Content adapted from this Zerohedge.com article : Source

It is no secret that both BOA and Goldman are warning of investor euphoria.

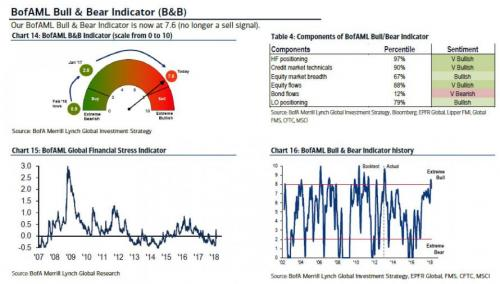

Even so, BofA CIO Michael Hartnett noted that investor rush to risk assets moderated of late sending the Bull & Bear indicator to 7.6 from 8.1.

One reason for great concern is that in 8 out of the 11 instances, when the indicator dropped below 8, global stocks saw further losses in the ensuing 3 months.

Hartnett sees a S&P of 2534 which would eliminate $6T from the global equity market cap. This is the figure that was lost in the 10% pullback in February.

He gives 6 reasons why the market could test those lows:

1. Positioning: peaking optimism…Bull & Bear Indicator still in v bullish territory; big equity inflows this week; GWIM private client asset allocation 61% stocks, 33% cash & bonds *

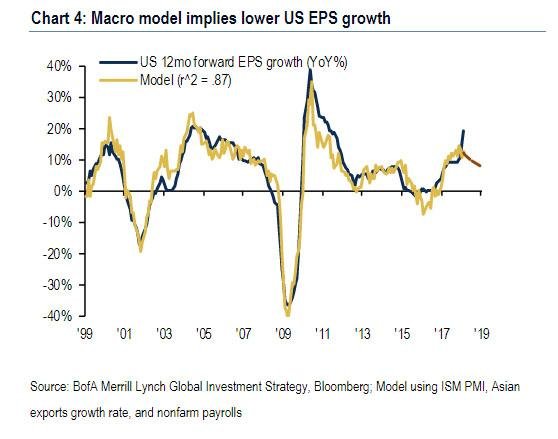

2. Profits: peaking…booming US 12-month forward EPS estimates now +20% (we say "peak"- Chart 4)…booming US consumer confidence 130.8, unemployment rate 4.1%, ISM 60.8…"buy humiliation & busts, sell hubris & booms"

*

*

3. Policy: peaking…global central banks have played "whatever it takes" card, by year-end Fed will have hiked 9 times, fiscal card played aggressively…no more stimulus to discount; only policy left to discount is... *

4. Protectionism:s tarting…and market pricing as "deflationary" (yields down, stocks down…and stocks down may be necessary to stop escalation of trade war) *

5. Price action: tech not making new highs (e.g. SMH, XLK), credit spreads not making new lows (H0A0, C0A0), homebuilders (XHB) are making new lows; global stocks (ACWI -0.3% YTD) no longer outperforming global government bonds (W0G1 -0.9%) *

6. Pain: trough in inflation, rates, volatility (all 9-year drivers of bull in corporate bonds & equities) now challenging bullish consensus.

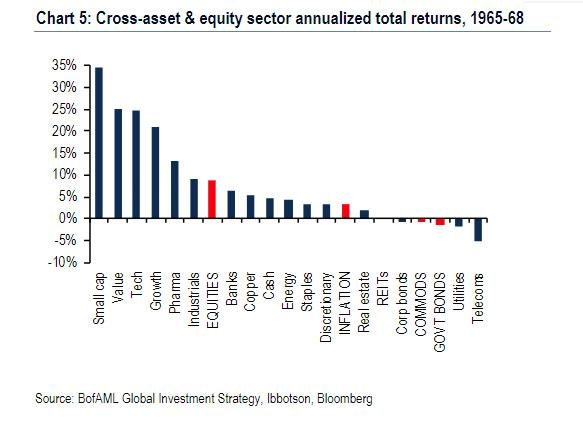

Hartnett feels the topping process has started and we give 1966/69 as an indicator.

Non-adapted content found at zerohedge.com: Source

I kind of thought the same thing today, but after this incredible reversal I don't really know. It seems like investors tend to find and like the positives much more than the negatives. With this idiot in charge... I don't know what to expect. Definitely caution with the overnight exposure is needed.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Along with all your points which I completely agree with such as positioning, profits, policy, protectionism, price action and pain, there is in my opinion probably a 50 percent chance that we still have to retest earlier lows from a few weeks ago, that’s what usually happens after big correction. After this weeks selloff that followed the big selloff the probability could be even higher. The Fed always creates bubbles, helped by margin calls, traders, speculators, short sellers and strategists who ride the wave BUT NEVER TAKEN IN ACCOUNT the setbacks and recessions that arise. Usually If Fed gets ahead, even slightly ahead, adjustment is mild yet positive. If late, nose-bleed PEs lead to meltdowns like 2009, 2001...Along the margin calls which kick within three days usually there will be traders who hedge their positions. We shell see...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@zer0hedge ""Go to ZeroHedge.com for more complete news coverage on what affects economics, geopolitics"" I will do so because I still do not know many things. Thank you, O Hero, for this effort ♡♡

#restem you post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks @zer0hedge very much for your useful information

Second It's still the same correction. The previous move to the 200dma needs to be solidified with much more volume. It cant just flash crash to the 200dma and then get bought back up in a blur where you blink and you miss it. We need solid, heavy, multiple trading days at the 200dma.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is really encouraging.

Atleast I was able to get one thing or the other through the post.it a nice and educative post .

I need more of it!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

i've been feeling like were due for a correction in stocks and real estate for a while now

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

excellent your post Thanks for sharing i will done up vote

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Mark my words, QE 4 in the years to come.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

the very latest information, I can know the progress and movement

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post dear.i appreciate your post..Thank for sharing...Resteemit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

stocks are taking hits, as we saw Buffett lose over 3 billion in assets, but we are still in one the biggest bull markets. Now's the time to buy in on your stocks that have dropped if you have the liquid

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thats for providing us an opportunity to know more about this. I am a atudent of Economics and nowadays I really want to know more about the market and investment. So I choose to different blogs about the crypto currency.

Peace

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I am thankful to you for sharing such a info and educative analysis valuable post .I appreciate your blog and hopeful

Keep it up

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's absurd to here another correction coming. All this is affecting the economy. Investors buying on the dips after a significant dip in the price of a stock index is the main reason for all this fuss.

Investors have got to purchase different stocks. Buying on the dip only allows these investors to take advantage of temporary bargains. These dips are hard to predict yet buying is the only strategy which investors maximise to win. They are blinded by the temporary bargains which most of them endeavor to take advantage of and end up forgetting the bigger picture.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is the type of information that investors don't want to see, because this means a lot of people might get scared, and it is not a bright future that you present on the post.

I think crypto follows most of the times what happen to the stock markets but with a bigger volatility, if this FUD start to spread to the stock markets I think we might see some big investors coming to crypto world, or we go down along side with the stocks.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit