Despite all the difficulties that traders have to face in the cryptocurrency market, they have great opportunities to use various strategies for trading cryptocurrency. Traders use a wide range of different instruments in their crypto trading that help to increase profits and reduce risks. Especially, Trailing Stops are very often used as a tool for exiting a trade.

This tool works very well in situations where a trader wants to get the maximum profit from trading and manage risk at the time. But in practice, this tool has a number of nuances that a trader needs to know.

What is the Trailing Stop?

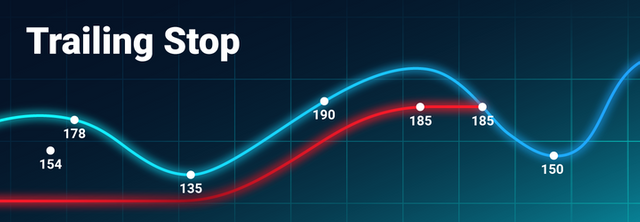

A trailing stop means a stop order that can be set up for fixing a percentage or amount of funds at a lower or higher current market price. This feature can reduce losses and help improve profit.

So, a Trailing Stop is a tool that allows you to move the price level to execute a stop order.

Pending orders, as we remember, include the Stop Loss and Take Profit. A trailing stop can be “tied” to any of them. What is it for?

Firstly, not everyone has the opportunity to constantly sit at the computer and monitor the trading process. Secondly, this tool will protect you from losses arising from sudden, accidental trend reversals.

A Trailing Stop is an option built into the crypto trading platform. You just need to set it for each open deal. Activation will occur at the moment when the price for a buy trade rises or falls (for a sell trade).

A Trailing Stop can be used in automatic mode (this is the most common method since its function is to save the trader's time) or manually, focusing on the values for the previous trading session.

What is a Trailing Take Profit?

A Trailing Take Profit is used for going after the price on the chart when it moves up.

What is a Trailing Stop Loss?

A Trailing Stop Loss is intended for moving down on the chart when the price is declining.

Trailing Stops plays a great role in the crypto trading process and can significantly increase the traders' profit, but this function is advisable to use by experienced traders, as this tool requires good skills and knowledge to set up it.

Pros and cons of a trailing stop order

Pros of a trailing stop order

By working with a Trailing Stop, you get the following benefits:

One of the advantages of trailing stops is the flexibility that it provides traders. Due to this, traders don’t need to move their stop manually, in case the price moves in the favorable direction, and you want to manage risk accordingly.

Profit maximization;

Limitation of losses;

Insurance against a sharp price reversal;

No need for constant monitoring of open positions;

The ability to work with several assets at once.

Cons of a trailing stop order

Possibility of losing profit if the value of the rollback is determined incorrectly. For example, there was a slight rollback, a trailing stop was triggered, the deal was closed, and the price reversed again in the direction you wanted.

For correct work of the Trailing Stop, your computer must be constantly turned on with an open window of the trading terminal. If you have problems with the internet connection, it may cause the stop order to fail.

How to set up a Trailing Stop Loss and Trailing Stop Profit in Cryptorobotics trading terminal?

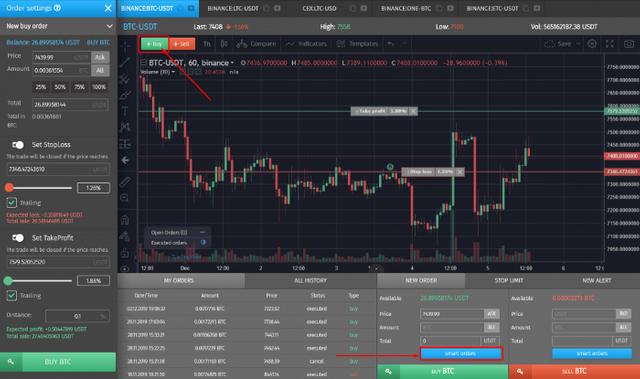

In order to set up Trailing Take Profit and Trailing Stop Loss, you need to place OCOs or smart orders. For this, any type of order available in the terminal can be used: market, limit, and stop-limit.

For example, we will select a limit order. In the Trade section, it is necessary to click on the “Smart Order” button or the “Buy” button, and a drop-down menu with settings will be opened in front of you.

The upper part is used to place buy orders:

- Indicate the cost of the coin at which you want to purchase it.

- Specify the amount of the purchased coin.

- You can enter any preferred deposit amount manually or select a specific percentage (25%, 50%, 75%, 100%).

- Customize the balance in the main currency.

- The cost of the coin can also be customized with the help of moving the level on the chart.

- After that, you have the option to configure Stop Loss and Take Profit.

- Set up a Trailing Take Profit and Trailing Stop Loss.

How do Trailing Stop Loss and Trailing Take Profit work?

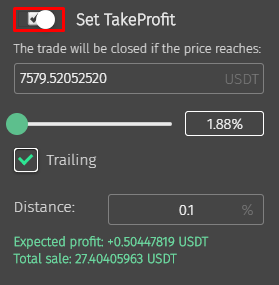

When you set up the Take profit, you should specify the cost of the coin in the percentage at which the order will be closed in profit. Take Profit can also be set up by moving the level on the chart.

To activate a Trailing Take Profit, you should add a checkmark and indicate the distance in percent. If the price exceeds the specified Take Profit, then the Take Profit will move upward with the deviation that you specified.

While the price is growing, a Trailing moves your Take Profit level above. Once the cost of the coin starts falling and reaches a specified deviation from the maximum price, the order will be closed.

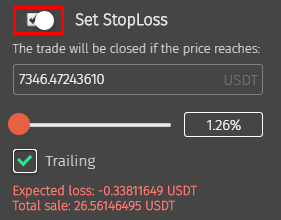

When you activate a Stop Loss, you should specify the loss in percentage that you can lose in case of a price decline. When reaching this value, the order will be closed automatically.

To customize a Trailing Stop Loss, you should add a checkmark.

When the price of the coin rises, Stop Loss will automatically move up. That is, if we indicated the Stop Loss from the price minus 2% with a positive price movement, the Stop Loss will move up at a distance of 2%.

When the price drops, it will stop its movement, and the order will be closed at the value indicated for Stop Loss or the cost of cryptocurrency where the Trailing pulled it.

It is undesirable to set up Trailing Stop Loss during the flat market, this function can reduce your profits.

After you have customized all the parameters, you should press the Buy button in the lower-left corner, and the order will automatically go into operation.