the Modern Economy

The clue is in the name: credit. It means belief, trust.

If you're a shopkeeper, who do you trust to repay a debt? For most of history, only someone you knew personally, which was fine since most of the people you encountered would be from the same small community. But as cities boomed, things became more awkward.

Large department stores couldn't rely on employees to recognise every customer by sight. So retailers issued tokens to trusted customers - special coins, key-rings, and in 1928, even objects resembling dog tags called "charga-plates".

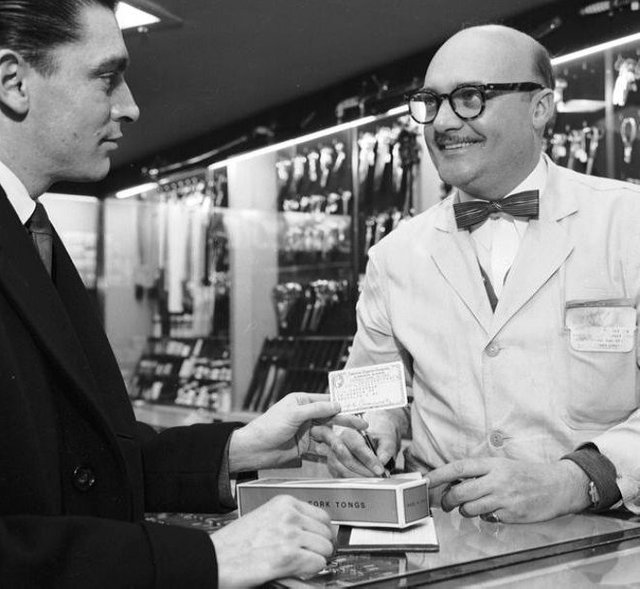

A customer pays with an American Express card in a cutlery shop in Manhattan, circa 1955

It would let him (and it was usually him) buy food and fuel,

rent hotel rooms, and entertain clients at a network of outlets around the United States.

And it took off: 35,000 people subscribed in the first year,

as the company rushed to sign up hotels, airlines, petrol stations and car hire firms.

In the 1950s came the American Express charge card, and credit cards set up by banks.

Overcoming inertia

Bank of America's imaginatively named BankAmericard would eventually become Visa. Its rival, Master Charge, became MasterCard.

But the early credit cards had two big problems to solve.

One was chicken-and-egg: retailers wouldn't accept the cards without significant consumer demand. Conversely many customers couldn't be bothered to sign up unless plenty of retailers would take them.

To overcome the inertia, in 1958 Bank of America experimented by simply mailing a plastic credit card to every single customer in Fresno, California - 60,000 of them.

Each card had a credit limit of $500 (£380), no questions asked - closer to $5,000 (£3,800) in today's terms.

This audacious move became known as the Fresno Drop. The bank took losses, of course, from delinquent loans, and outright fraud by criminals who simply stole the cards out of people's mailboxes.

But the Fresno Drop was quickly emulated. The banks swallowed the losses, and by the end of 1960, Bank of America alone had a million credit cards in circulation.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.modernghana.com/news/820446/credit-cards-have-changed-the-way-we-spend.html

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

no !

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit