A mentor once told me that the hardest thing to do in times of stress is to do nothing. He said this in regards to a moving stock market but I apply it to all parts of my business and personal life. I've always been the sort that naturally does the opposite of the crowd so it was nice to hear some solid advice on the other side of panicking.

Why is doing nothing hard when the market is squirrely?

One thing to remember about crypto markets is that you will find some of the largest percentage of "risk loving" people here. Traditional stock markets draw risk lovers as well but as stock markets have drifted into a more traditional type of investment it is more likely to pull all three personality types which are risk lovers, risk neutral and risk averse.

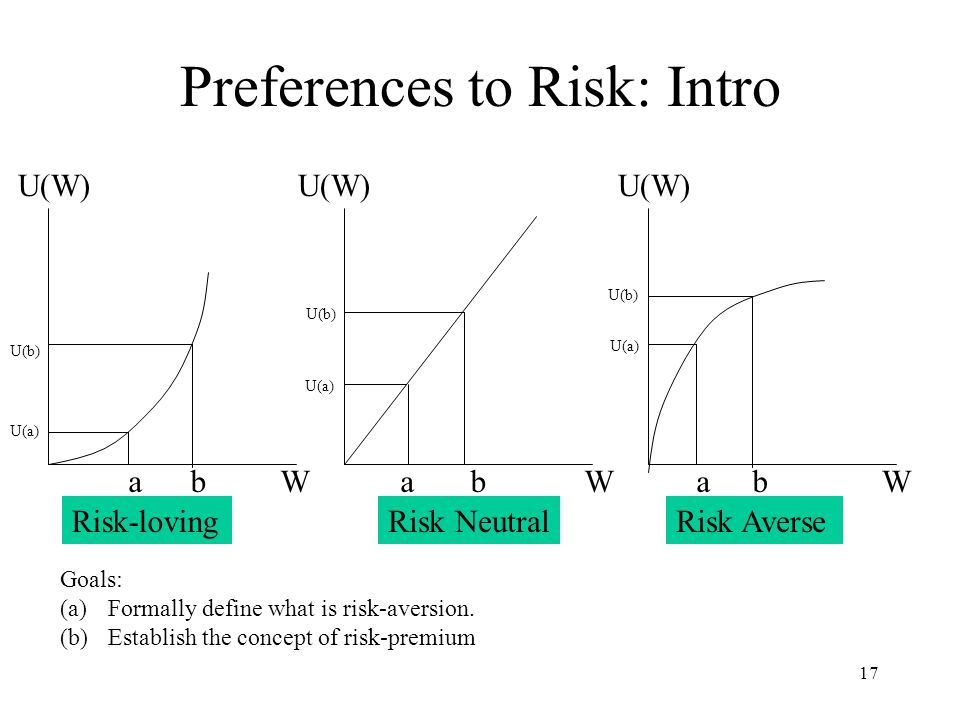

In graph terms here are our three personality types

(Graphs by Heather Pacer, http://slideplayer.com/user/4301312/)

The main takeaway from these graphs is the change of the slope of the line between points A and B which we can see on the Wealth (w) and Utility (U) axis's. This shows the gain in Utility and Wealth with each transaction based on the personality type.

Risk lovers experience the largest change in wealth and utility with a steep upward and forward move. This leap is the desired outcome with each transaction.

Risk neutral seeks consistent movement forwards. The slope of the line is consistently 45dgrs and the output U(w) is just more than the input (w) showing incremental growth as the goal.

Risk averse = none of us. But who are they? They are the laggards, the people who still drink dairy and think wal-mart is cool. They don't like change and therefore opt out of tech, fashion and any other quickly moving trends. They view any sort of gamble as having a payout of zero.

Looking more at Risk Averse personalities on the graph, utility or U(w) is going to be their main driver. Wealth or (w) is not the axis they are trying to maximize. When the curve is concave (upside down horseshoe) the possibility of increasing utility using wealth is difficult.

( )

)

(https://www.creativityatwork.com/2014/06/10/busy-innovate/)![wheel.png]

Couldn't help including this!

We now understand more about personality types pertaining to risk but how does this help us? (We'll leave out risk averse from here on since it doesn't apply to us.)

Well the more you understand why you make the choices you make, the more you can tailor your choices to yield you better results. You also don't have to follow the pack if you understand where the pack is going.

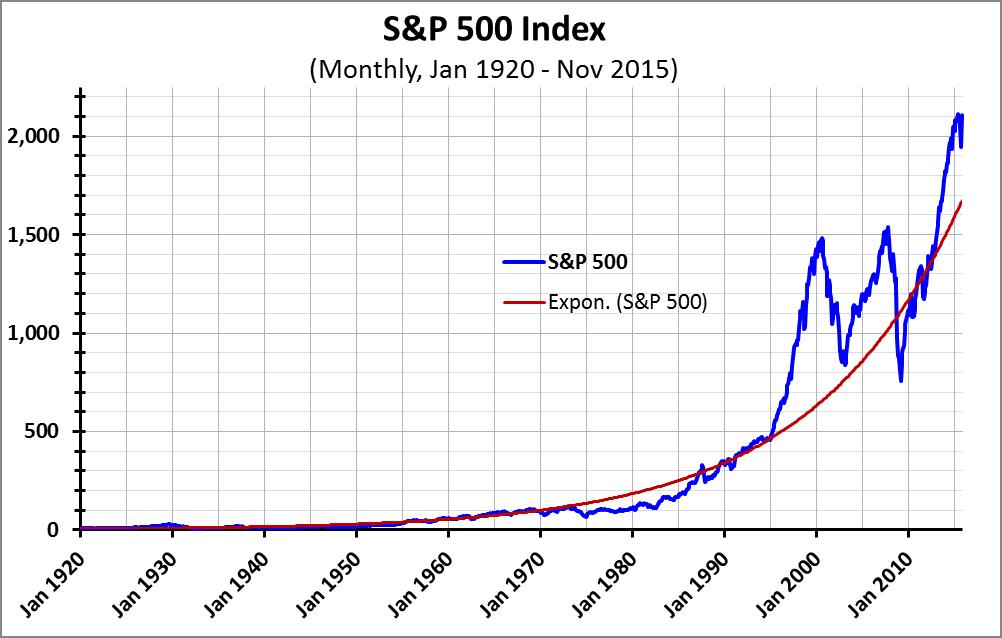

Risk lovers act like this...

(I borrowed this graph from http://www.painting-with-numbers.com/blog/the-second-most-useful-graph-ever This post is super good and it has some other really good graphs to check out. Highly recommend)

The highs and lows we see in this graph (post 1990) shows the lifestyle and demeanor that accompanies risk lovers. They make moves faster and enjoy being in uncharted territory. This makes them capable of taking home large gains and large losses. On Wall Street they use a white powder to help the masses adjust to this lifestyle. This personality is not surprisingly squirrely under pressure and they can believe taking on more risk is the way out of the hole. They want to skyrocket out of a hole instead of building over time.

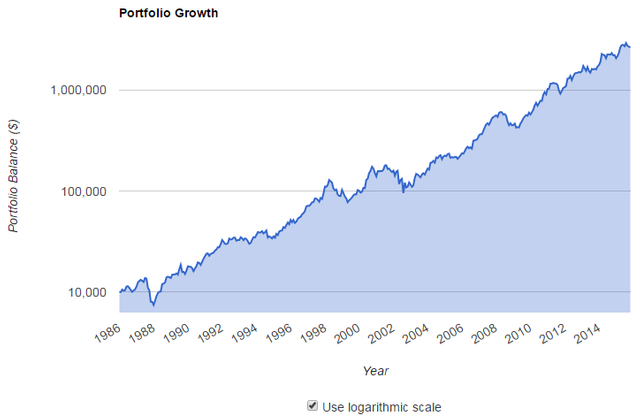

Let's take a look at a risk neutral personality....Looks pretty boring doesn't it?

(http://www.youngdividend.com/2015/11/)

That's a real issue when it comes to risk neutrality...you have to stay still sometimes...savasana

Risk neutral personalities can weather the storm with little action. Picture two people on a ship crossing the sea when a storm hits. One person remains sleeping in their cabin and the other goes outside and tries to catch the falling rain in a bucket to dump it overboard. He or she believes that because they are doing something that they are more likely to make it through the storm. In some versions of this story the man falls overboard in his attempt to catch the rain. The morning after the storm both people remain. One has had a joyous rest, the other is exhausted and worse for wear but nonetheless, they've both made it.

Who do you want to be in the morning? The person with the bucket trying to catch rain? or the one who knows that during some storms, it's better to rest?

That is true. It's much stressful to do nothing haha

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's a little funny once you realize ^^

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

There's not that much difference when you show both graphs with log scale and not log vs linear.

(taken from the same page as OP)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi there, yes of course if you use the log instead of linear that is indeed the case. However for the purpose I was explaining the linear graph shows the trend better. Thanks for the post though I really like to dive into the data as well 👌🏽👌🏽

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting article!

Checkout @cryptobroye for more bitcoin info and analysis. Im sure there's a lot we can learn from each other!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Intrusting story i like the picture most is it your creativity?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The graphs definitely aren't mine. I put the websites I borrowed them from right below each image :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I read more then 50 articles about crypto in average day but your concept is different :D Love your work @economistkerri

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Less is more my friend! The art of long term investing and NOT MAKING MOVES! Thanks for your comment, it's interesting to hear that my approach is different :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great article ! Thank you !

I prefer to buy when everyone lose confidence in coins, on long term we all be good :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm glad you enjoyed it! Now is a good time for you to buy then 👌🏽👌🏽👌🏽

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

My brain says”you know what to do during the storm”

My heart says”try to catch the train”🤔🤔🤔

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Which one do you listen to? 😄😄

Hopefully it's your brain!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Absolutely my brain 🧠

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I did like to be the 'one who knows that during some storms, it's better to rest'

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

As hard as it is to do, it's necessary to get ahead.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Merci pour cet article trés intéressant

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Durien ^^

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice to meet you. I first started to get into steemit. I'll follow you. Thank you for a good article.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Welcome to Steemit! Make sure you do an #introduceyourself post :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good idea i understand i also like hold only hold

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your analysis.

Good luck

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for reading 😄

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit