Hello reader, maybe we all ask questions What is a vena network?

For now, payments between currencies are encrypted, and in a fixed currency, mainly through a centralized OTC trading platform. Most countries do not enact encryption laws, which means the platform can operate without licenses and rules. Thus, users of this platform must always take risks in providing financial security and confidentiality, while the trading platform can manipulate prices in transactions to get superganancias. Of course, there is an increase in demand that users can do safely and comfortably between currencies, cryptographic management and trust.

What is vena network?

Vena Networks aims to create financing for decentralized digital assets and share networks through the Vena Protocol. The Vena Protocol is an open source protocol based on a block chain where people can trade between cryptographic currencies and decree currencies and use cryptographic currencies as collateral for loans without having to trust third parties. On the Vena network, users can use the criptomonedas market, and you can reduce the risk associated with criptomoneda cost fluctuations and unscrupulous entrepreneurs.

Vena node is a key element of vena issue. The Vena Protocol, two roles are defined: Core Agent and Relative of Vena. Vena nodes can be a role or a combination of two roles, or can contain all types of service providers originating from market competition. The Vena protocol is a mixed technology "Off-line Set-Relay", providing a balance between efficiency and security of operations and significantly reducing friction transaction costs. Thus, trade orders with encrypted signatures are sent via off-line channels, while transactions in the chain can occur only when the value is transmitted. Interested partners can add one or more orders, smart contracts, to ensure that transactions under the contract are smart.

The vena of market operations must provide accurate market data, as well as TBT operations and loan guarantees that are fair, transparent, safe and inexpensive. Each node in the VENA transaction market is a for-profit organization that is independent and can make a profit from providing financial services.

The Vena Foundation is a non-profit organization created by the Living Group in Singapore, which is responsible for the sustainability of the Vena project, the effectiveness of decentralized management, the safety and transparency of investment, and the development of entrepreneurship and innovation to help start-up companies based on the

Vena protocol.

Vena

Network Hub The main role of the Veena hub network is to promote the liquidity of the Vena network; Veins hubs can use the VENA SDK to configure and provide users with comprehensive transaction services, including but not limited to loans, asset transactions, credit scores, contract contracts and etc., and make a profit by collecting fees.

Qualifications

Vena certified sites must have qualifications, as well as experience in microcredit and the place where they work.

Warranty

Vena Certified Host must store VENA Token guarantees a specific percentage in the vein foundation.

High Liquidity

Vena certified orders in the general pool of liquidity, Vena nodes can share orders and earn commissions by promoting transactions, as well as improving the transaction network through economic incentives for profit distribution.

Security

Digital assets that are stored in their wallets or locked in a smart contract. Vena nodes do not contain digital user assets, thus avoiding the moral hazard of running the platform. At the same time, it also significantly reduces the cost of security for depositing assets for nodes.

The juror of the Application

In order to join the jury of the vein network, you must first submit an application to Vena DAO and provide proof of identity. After approval of the application, it is necessary to take part in online training and evaluation of the jury of veins

Arbitrage

A full suite of Arbitration software runs on infrastructure built by Ethereum and IPFS. Through a simple user interface, judges can easily obtain evidence submitted by both parties and arbitration

Economic incentives and deposit guarantees

In order to motivate the jury jury to properly use jury powers, a jury must deposit a certain amount of VENA Tokens in Vena DAO

Exit

Mechanism A. jury volunteers to exit B. fine more than 5 times during the term of the contract C. Vena DAO conspiracy to commit fraud)

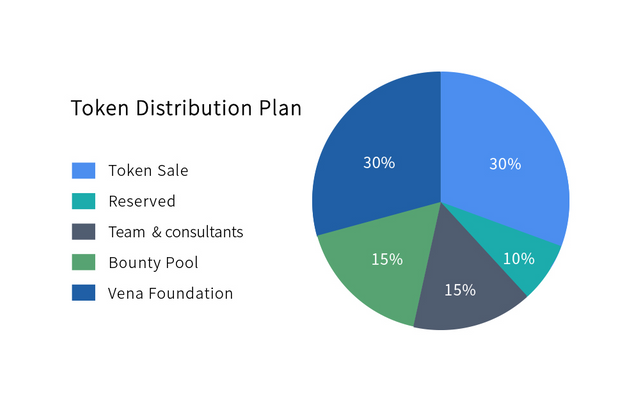

Marker vena

The Vena Team issued an ERC20 marker based on the Ethereum block chain. The problem with the initial volume of vena markers is thousands of millions, and each year needs to issue additional markers. The scope of additional problems with vena markers is closely related to the state of vena network operations. The Vena Network uses DAICO to manage funds and use funds from funds and introduce 100% correct code rules that will be controlled directly by participants and contracts, intellectuals, and not by third parties.

After completing Daico Vena, the Vena Foundation will make a special investment fund for investment and incubation of companies and DAO in the Vena ecosystem. The direction of investment includes the underlying technology of the unit, protocol units and applications, and extension of the Vena protocol. Vena investment funds are managed directly by the Committee, DAO Vena, accompanied by a professional research team, investment team and investment management after investment. Between 20% and 50% of the funds will be used to buy and eliminate Vena emergencies, which are traded in the market (scale of purchase depends on Vena prices), and the remaining income will be used for continuous investment.

Team and advisor: This section is 15% of the total number of VENA tokens issued, 1/4 part will be distributed immediately after the token release; The remaining 3/4 parts will be blocked for one year, and after the one-year blocking period, the tokens will be distributed as follows: 1) token vena advisers will soon be distributed; 2) 1/4 team tokens will be distributed soon, and the remainder will be distributed in stages for 12 months.

Private sales: VENA personal sales tokens will be distributed in two ways: 1) part of the token that is not included in the blocking plan will be distributed to participants' wallets 2 days before being listed as an exchange; 2) the part of the token included in the blocking plan will be blocked in the smart contract after the list in exchange, which will be opened and distributed to the participant's wallet in stages according to the rules set.

Public offer: after the public sale, this part will be distributed to the wallet for 2 days before being included in the exchange.

Bonus pool: every year, a fixed share of 1% is given to teams and community developers for 10 consecutive years; The remaining 5% will be used to implement important resources, including but not limited to talent, strategic partners, etc.

Reservations: Funds can be collected from parts reserved through DAO when the team does not have funds, or the ordered portion can be transferred to a collection of foundation funds to promote ecosystem development.

VENA ROADMAP

2018.Q2

- Official launch of white paper & Vena Network website

- Proof of concept & launch development

- Community building in countries including the United States of America 、 China 、 Canada 、 Australia 、 Russia 、 etc.

2018.Q3

- Release the official exchange beta version

- Conduct targeted financing and lending business based on the official beta exchange

- Open to application for Vena Nodes

2018.Q4

- Open source SDK of Vena Network is available in github

- Pilot run of official exchange and operation simulation

- Veins 1.0 release

- First Vena Node introduction

2019.Q1

- Vena 1.1 release

- Fully develop the ecosystem, start the city partner program, and introduce 20+ Vena Nodes

2019.Q2

- Vena 2.0 release

- Accelerate the expansion of global business, Introduce 50+ Vena Nodes

CORE TEAM AND VENA NETWORK ADVISOR

Ching

The CEO

Obtain the highest honorarium from 'Outstanding Student' from the University of UESTC.

Chainboard.io founder.

Former Ice Credit technical director, famous fintech company.

Previously served as a special technical consultant for several listed companies.

Jeremy

CTO

Co-founder and CTO of Hardrole.

Experienced blockchain engineers, are members of the core team on the Metaverse Blockchain.

Deep knowledge of the architecture underlying the blockchain, DAG network architecture, wallets, exchanges, security protection.

Previously in charge of cloud R & D in the design and architecture of Hiscene products, a well-known AI company.

Maybe

Director of Operations

Master of Finance NTU, XMU graduate.

Rich experience in entrepreneurship. Reach the first venture capital by establishing SATORI. In 2017, stepping in as CEO and selling shares to IT SETTING in 2018.

Now a leading professional team to provide one-place operational support internally to global technology companies, especially the blockchain startup.

Yuanfei

CSO

Founder Satori, initial developer of Ethereum, contributor of ENS.

Previoulé runs the Beico operation, a ICO investment agent platform and leads the development of high-performance exchanges.

He majored in computer science and technology at Shanghai Jiao Tong University, and founded Moregg during the university year.

Previously working on big data algorithms and machine learning in Silicon Valley, it was responsible for analysis and operations at Yahoo.

Yoki

Product Director

Rich experience in the Internet industry and previously worked for well-known Internet companies, for example. NetEase, Inc. (NASDAQ: NTES), etc. The products he handles have more than 100 million users.

Familiar with PC user analysis and mobile products, good front-end and back-end product design, 2B2C product design, rich experience in project design and data analysis.

Zed

Director of Buissness

Previously working as a project manager at CETC, led the entire process of building an encrypted platform and cyberspace security system for Armed Police.

Responsible for national cloud computing encrypting white paper applications, Sichuan Government Provincial Government and Yunnan Cloud projects that are worth more than 500 million RMB.

Amira

Foreign Market Manager

Seven years experience in business development and project management.

Previously worked as a translator at meetings including the G20 Minister of Finance and the Central Bank Governor's Meeting.

Very experienced in foreign market operations and involved in blockchain industry research.

ADVISOR OF VENA

Yanxi Gu

DAEX Chief Strategy Officer and Chair of the foundation.

MBA from the University of Texas, Master from Notre Dame University, Master of Science and Technology of China, Bachelor of Shandong University.

Former Deputy CIO Huatai United Securities and COO of several financial service companies.

Yang Zhao

Shanghai Xinyan Credit Information Service Co., Ltd., an expert in big data risk management COO.

Former VP from ESurfing Credit Information Co., Ltd.

Yongchao Zhai

The author of "Spring Cloud Microservice Practice".

famous technical blogger, Spring Evangelist from Boot / Spring Cloud, the initiator of the spring4all community.

Shawn Wang

Former Team Leader from the Maya Crime Investigation group on Network Security Systems.

Former Chief Security Officer from one of the ITFIN CITICPE companies.

Director of Information Security from the Fortune Global 500 Company.

Kong Huawei

Director of the Shanghai Branch of the Computing Technology Institute of the Chinese Academy of Sciences.

Partner of iStart Capital.

Scientific Consultant for Information Technology Canaan and Vice President of the Association of International Blockchain Applications.

SJ Zhang

Investor investment and Eastern European blockchain, out of the Master of Strategic Marketing at the Russian Central Bank Economy Institute.

Former advisor to the Sberbank blockchain insurance project and working as a translator at the state banquet from the Russia-China Economic and Trade Forum.

Early investor blockchain projects including Ton, Polkadot, Cindicator, Bibox.

Sameer Ahmed

Deputy President of BLVCK DIVMOND, Las Vegas-based top-tier marketing strategy.

Serial entrepreneurs, marketing experts, and experienced FX Traders at Wall Street Academy.

Focusing on marketing and strategic partnerships.

Jayson Pearson

Rich television experience, live stage production, and operations management.

Study politics and economics at Carroll College in Montana and get a BS in psychology.

Grant Leingang

President of DIVMOND BLVCK.

Leading Visual Development, Programming & Marketing Analysis.

PARTNER

Official (Vena):

Website - http://vena.network/en

White paper - http://whitepaper-en.vena.network/

Telegram - https://t.me/vena_network

Facebook - https://www.facebook.com/Vena-Network-207271413455484/

Twitter - https://twitter.com/VenaProtocol

Github - https://github.com/venanetwork

the author of the article:

************Dream Catcher*******************

Address ERC20:

0xb97fC73374375ad979e95886678262D2776c24c4

btc.talk profile:

https://bitcointalk.org/index.php?action=profile;u=2043993

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @thedreamcatcher! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit