1. What is a DAICO?

It's a change on the ICO raising money demonstrate that joins certain parts of DAO's.

The thought was recommended by Vitalik Buterin in January 2018 and is gone for influencing ICO's more to secure by including speculators in the underlying venture advancement process.

It will additionally empower token holders to vote in favor of the discount of the contributed reserves in the event that they are not content with the advance being made by designers.

For ventures that actualize the DAICO idea, it will constrain a level of responsibility on designers and give token holders extra significant serenity that they are ensured to either observe no less than a base reasonable item or recover their cash.

2. How does a DAICO function?

It begins off as a Savvy Contract in commitment mode.

The DAICO contract will have an instrument where patrons can send assets to the venture in return for organize particular tokens. At the point when the crowdsale period closes, the agreement will restrict anybody from contributing any further, i.e., typical token deal.

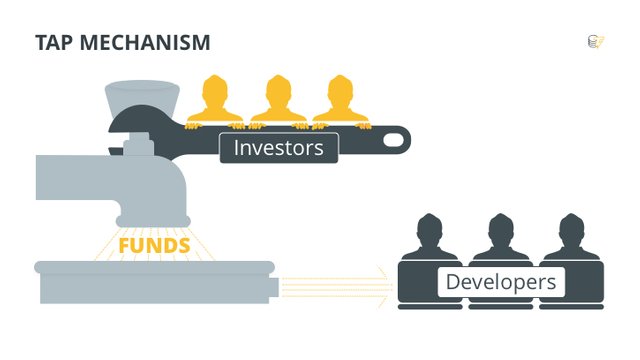

There is one variable that becomes effective after the commitment time frame has finished called the tap variable. This tap in the agreement can be modified to foreordain the sum (every second) that designers can pull back from the token deal stores.

At first, the breaking point will be set to zero, yet givers would then be able to vote on a determination to build the tap.

3. What components from a DAO are joined?

There are three fundamental components taken from DAO's.

To start with, at no time is finished trust set completely on an incorporated group. Choices on reserves from the get-go are chosen by a vote based voting framework.

Second, subsidizing isn't discharged in a singular amount, however an instrument is actualized to spread it after some time.

Lastly, there is a chance to discount the contributed cash. This choice depends on the 'shrewdness of the group,' i.e., the benefactors can vote in favor of a discount of the rest of the funds, if the group neglects to execute the task.

4. How is it not quite the same as an ICO?

The principle contrast is access to stores.

With an ICO, once the token deal completes, engineers have finish access to all the contributed reserves. Engineers need to figure ahead of time what amount is important to deliver a base suitable item and once they achieve this sum, called 'the delicate top', they can begin to take a shot at the item and spend the cash on whatever they esteem fundamental. On the off chance that they don't achieve this underlying delicate top, they need to discount the cash. In any case, in the event that they do, there's no further genuine commitment.

With a DAICO, benefactors can vote on resolutions (amid the advancement stage) to either build the tap or to restore the rest of the contributed stores (self-destructing the agreement).

5. What are the advantages contrasted with ICO's?

It puts more control in the hands of financial specialists.

Supporters have considerably more to state and impact in the improvement phase of the undertaking. On the off chance that they are not content with how the venture is advancing, they can set the agreement to pull back and get a discount.

This totally mitigates the danger of trick ICOs where engineers hold a token deal and after that flee with the cash when the ICO is done, without creating any item.

As the measure of assets that gets discharged from the Keen Contract is restricted and entirely controlled, it will lessen the event of 51% assaults. Regardless of whether a 51% assault happens, where an assailant needs to send assets to a picked outsider, the results will be contained to the sum that was approved to be discharged by the benefactors (or the creating group) at any one point (the tap).

With an ICO, once the group raises countless dollars, it endures weakening in its inspiration to actualize the venture; or, at any rate, the action diminishes altogether. With DAICO show the group's inspiration to breath life into the thought, i.e. to convey the item, is managed over a lifetime period.

6. What are a portion of the potential difficulties with DAICO's?

Similarly as with any new idea, there will be a few difficulties that need resolving.

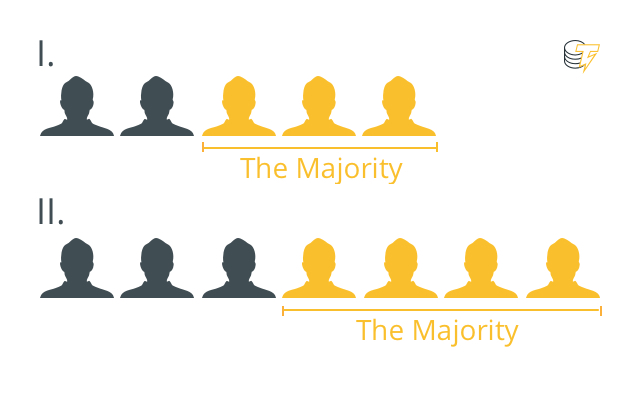

On the off chance that designers hold a huge piece of the conveyed tokens, they possibly just need to impact a little level of supporters of influence their vote and get more subsidizes discharged from the Shrewd Contract.

Givers' training is additionally vital. They have to comprehend why the cost of a particular token is rising or tumbling to settle on the correct choice when voting on expanding the tap sum, or restoring the assets. The best choice is one in light of the actualities identifying with the task itself, not on feelings associated with the cost of a specific token.

At last, givers can likewise totally withdraw by putting all their trust in the DAICO idea itself and in this way feel it's a bit much for them to really share in votes and resolutions, lessening the lion's share limit and debilitating the security of the component.

7. What are a portion of the fundamental attributes of a DAICO?

It's difficult to state as the idea has never been actualized yet.

In any case, to answer the inquiry, it is useful to take a gander at an undertaking that intends to lead the world's first DAICO.

The Chasm, for example, a cutting edge advanced circulation stage in light of a crypto remunerate biological system, plans to do this with the accompanying DAICO highlights:

A determination to vote on tap increments must be started by venture designers.

There's a rate restrict by which the tap can be expanded at once (to forestall manhandle).

The recurrence of potential tap increments is restricted (close to state once at regular intervals).

Just speculator tokens can be utilized to vote, not those held by venture engineers.

Benefactors will be educated well ahead of time of an arranged survey.

At the point when benefactors choose to end the task, the Brilliant Contract will change to withdrawal and discount their cash, while in the meantime pulverizing tokens held by engineers.

As a follower of @followforupvotes this post has been randomly selected and upvoted! Enjoy your upvote and have a great day!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much!.. ♡

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your Post Has Been Featured on @Resteemable!

Feature any Steemit post using resteemit.com!

How It Works:

1. Take Any Steemit URL

2. Erase

https://3. Type

reGet Featured Instantly � Featured Posts are voted every 2.4hrs

Join the Curation Team Here | Vote Resteemable for Witness

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit