized blockchain technology instead of traditional finance. The issuance of tokens by SparkFi as a means of raising funds is followed by the usage of those funds to produce a return for investors and holders of SparkFi tokens. SparkFi employs a number of different tactics, including trading and investing in various financial markets, in order to produce yield. Capital is used to produce yield by investing it in a variety of markets, including FOREX, Stocks, Commodities, Metals, and Cryptocurrencies, among others. The SparkFi team has a great deal of experience working in the financial industry, and they are also experts in market analysis. Using smart contracts that are hosted on a public blockchain, the return on investment is dispersed among the investors and token holders.

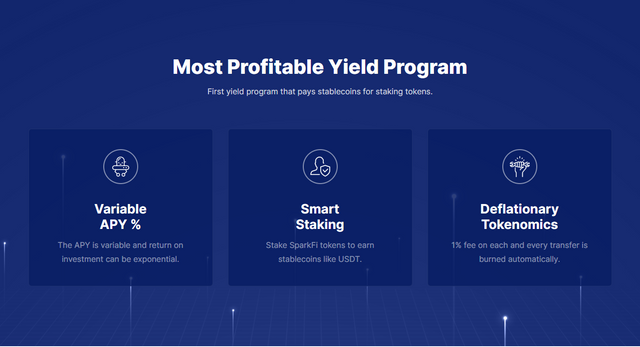

Deflationary Token-Economic Policies: The total number of SparkFi native tokens, denoted by the symbol $SPARK, is set at 100,000. Every transaction in $SPARK incurs a one percent fee, which is then destroyed immediately after it is processed. Because of this, the $SPARK token will have a deflationary effect, the total supply will continue to decrease over time, and the token will become more scarce and valuable as a result. In addition to this, it encourages investors to keep the token in their possession rather than trading or selling it.

How the Harvest is Produced: It is possible to generate yield in varying degrees by employing a variety of strategies, such as day trading, swing trading, investing for the short term and the long term, etc., which can all result in the development of yield in their own special ways. One can generate yield in varying degrees by employing a variety of strategies, such as day trading, swing trading, investing for the short term and the long term, etc. SparkFi conducts research on the overwhelming majority of the financial markets located all over the world in an effort to identify possible investment opportunities. Some of the markets that are considered to be included in this category are the foreign exchange (FOREX), equity, commodity, and metal markets, as well as cryptocurrency markets. However, these markets are not the only ones that can purchase items in this category. In addition, SparkFi makes investments in businesses that have the potential to become successful new startups, in addition to projects that include bitcoin.

The Methods of Yield Distribution: SparkFi employs the usage of smart contracts as a means of distributing yield in a manner that is equitable, and the $SPARK token functions as the primary cryptocurrency asset for the SparkFi network. On a monthly basis, any and all revenues that are earned by SparkFi's capital are converted to stablecoins such as USDT and BUSD, and then supplied to a particular yield contract. This process takes place regardless of whether the income was produced by SparkFi's capital or not. On a scale that includes the entirety of planet Earth, this event is currently taking place. Participants in the contract who have tokens of the $SPARK cryptocurrency will have the option to stake their tokens in exchange for stablecoins if they so choose. This option will be available to participants whether or not they have tokens of the $SPARK cryptocurrency. Every single $SPARK coin has the potential to become a part of the SparkFi economy at some time in the not-too-distant future. This is something that comes with the territory when you buy $SPARK coins. This guarantees that the harvest will be distributed equitably among all of the participants and that everyone will receive their appropriate portion of the bounty.

Withdrawal Procedures: SparkFi has no intention of withdrawing from the bitcoin mutual fund business unless it is required to do so by governing bodies. The end goal of the organization is to become the most successful asset manager in the industry. In the event that a black swan event or something else of a similar nature takes place, in which the team is forced to shut down the entire project, the team will withdraw their staked coins from the yield contract on SparkFi.io and deposit fifty percent of the total holdings converted to stablecoins in the yield contract. This will take place in the event that the team is forced to shut down the entire project. This will make it possible for token holders and investors to receive a portion of the money they invested in the project if it is ultimately necessary to shut down the project.

For further information pls visit the following links:

Website: https://sparkfi.io/

Twitter: https://twitter.com/SparkFiOfficial

Discord: https://discord.gg/dmDJkHNMFr

Telegram: https://t.me/SparkFi_io

Bitcointalk Username: AF_Nill

Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=3385240

BSC Wallet Address: 0xB986D0FC970aF72261A0932F65c657CAc5A6D0a1