Steem is the name of the token that can be bought and sold on the open market , based on the platform blockchain Steemit.

Steemit is a platform that allows publishers to monetize their content works the same way as many other social content networks.

Think Reddit, but in a way that pays writers and content managers.

Steemit reward the authors when their content is updated, and it also rewards people that help preserve the best content by updating the content of others.

Steem, one of three currencies proposed by the Steem platform, is an integral part of this system .

How Steem?

To take stock of Steem, we must review a little Steemit platform.

Every day, the network creates new Steemit Steem units and distributes its users. Users can then redeem these units on the open market against the bitcoin, other cryptographic currency or fiat money.

Steemit really gathered some "steam" (excuse the pun) in the community of content and the crypto currency because it allows virtually anyone to write about interesting topics and start earn money.

Steemit is different from other crypto currencies like Bitcoin because it depends not only on the mining to generate new monetary units. While you can technically undermine Steem, the network creates new monetary units Steemit and automatically distributed to people who write and commit to the platform.

The amount you get is correlated with the number of positive votes that the content you write gets and the amount of your involvement with the site (positive vote and comments).

Steemit solves a huge problem the world is facing the contents. Outside Steemit, current contents of the economy is upset.

Content creators work hard to make the sensational content, but the only way to monetize is through advertising, affiliate marketing, bringing readers into a funnel, among other ways to exploit their content, for be paid.

Since there is no way to directly monetize their hard work, the best content creators often have to rely on things that could have a significant impact on the impartiality and content orientation.

However, this is only the beginning of what can be offered crypto Steem.

What future for the encoding Steem?

Not only the current monetization mechanisms are a potential source of forgery, they are also less effective. content consumers have shown a strong distaste for the payment of online content, due to the amount of content available on-line mixed with a general refusal to consume content that requires a whitelist or going through a payment system.

Digital advertising, for example, has been greatly reduced thanks to the explosion of ad blocking. At the end of 2016, there was worth about 615 million worldwide advertising blocked by equipment , and the percentage of people who blocked the ads has grown steadily.

This is something that affects both individual content creators and large media companies. Now dozens of publications require you to the "whitelist" to read their content and, as you can imagine, this massively away casual readers.

In contrast, Steemit platform encourages consumers to engage naturally and organically into the content they read. People who update and help retain the best content on the site, and the commentators who contribute to the discussions, are rewarded by the platform.

Supply and Sustainability Steem

Steemit actually three types of monetary units: Steem, Steem Power and Steem Dollars

Steem

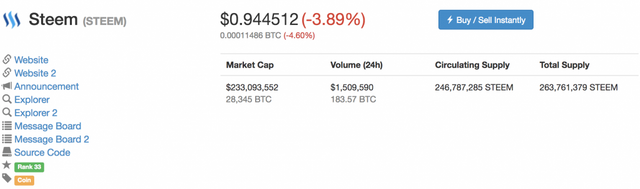

The Steem is bought and sold on the open market in the same way as any other token . Steem hold for long periods of time makes you run the risk of dilution because Steemit platform creates more each day. Steem is now eroding at a rate of 9.5% each year because of this production. However, the price of Steem generally increased and some investors have been able to fight against inflation and profits orchestrated by Steem.

Steem power

When buying a Power Unit Steem unit, you can not sell it for 13 weeks . This period, which was originally a 2-year period, is intended to prevent people from suddenly unload all their units on the market and bring the price.

It is essentially a long-term investment in the platform because the detention Steem Power entitles you to a proportionate share in the network. Thus, the value of your property increases gradually as the network grows (as it has already done).

Currently, about 15% of new Steem generated daily is distributed to persons holding Steem Power Units as Steem Additional Power Units. The remaining 85% are creators and content managers.

Half of that content creators receive as part of their payment item is in Steem Power Units.

Plus you have to Steem Power Units units plus your positive vote counts , which helps users gain more influence on the site. You will also receive a higher payment when you vote positively the work of others, and in this case also receive a higher payment.

Steem dollars

Steem Dollars is another type of currency Steemit which is supposed to be stable. Dollars Steem are indexed to the US dollar. When content creators produce popular content, 50% of their salary per item will Steem Dollars (the rest being in Steem Power Units).

The Steem Dollars are interesting because they give content creators three different choices :

1- Convert Steem Dollars in Steem and sell it on the open market (cash). It takes about 3.5 days.

2-Steem hold dollars and earn a 10% interest.

3- Exchanging dollars for Steem Steem Power (long term investments).

Distribution and supply Steem

The Steemit platform creates every day new tokens.

- 15% of these new units are proportionally distributed to holders Steem Power

- 85% of these new units are paid for content creators, users and commentators.

The designers who create content worthy of being paid receive half their pay in units of Steem Dollar, and the rest in Steem Power (immobilized for 2 years).

The history of Steem

Steemit was founded by Ned Scott and CEO BitShares, Dan Larimer , 2016.

The concept was introduced in a White Paper in March 2016 . It aimed to create a platform for social content similar to Reddit, but where the text content and metadata were preserved in a blockchain. The use of a block chain also simplified the creation of a system that rewards comments and messages.

Steemit has also established a reputation system where accounts can receive notes that have an impact on their reputation in an effort to encourage good behavior online (goodbye trolls!).

Steemit was designed to run on a decentralized network called Steem where tokens could move freely between the platform and users. The Steem accounts are designed to interact with the Steem database using alphanumeric names chosen by the user (which is much easier than cryptographic hashes).

Steem uses the "proof-of-stake" system to achieve consensus where accounts (called controls) are selected by the shareholders of Steem. According to the White Paper Steem:

75% of new tokens generated funds the reward fund, which is distributed among the authors and responsible for the content. 15% of new tokens are awarded to holders of [Steem Power]. The remaining 10% goes to pay witnesses that feed the block chain. "

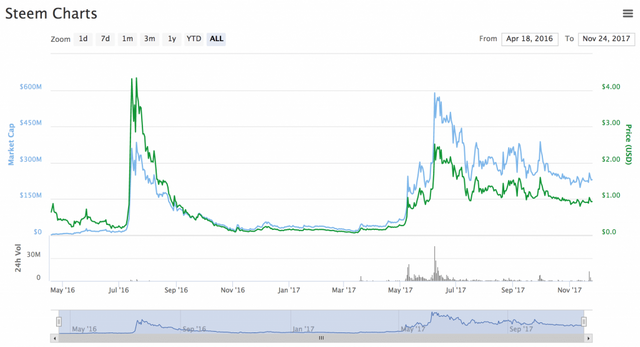

Trading History Steem

Steem is not like most other tokens on the market. It's incredibly functional compared to its original purpose, and it is in no way intended for storage of value.

The price of Steem will generally still lower . It is intended to enable creators and managers of content to get paid because Steemit platform creates every day new tokens.

Of course, it will not necessarily fall. If Steemit platform continues to grow significantly, the price should rise. However, it is worth noting the natural downward pressure exerted by the increase in supply and the case of "cashing".

Therefore Steemit offers three types of currencies (Steem, Steem Power Steem Dollars).

Each has a different purpose.

Where to buy Steem?

If you are interested in buying Steem, you can do it in one of the many outlets. We recommend you take a look at our comparison of the best platforms to buy crypto-currencies .

The easiest way to buy Steem may be to turn to a platform you already use . Binance seems to be the most popular method for buying and selling Steem witha large percentage of the total volume of Steem / BTC realized on this platform.

Steem corner - Complete Guide to crypto Steem

Binance - Large selection of alternative crypto-currencies

Binance is the platform for all crypto-souhaient traders diversify their portfolio with other altcoins

View site

Bittrex or Poloniex is probably the second best choice. Using one of these scholarships, you can buy and sell Steem on the open market and store it in the party associated with this grant portfolio.

You can also use a service such as Shapeshift.io to exchange different pairings against Steem but you have to have a destination portfolio to keep your purchase.

Finally, be aware that to use all the above exchange platforms, you must first buy bitcoins with your bank currency, namely the euro or the dollar. To do so, we recommend you go through Coinbase. You can read our full review of Coinbase with a manual or directly click the link below to register.

Steem corner - Complete Guide to crypto Steem

Coinbase - Earn € 10 through this link!

Coinbase is the most popular platform in the world to buy and sell bitcoins, the ethereums and litecoins.

View site

Steem and micropayments

The use of micropayments is often mentioned in any discussion of monetizing any content at scale.

Many people also wrongly describe the Steemit micropayment platform to ensure smooth operations.

Steemit explicitly states in its White Paper that it believes that micropayments do not work, in reference to the article by Clay Shirky on micropayments (19 December 2000):

- A transaction may not be worthwhile to require a decision, but it is so little that this decision is automatic. There is some anxiety in any purchasing decision, however small it is, and not derived from the interface used and the time required, but the very act of deciding. Micropayments, as all payments, requires a comparison: "Is it worth as much X as Y? "There is a minimum mental transaction cost created by this fact that can not be optimized because the only transaction that a user is ready to approve without thinking will be a transaction that costs him nothing, that is not a transaction at all. "

Clay Shirky

It is interesting to note how Steemit managed to eliminate the issue of compensation for consumers and integrating the network.

So where does the money Steemit?

The Steemit network operates by creating new monetary units that are assigned to people who participate in and secure network. These tokens can be sold on the market for fiat or other tokens.

We can also consider that this is a public company that issues new shares to raise working capital.

Another way of looking at it is to consider the issue of new currency as a tax for people who use the network. The impairment caused by the issuance of a new Steem causes a slight drop in the currency, while rewarding active people on the platform.

Ultimately, the price of Steem depends largely on the forces of supply and demand in an open market .

Conclusions - Notice Steem

Steemit seems to be a formidable self-sufficient ecosystem for content creators and managers, and those that secure the network.

It is positioned in an industry that is too ripe for change and has a value difficult to compete.

However, one of the main issues I encountered during decortication of my research on the currency Steem was: "Why would anyone buy the Steem if he were constantly and consistently fall?

There is a pressure to almost guarantee decrease of approximately 10% per year. Steem also seems to be the currency that users Steemit use to "cash in" on the platform.

I did find a few things against my initial hypothesis.

For the downward pressure could significantly cripple platform Steemit, it would imply a significant stagnation state. Generally Steem experienced sizeable growth in 2017 alone, and it has only been a little over a year and a half since the introduction of the White Paper.

Steemit n 'even has yet to reap the benefits of a significant network effect creators, leaders and influencers. Many articles on Steemit have not had a chance to rank high enough in search engines, which limits the total potential traffic.

In addition, Steem Power Units are locked for two years and offer users attractive benefits. Not only holders Steem Power Units receive remuneration in the form of dividends, but they also have their say on the future of a site that could grow rapidly.

It is important to note that this is not investment advice but it is only an introduction to a few points to help you understand where this token and the platform could lead to the future.

Steemit barely explored the surface of his potential. The last number I found for the number of users Steemit is the monthly average to 26 000. In comparison, Reddit has about 542 million monthly users.

If you are an author or if you just want to see new forums, see the community and Steem platform. You will meet interesting people, interesting ideas, and you might even earn money through.****

Congratulations @thepioneer! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

To support your work, I also upvoted your post!

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thank you all for your upvote

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit