Dear trading community,

Here is a look at my sample portfolio for Friday, November 22nd, 2019.

Closing IWM December 30 Delta Short Strangle

On Friday, October 25th, 2019, I sold this position for a credit of $3.75.

On Thursday, October 21st, 2019, I closed it for a profit of $1.58.

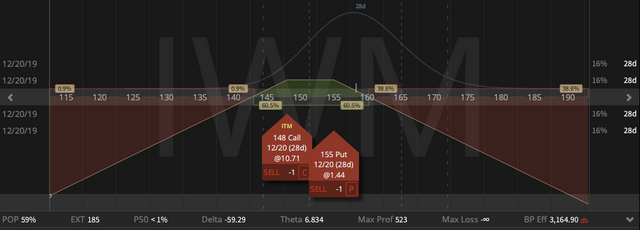

Inverted IWM Short Strangle

On Friday, August 23rd, 2019, I sold this call for a credit of $4.53.

On Thursday, September 26th, 2019, I rolled it up to the 147 strike and out to November for a credit of 69 cents.

On Friday, October 25th, 2019, I rolled it up to the 148 strike and out to December expiration and also added a short 148 put to reduce my short deltas.

On Friday, November 8th, 2019, my deltas got too short, so I rolled up my put into an inverted strangle for a credit of $1.22

My overall credit for this position is now $8.47.

No specific profit target, since this is all in defense mode.

At the moment this position is down $3.76 ($376 per one lot).

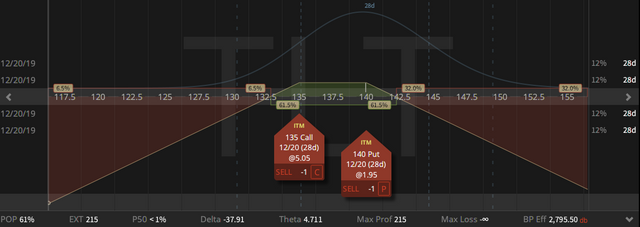

Going inverted in TLT December Short Straddle

On Friday, October 25th, 2019, I sold this position for a credit of $3.02.

On Friday, November 8th, 2019, my short put got hit, therefore I rolled down my call into a straddle for a credit of $1.99.

On Wednesday, October 20th, 2019, I had to roll up my puts for a credit of $1.47.

My overall credit for this position is now $6.48.

Since next week we hit the 21 DTE threshold, I’m hoping to scratch this position.

At the moment this position is down 67 cents ($67 per one lot).

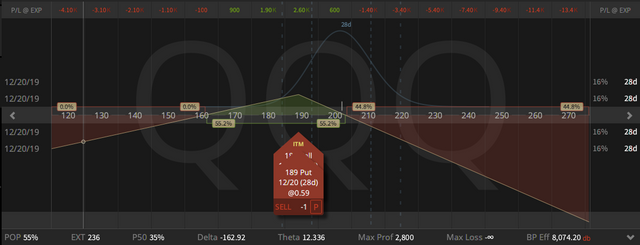

QQQ December Synthetic Covered Put

My synthetic basis on the covered put is $184.49, I have collected enough in credit in this position to have the chance to be profitable.

We'll see how and if this will work out.

This position acts as a hedge for my vega risk, so no specific profit target.

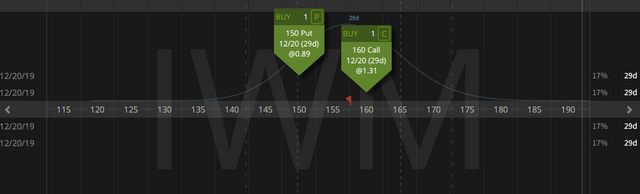

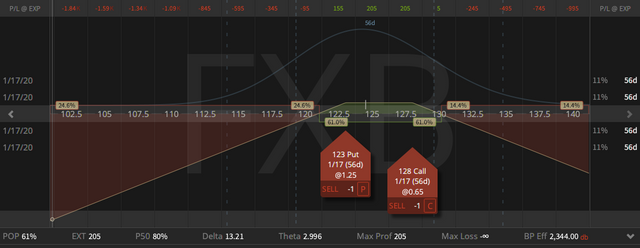

New FXB Strangle

On Monday, November 18th 2019, I sold this position for a credit of $2.02.

My profit target for this position is 85 cents, so I'm going to close it, when it trades for $1.17 or at 21 DTE.

At the moment this position is down 3 cents ($3 per one lot).

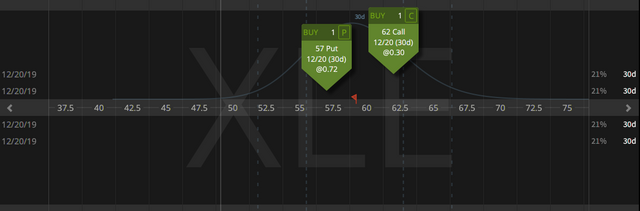

Closing XLE December 30 Delta Strangle

On Friday, October 25th, 2019, I sold this position for a credit of $1.71 only half my normal size, since IV is so low.

On Wednesday, November 20th, 2019, I closed it for a profit of 72 cents ($72 per one lot).

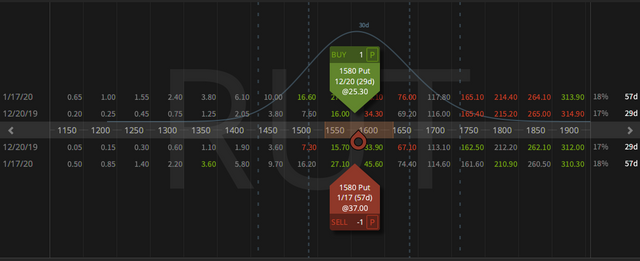

Closing RUT Put Calendar Spread

On Wednesday, November 13th, 2019, I opened this position for a debit of $11.20.

On Wednesday, November 20th, 2019, I closed it for a profit of $1.00 ($100 per one lot).

Books Update

With the completion of my latest book, I have now a trilogy.

The first book is still available for a huge discount on Google Play, so buy as long as it is still cheap.

You can also buy it for $19.99 on iTunes, Amazon or Barnes and Nobel.

Thanks to all my readers for buying it.

If you like it, you would do me a great favor by writing a short review on amazon.

My second book is available for $5.99 on Amazon, Google and on Apple.

Thanks to all my readers for buying it.

If you like it, you would do me a great favor by writing a short review on amazon.

My third book is available on Amazon, Google and iTunes.

Have a great weekend,

Stephan Haller

Legal disclaimer: These are not trade recommendations. Options involve risk and are not suitable for all investors. The trades shown above are for educational purpose only.