Overview

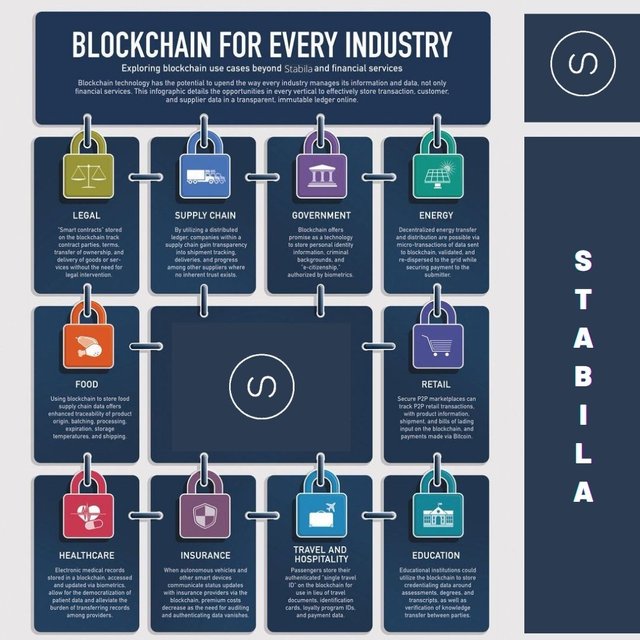

Blockchain has the power to change our world for the better in so many ways. It can provide unbanked people with digital wallets, prevent fraud, and replace outdated systems with more efficient ones. Cryptocurrencies are gaining much more popular due to the evolution of blockchain faster than expected. The crypto industry has significantly grown and expanded, attracting many newbies and experienced traders and investors. While BTC gets all the juice, cryptocurrency knowledgeable understand that Ethereum was the leading blockchain out there from any standpoint for the last few years. Many decentralized apps (dApps) were built on the Ethereum network. Moreover, ETH developers give power and value to the eth blockchain. Early adopters, building out their blockchains versions, are unwilling to switch away from ETH because it would take much time, effort, and money. From other perspectives, if you are a new company building out a blockchain now, there is no way to choose Ethereum to build it on. The Ethereum technology is too slow and too expensive. That’s why most developers in the future will build out on the Stabila blockchain.

What is Stabila blockchain?

STABILA is a project committed to financial system decentralization. STABILA Protocol provides a public blockchain service with high throughput, flexibility, and reliability. All of the Decentralized Applications (DApps) in the STABILA space are licensed to counter fraud and minimize risk for its users. Digital transformation lets the world reimagine itself — and STABILA is happy to be among the changemakers by enabling customer-centric services and lasting relationships.

Stabila’s technology is user-friendly, faster, and cheaper than Ethereum’s or any other market competitor. Stabila is a blockchain-based smart contract platform for powering decentralized fintech applications, or DApps, competing with platforms such as Ethereum and Bitcoin. The blockchain is secured through a delegated proof-of-stake system that sacrifices some degree of decentralization for speed and efficiency. The network is powered by its native cryptocurrency, STB, which is used for payments, miner rewards, and system resources.

Stabila is a cryptocurrency and blockchain developed by the Moneta Holdings company. Stabila software supports smart contracts and decentralized apps (known as DApps in the crypto community), which makes it a suitable platform for additional cryptocurrencies in addition to the Stabila crypto coin central to the operation of the blockchain.

Features of Stabila :

Proof of Stake- Stabila utilizes a delegated proof-of-stake system, which means it uses far less power than competing currencies like Bitcoin.

Faster — Stabila’s architecture gives the Stabila network the ability to handle far more transactions at a time than proof-of-work systems such as Bitcoin, which rely on a massive network of cryptocurrency miners.

Stabilacrypto open banking connects banks, third parties, and technical providers — enabling them to simply and securely exchange data to their customers’ benefit.

Stabila helps you hedge against crypto-volatility by launching your own stablecoin. Peg your cryptos to assets like fiat currency and gold, and tap into a stable crypto world, promoting better safety among crypto

Stabila is a project dedicated to the decentralization of the financial system. The STABILA Protocol offers public blockchain service and support of high throughput, high scalability, and high availability for all (DApps) in the STABILA ecosystem.

STABILA has a 3-layer architecture.

Storage — Multi-decentralization technology that achieves military-grade security and fulfills data-privacy compliance requirements for the storage of sensitive data and digital assets. The DataVault Storage SaaS is a private blockchain operating system (OS) for enterprises, providing an exceptionally secure environment for data management. It was created specifically to help enterprises, banks, and governments to securely communicate and manage sensitive data and digital assets in a permission-based, fraudless, and unhackable environment.

Core- Wallet-Cli is a command-line version of the wallet, provides essential tools to communicate with the STABILA public chain. Web Wallet is the wallet embedded with a blockchain explorer. StabilaClick is an outstanding STABILA wallet dedicated to providing users with complete functions, a convenient experience, secure funding options.

Application- STABILA blockchain explorer. It has all the essential functions, including searching transactions/ accounts/ blocks/ nodes/ smart contracts, on-chain statistics, token creation, a built-in web wallet, and a DEX.

The STABILA protocol is based on Google Protobuf, which allows multilanguage extension by default.

STABILA Virtual Machine (SVM) — The SVM is a Turing complete virtual machine that is lightweight. The SVM is fully integrated into the current environment.

Decentralized Exchange (DEX) — Decentralized exchange features are built-in to the STABILA network. Multiple trading pairings make up a decentralized exchange. A trade-off Market between SRC-10 tokens, or amidst an SRC-10 token and STB, is referred to as a trading pair (notation “Exchange”). A trading pair between any tokens can be created by any account.

How does it work?

In the STABILA network, there are three sorts of accounts.

- Standard transactions are handled using regular accounts.

- SRC-10 tokens are stored in token accounts.

- Contract accounts are basically smart accounts that are established by ordinary accounts and can also be activated by

them.

Account Creation

A STABILA account can be created in one of three ways:

- Use the API to create a new account.

- Move STB to a different address.

- Send any SRC-10 tokens to a new address.

Private Key and Address generation

An address (public key) and a private key can be used to create an offline key pair. The user address generation algorithm begins with the creation of a key pair, followed by the extraction of the public key

Signing

STABILA uses a typical ECDSA cryptographic method with a SECP256K1 selection curve for transaction signature [2] The public key is a point on the elliptic curve, while the private key is a random number. To get a public key, first, generate a random integer as a private key, and then multiply the private key by the base point of the elliptic curve to get the public key. When a transaction takes place, the unprocessed data is transformed into byte format first. The unprocessed data is subsequently hashed using the SHA-256 algorithm. The output of the SHA256 hash is then signed using the private key associated with the contract address. The transaction is then updated with the signature result[3].

How to Mine Stabila?

Stabila coins are not directly mineable by the general public. Instead, the consensus network relies on users who stake Stabila currency, maintaining a balance of Stabila in an eligible cryptocurrency wallet, to mine blocks and validate transactions. The users who get to mine blocks are called Governors.

The Stabila delegated proof-of-stake system relies on 79 Executives to verify and 21 Governors to produce new blocks for the network. These members are picked through reputation ranking and vote of STB coin holders. A new block gets generated on the Stabila public chain every three seconds, and the Governors get a certain amount of STB as a reward for mining

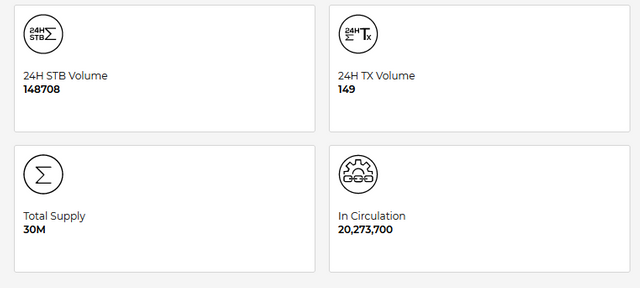

STB Tokonomics

Token Name: Stabila Protocol

Token Ticker: STB

Network: Stabila Blockchain

Total Supply: 30,000,000 STB

Circulating Supply: 20,000,000 STB

Roadmap

Team

Conclusion

Most developers in the future will build out on the Stabila blockchain, not Ethereum. The simple difference in concept, usability, speed, cost, etc… makes it very simple. Moreover, Stabila pushes a new fraud/scam-free concept and environment that proves to be a winner in the competition race. Stabila’s technology is user-friendly, faster, and cheaper than Ethereum’s or any other market competitor. So Stabila has the biggest potential and ROI an investor can envision for 2022. Because of the rise of the Stabila blockchain, the crypto industry is in a state of regrouping right now.

Read More Here:

Website: www.stabilascan.org

Whitepaper: https://stabilascan.org/api/static/Stabila_Whitepaper_(7).pdf

Telegram: https://t.me/stabila_stb

Twitter: https://twitter.com/moneta_holdings

Facebook: https://www.facebook.com/stabilacrypto

Linkedin: https://www.linkedin.com/company/stabilacrypto

Instagram: https://www.instagram.com/monetaholdings/

Reddit: https://www.reddit.com/r/moneta_holdings/

Proof Of Author

Bitcointalk username: Cantika28

Profile link: https://bitcointalk.org/index.php?action=profile;u=3334480

STB Address: SW3zYnjLnC7wxErqcFSGK9nmoXZAvMjHf9