Bitcoin (BTC) is the first and most well-known cryptocurrency, launched in 2010. It is a decentralized digital currency that operates on a peer-to-peer network without the need for a central authority. Bitcoin can be generated through the process of mining, where powerful computers solve complex mathematical problems to validate transactions on the network.

As of now, the current price of Bitcoin is $54,771.66 USD, with a decrease of 9.60% over the last 24 hours. The market capitalization of Bitcoin stands at approximately $1,075,581,474,800.95, indicating its significance and dominance in the cryptocurrency market.

Bitcoin has a total supply of 21 million tokens, and the circulating supply is currently around 19,736,046 BTC. This means that approximately 93.98% of the total supply has been mined and is in circulation.

Bitcoin has a large trading volume, with $44,252,877,033.62 traded over the last 24 hours. It is actively traded on 11,623 markets, indicating its widespread acceptance and availability for trading.

It is important to note that the cryptocurrency market is highly volatile, and the price of Bitcoin can fluctuate significantly within short periods. Investors and traders should exercise caution and conduct thorough research before making any investment decisions.

【Analysis】

Based on the current market data and technical indicators, let's analyze the current situation of BTC.

1. Price:

The current price of BTC is $54,433.4.

2. Trend:

The current trend analysis shows that BTC is in a neutral state. This means that there is no clear upward or downward trend at the moment.

3. Major Holders:

The long/short ratio on Bybit is 1.2:1, indicating that there are slightly more long positions than short positions among major holders.

4. Funding Rate:

The current currency funding rate is -0.00002332. This negative value suggests that there is strength on the short side in terms of funding rates.

5. Support and Resistance Levels:

The latest BOLL support price is $50,828.6, while the BOLL resistance price is $56,337.1. These levels can be considered as potential support and resistance zones respectively.

6. Market Sentiment:

The Market Sentiment Index is currently at 26, which falls within the "Fear" category. This indicates that there is a cautious sentiment prevailing in the market.

7. Neutral Indicators:

The following technical indicators (KDJ, MACD, RSI, EMA BREAK, BOLL) do not show any specific patterns at the moment, suggesting a neutral stance.

Overall, based on the current data and indicators, the BTC market is currently in a neutral state with a slight inclination towards fear. The price is hovering around $54,433.4, and major holders have a slightly higher long position ratio. The funding rate is negative, indicating strength on the short side. Traders should pay attention to the support and resistance levels at $50,828.6 and $56,337.1 respectively. It is important to closely monitor market sentiment and any potential changes in the neutral indicators for a clearer understanding of BTC's future direction.

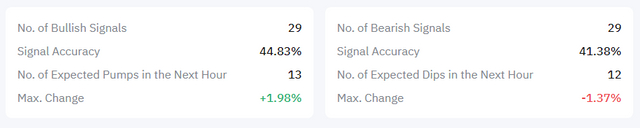

Backtest Based on the Last 30 Days

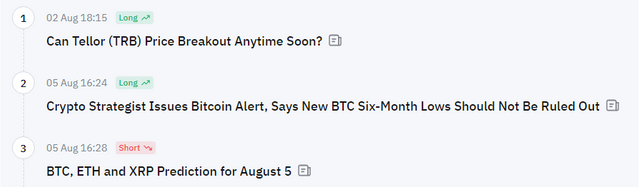

【Latest News About BTC】

Bitcoin (BTC) has experienced a recent drop in price, breaking below the support level of $53,550. However, there is a possibility of a bounce back to the $56,000 zone. It's important to note that BTC's price is influenced by various factors, including market sentiment, news events, and technical indicators.

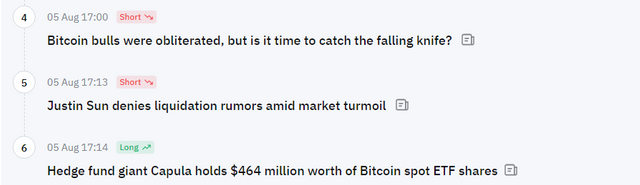

Currently, Bitcoin's price is facing downward pressure, with traders' morale low, as indicated by Bitcoin derivatives. This suggests that the odds of a 20% rise from the recent bottom of $49,320 are weakened. However, it's crucial to consider multiple indicators and factors before making any investment decisions.

Looking at the broader market, it's worth noting that most cryptocurrencies, including BTC, ETH, and XRP, have experienced significant drops in their prices. This overall market sentiment can impact Bitcoin's price movement.

In terms of potential price levels, if Bitcoin continues to decline, it could potentially drop below $50,000 and reach new six-month lows, as warned by a crypto strategist. However, the strategist also believes that Bitcoin will eventually rebound and reach new all-time highs by the end of the year. It's important to note that these predictions are based on analysis and should be taken with caution.

In summary, Bitcoin's current price movement suggests a bearish sentiment, with a potential for further downside. However, it's important to consider multiple factors, including market sentiment, news events, and technical indicators, before making any investment decisions. It's always advisable to conduct thorough research and consult with a financial advisor before entering or exiting any cryptocurrency positions.

There have been notable changes in recent activities and developments related to BTC:

Risk Disclosure: Predictions are for reference only, not investment advice. Investing involves risks; please make decisions cautiously.For any inquiries about Bybit's products and services, please contact Bybit Customer Service or Bybit Help Center.