Like most of you I follow the price of steem quite closely. There are a few things that have got me quite excited about the current chart setup, (as well as a few other things that have also got me excited).

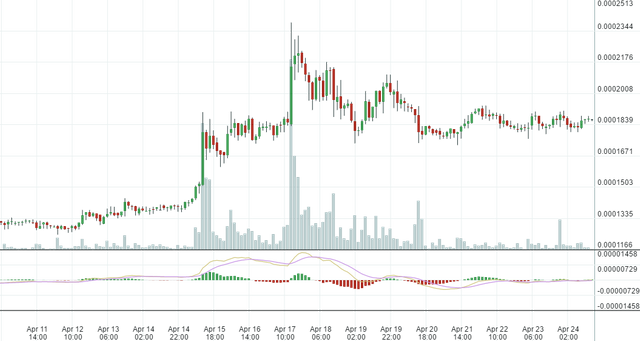

Lets take a look at the chart here:

These are 2-hour charts, meaning that each candle stick represents 2 hours of trading activity. It is shown over a period of the last 2 weeks.

I like to look at my charts clean with not much clutter on them, however, sometimes it really does help to have a few overlays and technical indicators to really help you get a clearer picture of exactly what is going on.

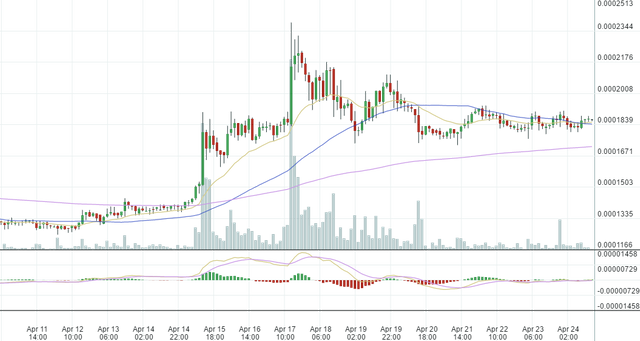

For that reason here is the same chart with a couple moving averages and Bollinger Bands included.

The moving averages are 20, 50, and 200 time periods.

What does the chart tell us?

The first thing that jumps out to me is that it looks like the price has finally reset after that big run up just over a week ago. There were profit takers after we touched $.28 as the price retraced for a couple days, but it failed to break that $.20 floor, which was a bullish sign.

Now we have the price setting in the low $.20's area on decreasing volume with the 200 MA rising to meet it. This is the first time we have had this setup in quite some time.

In the more immediate term, we also have the faster moving average crossing the slower moving average to the upside with both of the them under the price and pointing up. Bullish setup.

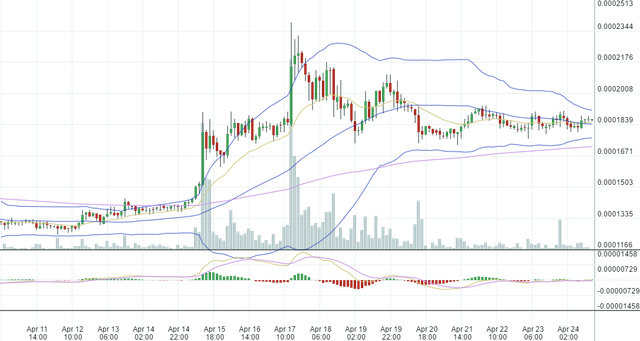

The Bollinger Bands are also pinching, which is a sign of a big move coming. They don't predict which way the move is going to go, but when they start to pinch like they are above, they indicate that a higher volatility move is coming.

I mentioned earlier that volume has been decreasing and why that is a good thing in this particular instance. It means that most of the motivated sellers have exited around these levels. The next bit of good news that causes some buying likely won't be met with much resistance from sellers until higher prices.

We also have the MACD pretty much completely neutral. It's not really a bullish position by itself here but given the chart setup, to me that MACD is bullish because it is showing that there is room to the upside before showing any kind of signs of being overbought.

Overall, this is the kind of chart setup that screams continuation of a previous move to me. First we had the big momentum up move, followed by some slight profit taking, but the profit taking wasn't able to push the price back to the previous lows. Now all the technicals on the chart have reset and are ready for the next move up. All it is gonna take is a minor catalyst...

Back in my trading days, this is a chart pattern where my alerts would be going off with a message reading "loading zone". Meaning it's a good spot from a risk reward perspective to be loading up on the long side.

Some other tidbits that have me bullish:

A couple other things to keep in mind that may help push the price higher are the way that rewards are currently being paid out. Currently zero liquid steem is being paid out and it has been that way for almost 2 weeks now. That means that any steem that is to be sold from earnings will have to be powered down or converted from SBDs. That may not sound like much, but sometimes just removing a little bit of supply off the market might be all it takes to send prices higher.

Another thing that has me bullish is the marketing efforts. I think we are just now starting to get a grasp on what exactly the marketing team wants to do with the their campaign. I imagine as their plans start to materialize and mature, and then get implemented, we will start to see new users coming in.

The rewards pool is also getting just a little bit fuller every day. Seeing the higher rewards causes a positive psychological reaction in most people that are actively posting and participating on steemit.com on a daily basis. The higher rewards also tend to attract outside users when they see the potential earnings that can be made from writing blog posts.

Adding these to the chart setup above only helps add to the bull case in my opinion. I would not be surprised at some point to see steem make a run for the $.30's in the next couple weeks.

Conclusions:

This is the calm before the storm in my opinion. A great spot to be loading for the continuation of the recent up move. The price of steem finally has some tailwinds at its back in the form of chart technicals. It also seems to have some fundamentals on its side right now making for a great environment for an up move in the price of steem.

Steem looks like a good buy as long as it holds the $.20 area over the coming days. Looking for a move into the $.30's within a couple weeks.

As always, remember to do your own DD before making any investment decisions.

*This is not investment advice. Just one former stock traders thoughts on where he sees the price of steem going next.

Live well my friends!

Follow me: @jrcornel

so far as i have seen analysis on this site and about the Steem itself, this is the very best one I have came across. I pay attention to them as I try to understand more and more about this world of digital currencies. Great work, thank you for sharing, namaste :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for the kind words Eric. You always have a way with words. Namaste :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

do you think its valid

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I can't help it. Namaste :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

There's a lot of encouraging (fundamental-- not necessarily technical) stuff going on at the moment. People are motivated by the rewards, and now we're seeing a few posts earn fairly well again... which makes it more likely everyone will get back to "normal" posting.

The second "rub" is people like myself have been somewhat "holding off" on doing widespread publicity for Steemit to our "off-site" followers, pending there being a somewhat stable site. For example, I have several "niche" blogs that regularly get 1200-1500 reads on new posts; a Facebook page with 16000+ followers, admin of a couple of FB groups with about 20000 members. Wasn't going to stake my reputation on saying "You guys oughta check out Steemit!" as long as it seemed like a highly volatile and unstable environment... now I'm back to working on "recruiting" posts to reach those. And I'm sure I'm not alone.

Meanwhile, I'm also hopeful that Steemit will ride the general uptick in interest in Alt coins... some have been doing pretty well recently, and as they get spendier and spendier (like Dash touching $100) investors might start shopping for the next "rising star." And why not Steem?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great comment and great points. I have been holding off on recruiting outside members as well. I have been fearful that they would join only to have some major rule change happen that turns them off forever. However, I think we are now closer than ever before to a point where I feel comfortable bringing them in. Plus with the whale experiment or linear rewards curve, (whichever we have at the time) it makes it easier than ever before for new users to earn some rewards. Thanks for a great comment!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your analysis - let's hope that your gut feeling is true and we'll see another rise of the steem price soon!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's the hope! :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

ENCOURAGING!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think so as well. As we all know, charts don't guarantee anything, but I would rather have them on my side than not! :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good analysis but I would suggest a more detailed analysis using Steem data stat will be further useful. It is like combining fundamental analysis with Technical analysis.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What is steem data stat? I agree that technicals as well as fundamentals are likely the way to go. I briefly touched on both of those above.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

My THIRDS bag of STEEM is will be READY!!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Buying in thirds?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ahhh...we have a live one!

I buy in thirds...

I sell in thirds...

"thirds rule strategy"

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That is a great strategy to have. It certainly makes it much easier to sleep at night :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Now you GOT IT!

Quick learner!!

Keep STEEM N ON!!!

Frank III

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice call on this one - only took a few days.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you! Every now and then I get it right ;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Haha, it only takes a few. ;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah every time I checked it is above .20 cents. I hope that is as low as it goes and goes up from there.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That is my hope as well :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's a good trend and much better than the sub 10c times not so long ago. I think we need a flood of new users and some releases from the team. Communities maybe? I think we're in a good place

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think so as well. Higher prices tend to bring in new users as well. Things are looking pretty bright right now.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

nice post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Informative Post . Thank you for your effort friend ! Upvoted and Followed !!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Welcome !

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Following the price of Steem keeps me from being depressed over the price of my posts!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Haha there you go! I am hearing that the reward pool isn't likely to be full for weeks yet, possibly another month still. That should also give you hope that your posts will continue to gain in value over the coming weeks even if the price doesn't go up. If it goes up as well, now we are cookin! ;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I heard 30 days over a month ago. I see the whales are doing good though. My views are going away... my posts today only got about 25 views (about 1/3 of usual). A lot of my dolphin friends have gotten discouraged and left and minnow votes don't generate a lot of cash. I also read something about the Larimers being internet scam artists!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yea that original projection was way off. The pool is filling much slower than was originally expected. The newer projections are much more accurate based on the it's refill rate.

I would imagine that when the rewards are back up the people who left because of them disappearing will be back.

I hadn't heard anything about Larimers' being internet scam artists? Have any links? From what I know of Dan, I would be very surprised if there was much truth to that... either way though Dan is no longer attached to this project.

The biggest thing to keep in mind though is that what we see today is likely not what we will have months and years from now. Build up steem and your blog now, because they are going to try to bring millions of users in when everything is ready... now is the time to build.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I don't believe it about the Larimers...even if it were true, all I have invested is sweat equity. I was doing the same thing for free on blogspot. If you look at my first post today, you'll see how I feel about the platform in general. Found it...that took some doing!

https://steemit.com/steemit/@ogoowinner/is-steem-a-scam

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice observation @jrcornel. Whenever Bollinger Bands start to shrink as the price starts moving sideways, there is a sign that something will happen. I honestly can't tell what, could be that we are going down again or up, Historically I would say we are going down, but staying over 20 cents for so long made me more optimistic.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Exactly the same observations I am having...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice to read your post, very helpful

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great stuff. I have been seeing/feeling some confidence return to Steemit (not me, I was always full to the brim ;O)) I like your analysis above and didn't know that Bollinger Bands pinching meant that something was in the wind. Great to pick up new things!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well just the fact that they are pinching doesn't necessarily mean anything, but throughout history periods of low volatility are often followed by a period of high volatility. Therefore, pinching bollinger bands often offer a great time time to get in before the bigger move comes... However, there is no way of knowing for sure what direction that move will go.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Its the excitement of it all, keeping all the fingers crossed its a good direction!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great stuff as always! Resteemed

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great analysis

I'm not big on technical analysis myself but I do find it reassuring that it's settled around the 20c+ mark now

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I find that reassuring as well. It was going down for a long time. It appears that downtrend is finally breaking...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So, given the context of the market what probability would you assign to a move up compared to a move down?

Given that what would be the amount you risked Vs your profit target?

Reading the markets isn't about seeing abstractions in abstractions. It's about taking abstractions and forming them into probabilities and then having a plan to trade and execute them.

Provide a stop please :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ah... spoken like a true day trader.

In response to your questions:

Given the reasons mentioned in my post I would say it has a 60-70% chance of going up from these levels as long as that $.20 area holds.

That was also the level I would use as my stop. (You can use $.19 to let the trade "breath" a bit if you like.)

My target would be anywhere north of .28. Therefore buying at $.22 with a stop of .19 and a target of .28 plus gives you at least a 2:1 reward/risk ratio. However, I think the trade likely goes to the .32 area which would be a trade in excess of a 3:1 reward/risk ratio.

3:1 is always a target I used to shoot for in my stock trading days.

You can use any dollar amount you want but those are the ratios I would target.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great response to my nudge. That's an insane edge though. 3:1 ratio along with 60/70% probability.

Could happen in crypto though. Given it was properly managed after entry and alot more scenarios were taken into account.

Given your stated edge, you must be going in big. Seems like the trade of the year.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Haha I wouldn't say that and remember that is my perceived edge. It's impossible to quantify it exactly with all the variables involved. But when you have a downtrend break, a holding up of the price above support for an extended time, a reset of the technicals on a continuation move like we have here, as well as the positive fundamental factors on your side it is at least a 60% chance of success in my mind.

The biggest issues are always the fake outs on setups like this in my opinion... In general I like to give my stop loss a couple points below the support area to account for fake outs. For example, you often might see a touch of .19 or so on a setup like this only to have it reverse and rip up to .32 leaving you out of the trade.

So, sometimes you have the fake out, lose your 3 ticks, get back in when it holds up to have it run to your target, so you lose the 3 ticks and then gain the 10 ticks on your second entry. So your actual take ends up being closer to 2:1. Does that make sense?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Makes sense to me. Again just probing a little deeper.

The other scenarios I mentioned in my last reply was alluding to the fact of fake breaks and looking at the trade as a 'series' of trades rather than just an overly exaggerated edge. Over a series of trades the edge is much more competitive and brutal.

Please take into account that people are listening to you and respecting what you're saying without understanding the nuances of an experienced trading strategy.

It's very irresponsible to only show one side of the coin, especially in something everyone on this site is vested in and maybe not experienced in... I.e TA

Given your platform on this site I hope you can show both sides of the coin in subsequent posts.

:)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Haha sure. I can try to present both sides a little more objectively in the future. Thanks for tip :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Appreciate your replies. Looking forward to it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thank you for this post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I had not heard of your trading days or seen you do something like this, so that was neat.

Good stuff man.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks. Yea I haven't posted a lot about steem or steemit in the past. Regarding trading, if you look on my profile it is the last thing mentioned under my profile name, "stock trader". ;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit