Dear trading community,

I did not find enough time to post a sample portfolio update last week.

So here is a look back to my sample portfolio of last week and this week.

Week 33 - Friday August 16 2019:

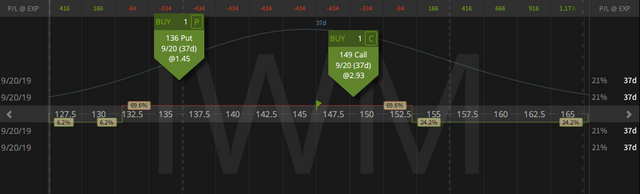

Inverted Strangle in IWM

On Wednesday, July 31st 2019, I had to roll up my put into a straddle for a credit of $2.35, since my short call got hit. Because of the following sell off I had to defend the position again by rolling down my call for a credit of $2.86 and go inverted.

On Monday, August 5th 2019, I had to roll down my call again for a credit of $2.22.

My overall credit for this position is $11.14.

My profit target for this position hasn't changed, it is still $1.70, so I'm going to close this position when it trades for $9.44 or at 21 DTE.

At the moment this position is down $2.93 ($293 per one lot).

Closing Aggressive Short Delta Strangle in IMW

On Monday, August 5th 2019, I sold this position for a credit of $6.14.

On Wednesday, August 14th 2019, I closed it for a profit of $1.80.

IWM September Short ATM Call

To keep my short deltas in IWM, I sold this one for a credit of $3.97.

Since this is a delta adjustment, I don't have a special management target.

At the moment this position is down 82 cents ($82 per one lot).

TLT Inverted Short Strangle

On Friday, July 26th 2019, I sold a strangle for a credit of $1.91.

On Thursday, August 1st 2019, I had to roll up my put into a straddle for a credit of $1.22, because my deltas got too short.

On Monday, August 5th 2019, I had to roll up my put again and go inverted to the 138 strike for a credit of $1.52.

My overall credit for this position is now $4.65.

Since the most I can make on this position is 65 cents, I'm looking for a scratch, so I'm going to close this position when it trades for $4.65 or at 21 DTE.

At the moment this position is down $7.68 ($768 per one lot).

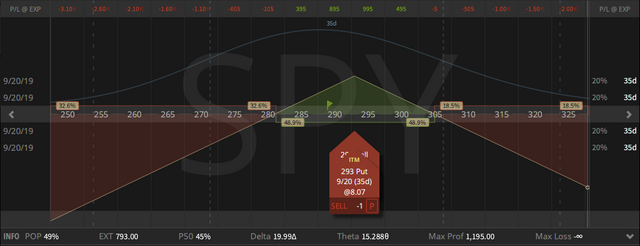

SPY September Straddle

My overall credit for this position is $10.56.

Since I'm in full defense mode on this position, I'm looking for a scratch in this position.

At the moment this position is down $1.39 ($139 per one lot).

Closing SPY Skewed Strangle

On Monday, August 5th 2019, I sold an atm call for a credit of $7.71 and since the market kept selling off, I added a short 16 delta put for a credit of $2.41

My combined credit on this position was $10.12.

On Wednesday, August 14th 2019, I closed it for a profit of $2.18 ($218 per one lot).

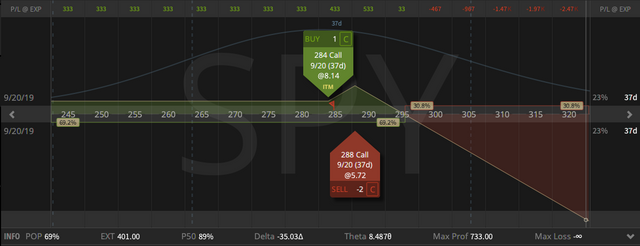

SPY September Call Ratio Spread

I sold this one for a net credit of $3.33 on Wednesday, August 14th 2019, to keep my short deltas.

My profit target is 25% of max profit ($1.83 cents), so I'm going to close this position, when it trades for $1.50 or at 21 DTE.

At the moment this position is down 76 cents ($76 per one lot).

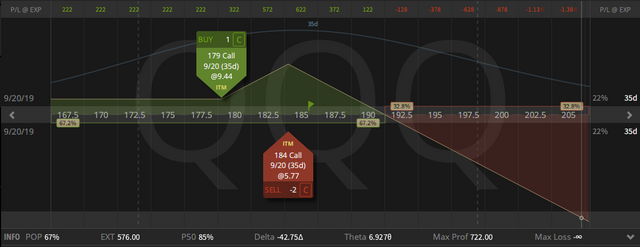

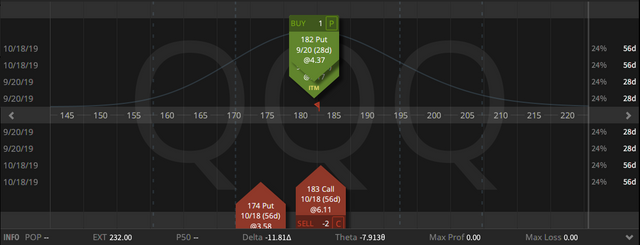

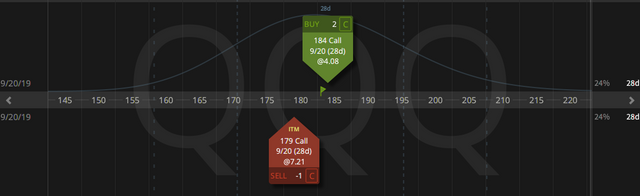

QQQ Synthetic Covered Put

I collected $12.14 in credit for the two atm calls.

My synthetic basis on the covered put is now $177.79, so I have to collect $4.09 more in credit on this position, until I can break even.

At the moment I'm synthetically down $11.03 ($1,103 per one lot).

Coming back...

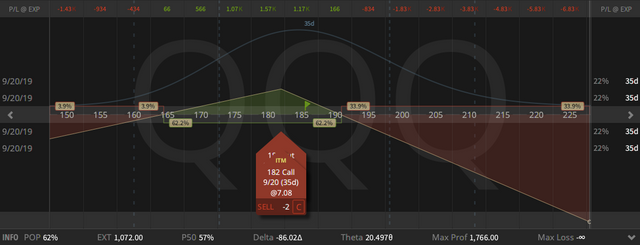

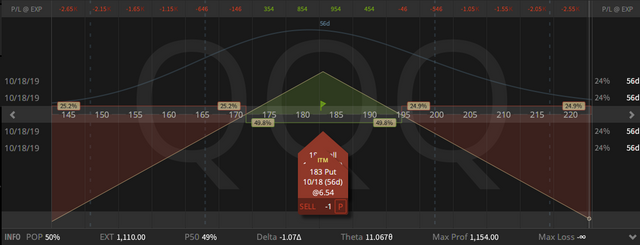

QQQ September Short Straddle

The overall credit on this position is $8.09.

Since I'm in full defense mode on this position, I'm looking for a scratch in this position or maybe a small profit.

At the moment this position is down $1.70 ($170 per one lot).

QQQ September Call Ratio Spread

I sold this one for a net credit of $1.58 on Monday, August 5th 2019.

My profit target is 25% of max profit ($1.64 cents), so I'm going to close this position, when it trades for a credit of 6 cents or at 21 DTE.

At the moment this position is down 64 cents ($64 per one lot).

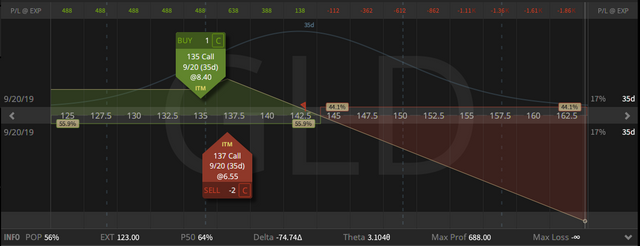

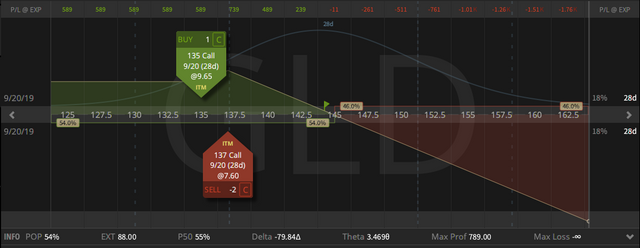

GLD September Call Ratio Spread

I sold this one for a net credit of $1.26 on Thursday, August 1st 2019.

My profit target is 25% of max profit (90 cents), so I'm going to close this position, when it trades for 71 cents or at 21 DTE.

At the moment this position is down $3.62 ($362 per one lot).

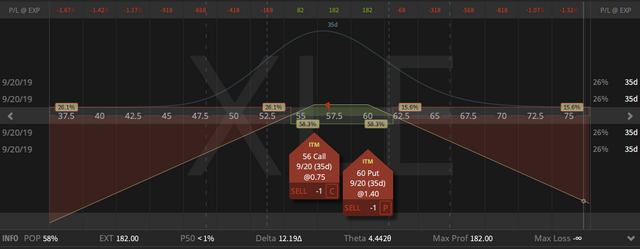

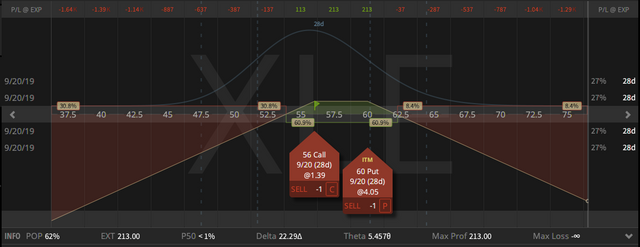

Defending XLE September 25 Delta Short Strangle

On Monday, July 22nd 2019, I sold a strangle for a credit of $1.40.

On Monday, August 5th 2019, I had to roll down my call into a straddle for a credit of $2.03.

On Thursday, August 15th 2019, I had to roll down my call further for a net credit of $1.52 and go inverted.

My overall credit on this position is now $4.95.

My profit target for this position hasn't changed, it is still 70 cents, so I'm going to close this position when it trades for $4.25 or at 21 DTE.

At the moment this position is down 87 cents ($87 per one lot).

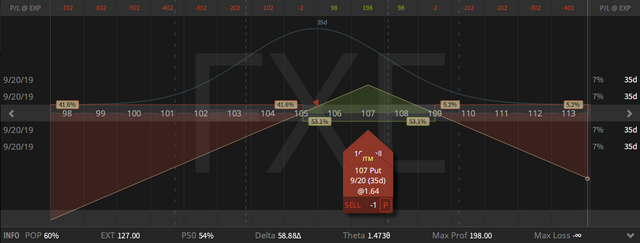

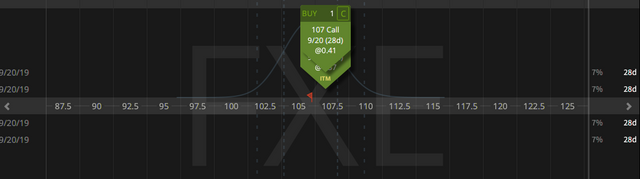

FXE September Short Straddle

On Monday, July 22nd 2019, I sold this position for a credit of $1.85.

My profit target for this position is 45 cents, so I'm going to close this position when it trades for $1.40 or at 21 DTE.

At the moment this position is down 13 cents ($13 per one lot).

Now let's have a look at week 34.

Week 34 - Friday August 23 2019:

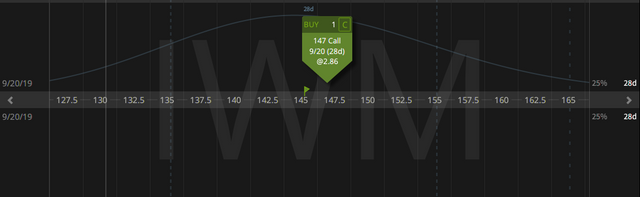

Inverted Strangle in IWM

On Wednesday, July 31st 2019, I had to roll up my put into a straddle for a credit of $2.35, since my short call got hit. Because of the following sell off I had to defend the position again by rolling down my call for a credit of $2.86 and go inverted.

On Monday, August 5th 2019, I had to roll down my call again for a credit of $2.22.

My overall credit for this position is $11.14.

My profit target for this position hasn't changed, it is still $1.70, so I'm going to close this position when it trades for $9.44 or at 21 DTE.

At the moment this position is down $4.19 ($419 per one lot).

Closing IWM Short Call

On Wednesday, August 14th 2019, I sold this position for a credit of $3.97.

On Friday, August 23rd 2019, I closed it for a profit of $1.13 ($113 per one lot).

New October IWM Short Call

In this high IV environment, you gotta keep short deltas, so on Friday, August 23rd 2019, I sold this call for a credit of $4.53.

No special profit target.

TLT Inverted Short Strangle

On Friday, July 26th 2019, I sold a strangle for a credit of $1.91.

On Thursday, August 1st 2019, I had to roll up my put into a straddle for a credit of $1.22, because my deltas got too short.

On Monday, August 5th 2019, I had to roll up my put again and go inverted to the 138 strike for a credit of $1.52.

My overall credit for this position is now $4.65.

Since the most I can make on this position is 65 cents, I'm looking for a scratch, so I'm going to close this position when it trades for $4.65 or at 21 DTE.

At the moment this position is down $7.59 ($759 per one lot).

Scratching SPY September Straddle

On Tuesday, August 20th 2019, I was able to scratch this trade. No profit, no loss

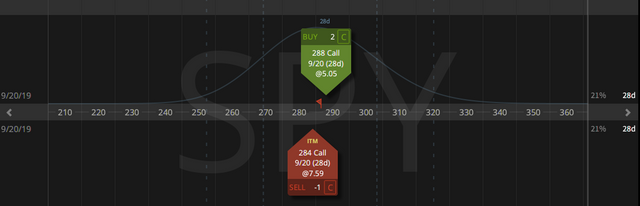

Closing SPY September Call Ratio Spread

I sold this one for a net credit of $3.33 on Wednesday, August 14th 2019, to keep my short deltas.

On Friday, August 23rd 2019, I closed it for a profit of 84 cents ($84 per one lot)

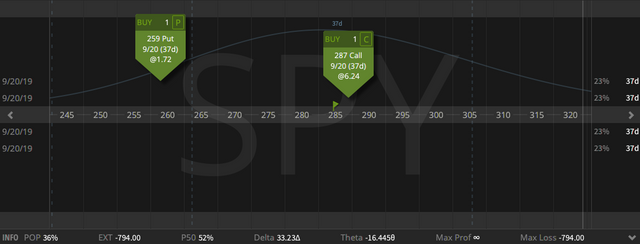

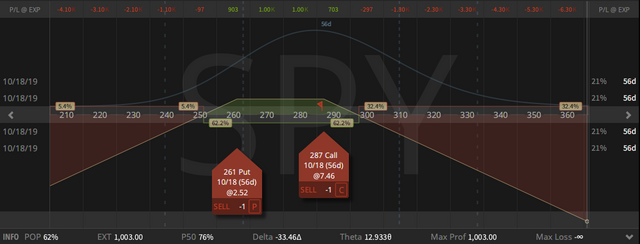

New October SPY Aggressive Short Delta Strangle

On Friday, August 23rd 2019, I sold this position for a credit of $10.03.

My profit target for this position is $3.56, so I'm going to close this strangle when it trades for $6.47 or at 21 DTE.

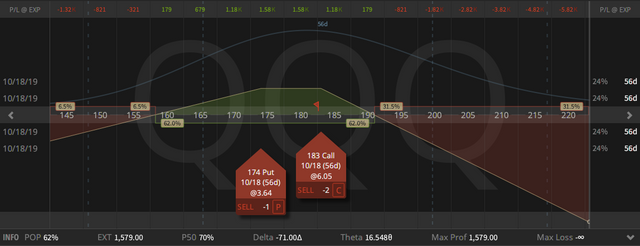

Rolling QQQ Synthetic Covered Put to October

On Friday, August 23rd 2019, I rolled this position out to October for a credit of $1.18.

I also rearranged the calls and the put to get 70 short deltas.

My synthetic basis on the covered put is now $178.97, so I have to collect $2.91 more in credit on this position, until I can break even.

Rolling QQQ September Short Straddle to October

On Friday, August 23rd 2019, I rolled this position out to October for a credit of $3.35.

The overall credit on this position is $11.54.

Since I'm in full defense mode on this position, I'm looking for a scratch in this position or maybe a small profit.

Closing QQQ September Call Ratio Spread

I sold this one for a net credit of $1.58 on Monday, August 5th 2019.

On Friday, August 23rd 2019, I closed this position for a profit of 71 cents ($71 per one lot).

GLD September Call Ratio Spread

I sold this one for a net credit of $1.26 on Thursday, August 1st 2019.

My profit target is 25% of max profit (90 cents), so I'm going to close this position, when it trades for 71 cents or at 21 DTE.

At the moment this position is down $4.63 ($463 per one lot).

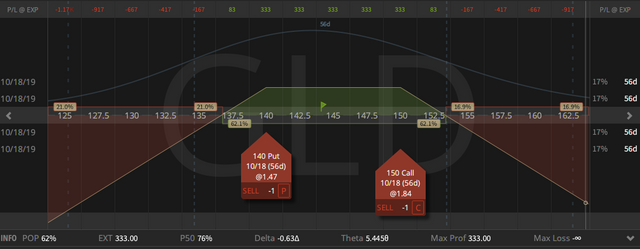

New October GLD 30 Delta Strangle

On Friday, August 23rd 2019, I sold this position for a credit of $3.33.

My profit target for this position is $1.60, so I'm going to close this strangle when it trades for $1.73 or at 21 DTE.

XLE Inverted Strangle

On Monday, July 22nd 2019, I sold a strangle for a credit of $1.40.

On Monday, August 5th 2019, I had to roll down my call into a straddle for a credit of $2.03.

On Thursday, August 15th 2019, I had to roll down my call further for a net credit of $1.52 and go inverted.

My overall credit on this position is now $4.95.

My profit target for this position hasn't changed, it is still 70 cents, so I'm going to close this position when it trades for $4.25 or at 21 DTE.

At the moment this position is $1.18 ($118 per one lot).

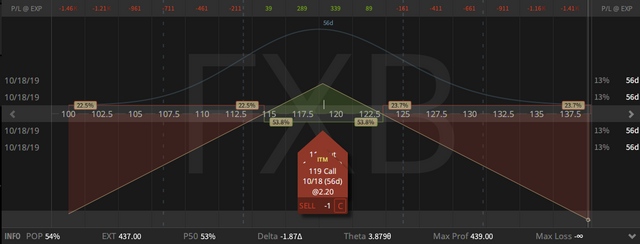

Closing FXE September Short Straddle

On Monday, July 22nd 2019, I sold this position for a credit of $1.85.

On Friday, August 23rd 2019, I closed this position for a small profit of 2 cents ($2 per one lot).

New October FXB Short Straddle

Since IVR in the British pound is higher at the moment as in the Euro currency, I sold this position for a credit of $4.39.

on Friday, August 23rd 2019.

My profit target for this position is $1, so I'm going to close this strangle when it trades for $3.39 or at 21 DTE.

Books Update

With the completion of my latest book, I have now a trilogy.

The first book is still available for a huge discount on Google Play, so buy as long as it is still cheap.

You can also buy it for $19.99 on iTunes, Amazon or Barnes and Nobel.

Thanks to all my readers for buying it.

If you like it, you would do me a great favor by writing a short review on amazon.

My second book is available for $5.99 on Amazon, Google and on Apple.

Thanks to all my readers for buying it.

If you like it, you would do me a great favor by writing a short review on amazon.

My third book is available on Amazon, Google and iTunes.

Have a great weekend,

Stephan Haller

P.S. Probably no update for the next two weeks.

Legal disclaimer: These are not trade recommendations. Options involve risk and are not suitable for all investors. The trades shown above are for educational purpose only.

Congratulations @stehaller! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit