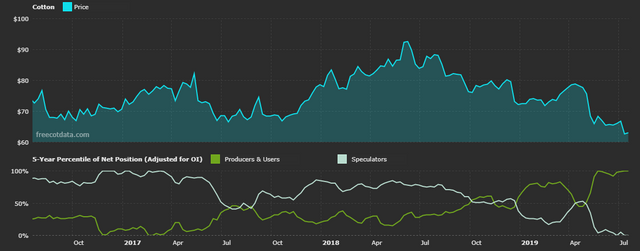

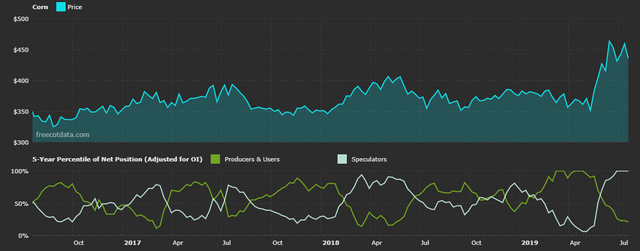

COT report measures positions of all commercials and speculators who usually take the opposite side. If either is on

1-3 year historical top or bottom and the other on the opposite side, it usually harbingers a good opportunity for midterm investment.

Reports:

.png)

Technicals:

Both markets are closing on their key structures. I want to see them bounce and create a higher low in case of cotton and lower high in case of corn. If success, I will be looking for an entry point within or around the circles. As they bounce, I want to see candles decreasing over the duration of bounce. Perhaps, some rejection candles (long tail for cotton, long wick for corn). Then, I will open my position on one of these.

Corn's downward move is also strongly supported by seasonality, so I would favour taking it more.

Remember that my analysis is just my opinion and it is only your decision to either invest or not invest.

Thanks for reading! Have a nice day!

Congratulations @godalys! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit