It is no more news that the banking industries in countries whose economies are developing and underdeveloped are under serious challenge of servicing their customers like the developed countries due to a lot of challenges. A few years ago in Nigeria there was a regulation made by the central bank which gave a minimum capital level for banks which will be operation in the country. This struck a big blow on many banks who are operating on low capital and led to their closing down. Many other banks conglomerate and formed new ones which are still in operation. This action had so many implications one of which affects the rate of credit returns (this had been high). There are many underdeveloped countries suffering the same fate as the banks in Nigeria where local credit companies are unable to effectively service the credit demands of the populace. Such countries have millions which have no access to banking facilities and services. Because of their income rate and inadvertently no collateral they cannot be deemed certified customers by the credit companies. These credit companies or banks are not to be blamed because of high banking infrastructures, high cost of capital and tax regulations mixed with other dues to be paid which are alarmingly high. This led to low credit offering, high interest rate. Underdeveloped country citizens receive a very low remuneration on their savings and credit is expensive compared to developed countries.

Investors in developed countries are on the other hand looking out for investment opportunities which does not exist in their countries, for the regulations of low credit returns. Take for example countries like Japan in which the credit return rate is very low (compared to some underdeveloped countries), it stands at 0.3%. Investors from countries like this look out for countries where the credit returns is relatively high to make profit. They are incapacitated because of regulations, confirmations of identities and so many other documentations which has to be done since it is cross-border investment. Thus there is a very wide gap to be breached.

This and other challenges relating to credit demands and offering informed a project which comes with a lasting and effective solution SWAPPY

source

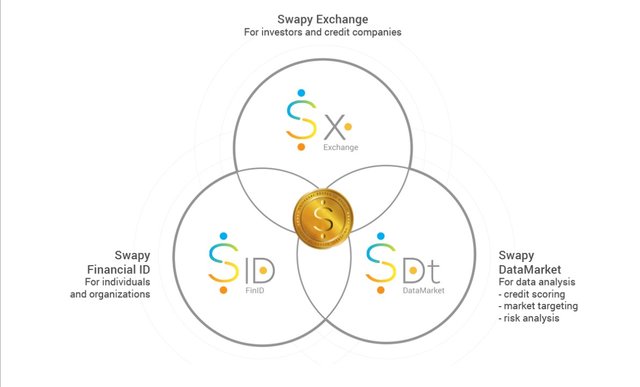

Swapy Network combines a decentralized protocol with a suite of three integrated applications. Swapy Exchange connects international investors from countries where the interest rates are lower to credit companies in countries where the interest rates are much higher. Swapy Financial ID empower individuals, giving them the right to a worldwide financial identity. Swapy DataMarket transforms user's financial data into value for the data owners. Now, individuals will hold their own data and choose how much tokens they receive in exchange for it when they want to share, and for whom.

The swappy network provides:

The Swappy Exchange

This allows international investors from developed countries where credit returns rate are very low to provide or invest fund to local credit companies in countries where the credit rates are relatively higher. This means a maximized returns or profit for the international investors and lower capital for the underdeveloped countries -its a win-win.

Swappy Financial Identity (Id)

This allows users to have a financial identity which would be recognized worldwide. Swappy will allow all users to go through a series of verification processes like documents submissions all handled by Know Your Customer (KYC) and Anti Money Laundering (AML). Users will also be able to store all sorts of financial related information such as bank statements, purchase installments, etc. All of this information are stored on the InterPlanetary File System (IPFS) - a decentralized storage. Which marks out problems related to storing of sentive or confidential information in a centralized storage. The privacy of all data provided is important to Swappy and it is made sure that these data are only accessible to the owners and those they wish to share these information with at a prize determined by the owner.

Swappy Data Market

Data is very important to companies especially for credit scoring. Users of swappy network who has a financial identity are able to share their information with organisations or companies that needs them for a prize determined by them. They can exchange data for token (SWAPPY - an ERC20 built on the etherium blockchain with 18 decimals).

Notes

Edmilson Rodrigues, the Ceo of the swappy network was a student at the Drapper University under the great riskmaster Tim Drapper. Tim Drapper is one of the investor and adviser of the swappy network which should give investors and risk takers some level of security about the platform. You can read more here : Silicon Valley Dream: A Thank You Letter to Tim Draper, the RiskMaster and A Brief history of Swapy Network.

For more information

https://bountyhive.io/browse/Swapy%20Network

https://medium.com/swapynetwork/a-brief-history-of-swapy-network-6a21f5d37ca9

https://www.facebook.com/Swapynow/

http://s3.us-east-2.amazonaws.com/swapynetwork/SwapyNetwork_TokenSale_Whitepaper-EN-US.pdf

My bountyhive username is Ayobami

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Managing risk is one great skill anyone can develop, this sounds nice for consideration

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes and good for investors

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is what one should call ‘symbiosis’ on the blockchain, especially for we who are in tge developing countries, this is great and worthy of investing

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

symbiosis indeed, thanks for that

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Reading through this, I can say with full confidence that this is worth investing. Great work by the team

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, kudos to them

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit