Dear trading community,

Here is a look at my sample portfolio for Friday, November 8th, 2019.

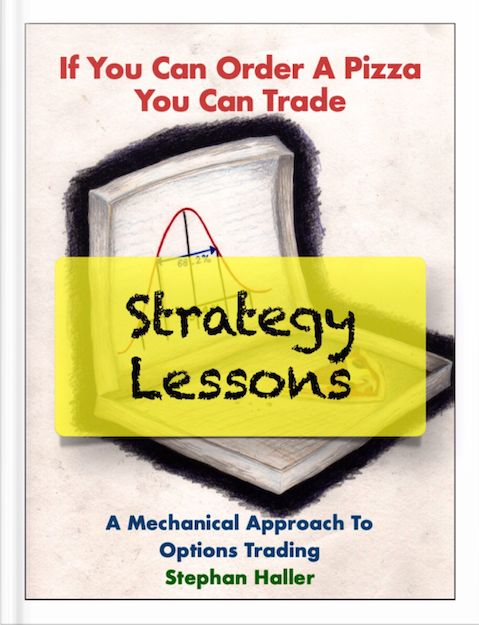

IWM December 30 Delta Short Strangle

On Friday, October 25th, 2019, I sold this position for a credit of $3.75. Only half of my normal size since IV is so low.

My profit target for this position is $1.60, so I'm going to close it, when it trades for $2.15 or at 21 DTE.

At the moment this position is 16 cents ($16 per one lot).

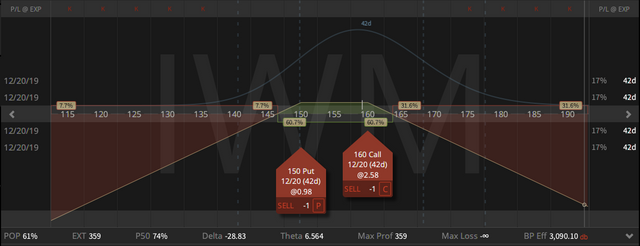

Going Inverted in IWM Short Straddle

On Friday, August 23rd, 2019, I sold this call for a credit of $4.53.

On Thursday, September 26th, 2019, I rolled it up to the 147 strike and out to November for a credit of 69 cents.

On Friday, October 25th, 2019, I rolled it up to the 148 strike and out to December expiration and also added a short 148 put to reduce my short deltas.

On Friday, November 8th, 2019, my deltas got too short, so I rolled up my put into an inverted strangle for a credit of $1.22

My overall credit for this position is now $8.47.

No specific profit target, since this is all in defense mode.

At the moment this position is down $5.30 ($530 per one lot).

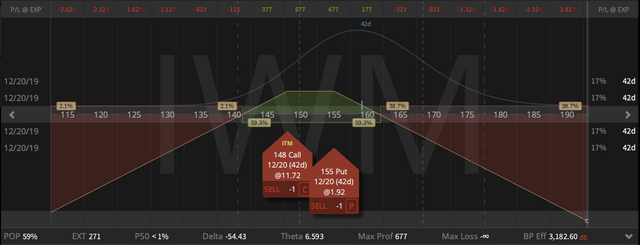

Rolling TLT December 30 Delta short Strangle into a Straddle

On Friday, October 25th, 2019, I sold this position for a credit of $3.02.

On Friday, November 8th, 2019, my short put got hit, therefore I rolled down my call into a straddle for a credit of $1.99.

My overall credit for this position is $5.01.

My profit target for this position hasn’t changed. It is still $1.28, so I'm going to close it, when it trades for $3.73 or at 21 DTE.

At the moment this position is up 11 cents ($11 per one lot).

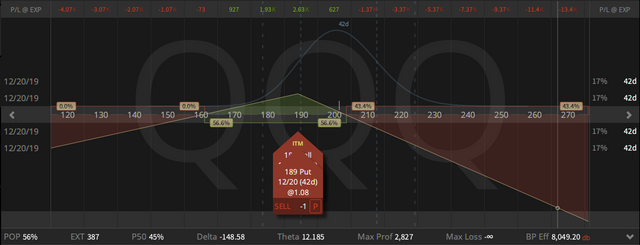

QQQ December Synthetic Covered Put

My synthetic basis on the covered put is $184.49, I have collected enough in credit in this position to have the chance to be profitable.

We'll see how and if this will work out.

This position acts as a hedge for my vega risk, so no specific profit target.

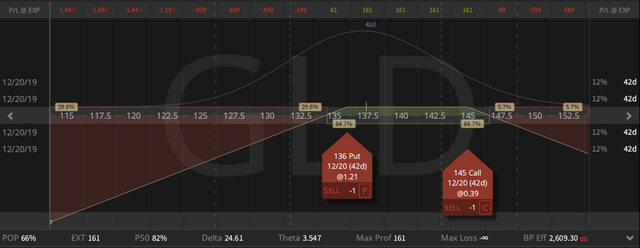

GLD December 30 Delta Strangle

On Thuesday, October 22nd, 2019, I sold this position for a credit of $2.46.

My profit target for this position is $1.23, so I'm going to close it, when it trades for $1.23 or at 21 DTE.

At the moment this position is up 85 cents ($85 per one lot).

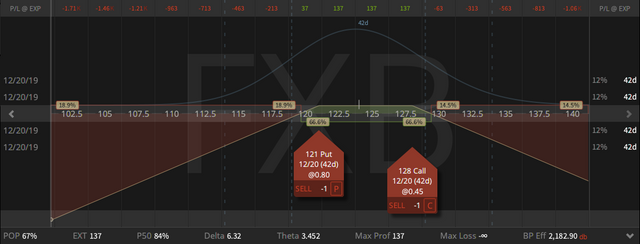

FXB December 30 Delta Strangle

On Wednesday, October 16th 2019, I sold this position for a credit of $2.34.

My profit target for this position is $1.14, so I'm going to close it, when it trades for $1.20 or at 21 DTE.

At the moment this position is up 97 cents ($97 per one lot).

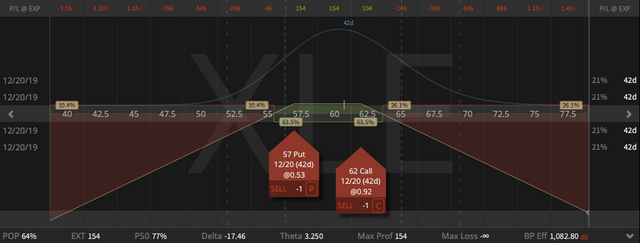

XLE December 30 Delta Strangle

On Friday, October 25th, 2019, I sold this position for a credit of $1.71 only half my normal size, since IV is so low.

My profit target for this position is 71 cents, so I'm going to close it, when it trades for $1 or at 21 DTE.

At the moment this position is up 17 cents ($17 per one lot).

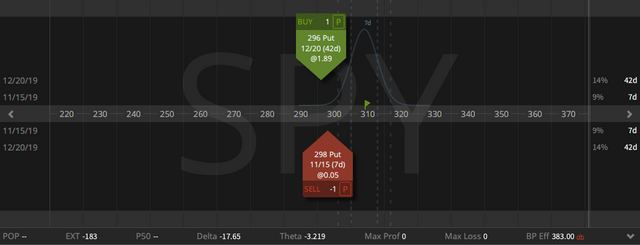

SPY Classic Put Diagonal

On Thursday, October 24th, 2019, I bought this position for a debit of $2.35, but this is not my max loss, since there comes an additional $2 in margin requirement, so my max loss on this position is $4.35.

My profit target for this position is the price of the imbedded put spread at trade inception (= 63 cents).

So, I'm going to close this position, when I can sell it for 2.98 or when the front-month short put expires.

At the moment this position is down 52 cents ($52 per one lot).

Books Update

With the completion of my latest book, I have now a trilogy.

The first book is still available for a huge discount on Google Play, so buy as long as it is still cheap.

You can also buy it for $19.99 on iTunes, Amazon or Barnes and Nobel.

Thanks to all my readers for buying it.

If you like it, you would do me a great favor by writing a short review on amazon.

My second book is available for $5.99 on Amazon, Google and on Apple.

Thanks to all my readers for buying it.

If you like it, you would do me a great favor by writing a short review on amazon.

My third book is available on Amazon, Google and iTunes.

Have a great weekend,

Stephan Haller

Legal disclaimer: These are not trade recommendations. Options involve risk and are not suitable for all investors. The trades shown above are for educational purpose only.