Ready for the two new TA indicators? VHCEx expert team is here for you. Below are the popular Bollinger Bands and Directional Movement Index.

Bollinger Bands

👉 What does it represent?

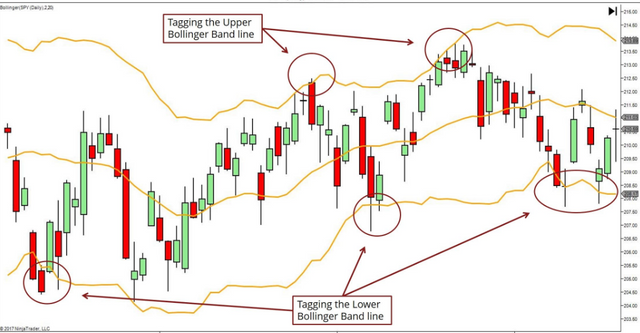

Bollinger bands are part of the trend indicators.

measure market volatility but also make it possible to predict periods of high future volatility, identify market consolidation phases, identify prosecutions or reversals of the trend and provide information on potential market peaks or troughs and price targets.

👉 How to use it?

Major price changes generally come after a tightening of the bands. The spacing of the bands that will follow, indicates the said change.

After a tightening of the bands, prices tend not to go in the right direction. However, later on, the price curve quickly proves the prediction right.

➡️ When the price curve goes out of the lower band ⇒ upward signal

➡️ When the price curve goes out of the upper band ⇒ drop signal

A price movement that originates on one edge of a strip always tends to go to the other edge of the other strip.

DMI "Directional Movement Index"

👉 What does it represent?

The DMI (Directional Movement Index) is one of the trend indicators.

It provides a set of indicators (ADX, D+ and D-) that can be used to indicate the existence of a trend and to assess its strength and power.

The DI+ (indicator accumulating increases) and the D- (indicator accumulating decreases) are used to measure the balance of power between buyers and sellers and the ADX "Average Directional Index" which aims to measure the strength of the trend.

👉 How to use it?

The DI+ and the DI- form two curves and the positioning reading of these two curves in relation to each other allows us to see if the market is dominated by buyers or sellers. In addition to the DMI+ and DMI- curve, the ADX curve acts as a second filter to identify whether or not the trend exists. ADX above its critical threshold of 20 shows that the market is following a marked trend. Conversely, when the indicator is below the 20 level, the market evolves without a real trend and the dominance of buyers or sellers is only temporary and it is not worth taking a position on value.

The DMI cannot be used as the only buy or sell signal and can be perfectly matched with other indicators such as the RSI.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.investopedia.com/articles/trading/07/adx-trend-indicator.asp

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello vhcexexchange,

@SteemEngineTeam would like to take the time to thank you for signing up and participating in our community. Your contributions and support are important to us and we hope you will continue to use our platform.

We plan to give back to our community members, so have an upvote on us!

Thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very decent guide thanks https://9blz.com/dmi-indicator-explained/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit