Dear trading community,

Here is a look at my sample portfolio for Friday, October 25th, 2019.

Since we hit the 21 DTE threshold on Friday, I had a lot of rolling and closing/reestablishing to do this week.

Closing IWM November Short Straddle

On Tuesday, September 24th, 2019, I sold this position for a credit of $4.22.

This time only half the size, since IVR was low.

On Wednesday, October 2nd, 2019, I had to roll down my call for a credit of $3.55, since my short put got hit.

My overall credit for this position was now $7.77.

On Thursday, October 24th, 2019, I closed it for a profit of 12 cents ($12 per one lot).

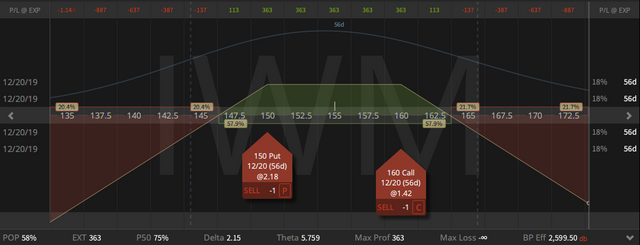

New IWM December 30 Delta Short Strangle

On Friday, October 25th, 2019, I sold this position for a credit of $3.75. Only half of my normal size since IV is so low.

My profit target for this position is $1.60, so I'm going to close it, when it trades for $2.15 or at 21 DTE.

At the moment this position is up 12 cents ($12 per one lot).

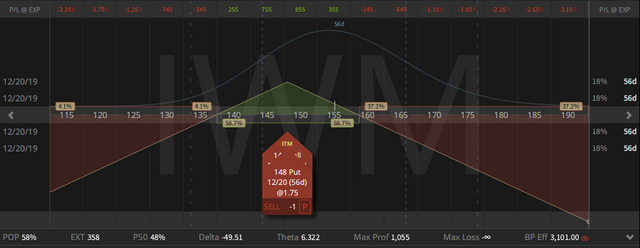

Rolling IWM November Short Call out and up to December and into a Short Straddle

On Friday, August 23rd, 2019, I sold this call for a credit of $4.53.

On Thursday, September 26th, 2019, I rolled it up to the 147 strike and out to November for a credit of 69 cents.

On Friday, October 25th, 2019, I rolled it up to the 148 strike and out to December expiration and also added a short 148 put to reduce my short deltas.

My overall credit for this position is now $7.25.

No specific profit target, since this is all in defense mode.

At the moment this position is down $3.30 ($330 per one lot).

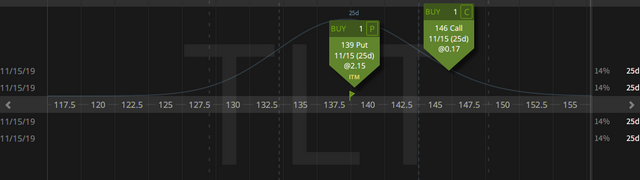

Closing TLT November 30 Delta Strangle

On Friday, September 27th, 2019, I sold this position for a credit of $2.87.

On Monday, October 21st, 2019, I closed it for a profit of 59 cents ($59 per one lot), since my short put got hit.

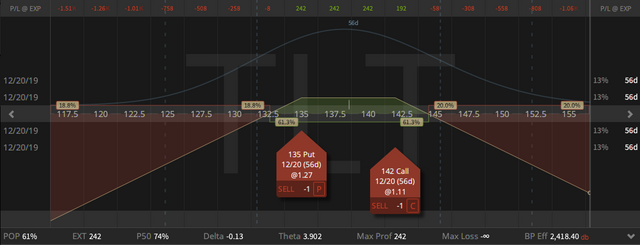

New TLT December 30 Delta Strangle

On Friday, October 25th, 2019, I sold this position for a credit of $3.02.

My profit target for this position is $1.28, so I'm going to close it, when it trades for $1.74 or at 21 DTE.

At the moment this position is up 60 cents ($60 per one lot).

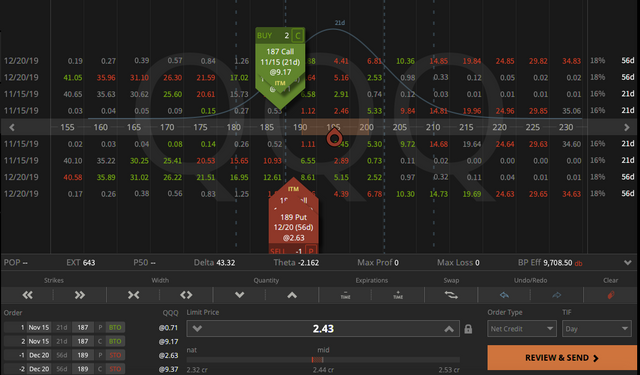

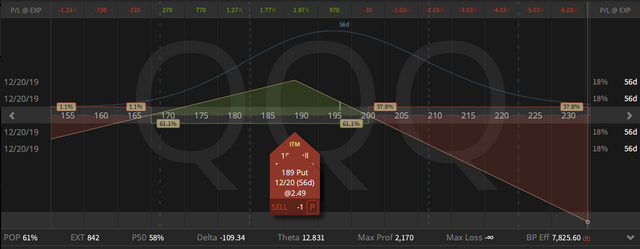

Rolling QQQ November Synthetic Covered Put up and out to December

Rolling time also on this position. Up and out for a credit of $2.43.

My synthetic basis on the covered put is now$184.49, I have collected enough in credit in this position to have the chance to be profitable.

We'll see how and if this will work out.

Closing GLD November Short Straddle

On Monday, September 23rd, 2019, I sold this position for a credit of $3.25.

On Wednesday, October 2nd 2019, I had to roll down my call for a credit of $1.71, since my short put got hit.

My overall credit for this position is was $4.96.

On Thuesday, October 22nd, 2019, I closed it for a profit of $1.33 ($133 per one lot)

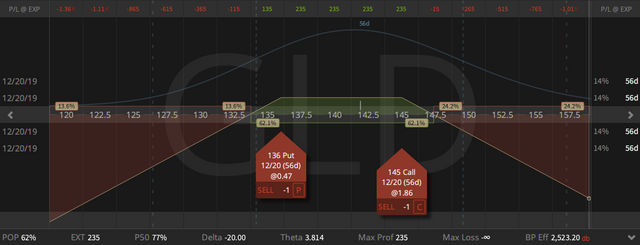

New GLD December 30 Delta Strangle

On Thuesday, October 22nd, 2019, I sold this position for a credit of $2.46.

My profit target for this position is $1.23, so I'm going to close it, when it trades for $1.23 or at 21 DTE.

At the moment this position is up 11 cents ($11 per one lot).

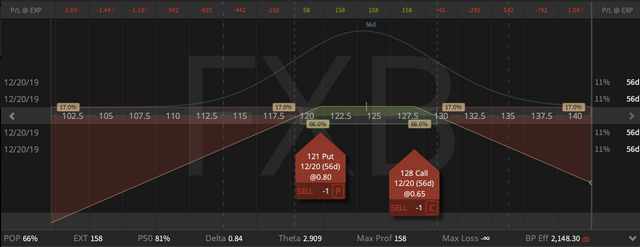

FXB December 30 Delta Strangle

On Wednesday, October 16th 2019, I sold this position for a credit of $2.34.

My profit target for this position is $1.14, so I'm going to close it, when it trades for $1.20 or at 21 DTE.

At the moment this position is up 76 cents ($76 per one lot).

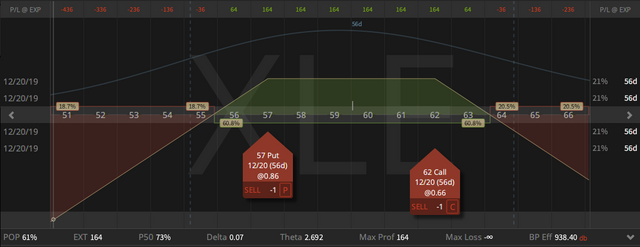

New XLE December 30 Delta Strangle

On Friday, October 25th, 2019, I sold this position for a credit of $1.71 only half my normal size, since IV is so low.

My profit target for this position is 71 cents, so I'm going to close it, when it trades for $1 or at 21 DTE.

At the moment this position is up 7 cents ($7 per one lot).

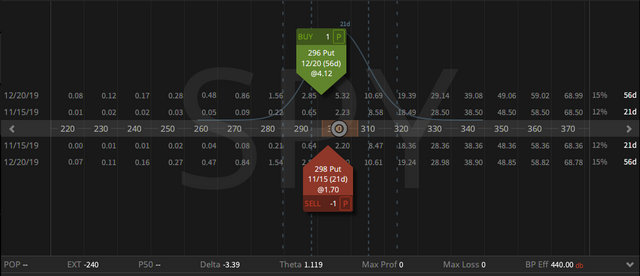

New SPY Classic Put Diagonal

The VIX is super low at the moment, so a delta neutral horizontal spread with long vega is the right strategy for this environment.

On Thursday, October 24th, 2019, I bought this position for a debit of $2.35, but this is not my max loss, since there comes an additional $2 in margin requirement, so my max loss on this position is $4.35.

My profit target for this position is the price of the imbedded put spread at trade inception (= 63 cents).

So, I'm going to close this position, when I can sell it for 2.98 or when the front-month short put expires.

At the moment this position is up 5 cents ($5 per one lot).

More on this strategy in my 3rd book (link below).

Books Update

With the completion of my latest book, I have now a trilogy.

The first book is still available for a huge discount on Google Play, so buy as long as it is still cheap.

You can also buy it for $19.99 on iTunes, Amazon or Barnes and Nobel.

Thanks to all my readers for buying it.

If you like it, you would do me a great favor by writing a short review on amazon.

My second book is available for $5.99 on Amazon, Google and on Apple.

Thanks to all my readers for buying it.

If you like it, you would do me a great favor by writing a short review on amazon.

My third book is available on Amazon, Google and iTunes.

Have a great weekend,

Stephan Haller

Legal disclaimer: These are not trade recommendations. Options involve risk and are not suitable for all investors. The trades shown above are for educational purpose only.

Thank you for posting from the https://steemleo.com interface 🦁

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit