Index - https://steemit.com/tax/@alhofmeister/2666al-tax-blog-index

Introduction

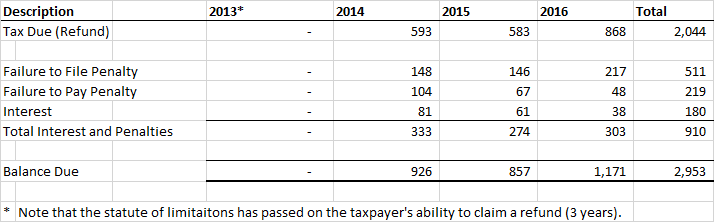

In my next series of case studies, I will be focusing on the tax consequences of failing to file a tax return as well as the steps to return to good standing with the IRS. Before anything else, a taxpayer who has failed to file tax returns will need to submit the missing returns. This article will cover the penalties & interest that the IRS would assess (maybe not penalties depending on the facts and circumstances of the case).

Problem

Taxpayer A did not file their tax returns for 2013, 2014, 2015, or 2016. In 2018, Taxpayer A decided to settle with the IRS before they received a notice. Note that these calculations assume that the taxpayer files on February 28, 2018.

References

https://steemit.com/tax/@alhofmeister/case-study-31-failure-to-file-2013

https://steemit.com/tax/@alhofmeister/case-study-32-failure-to-file-2014

https://steemit.com/tax/@alhofmeister/case-study-33-failure-to-file-2015

https://steemit.com/tax/@alhofmeister/case-study-34-failure-to-file-2016

Disclaimer

Any accounting, business or tax advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor is it sufficient to avoid tax-related penalties.

great work

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Much appreciated.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@OriginalWorks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I love this publication, it helps us a lot to solve doubts. keep publishing that kind of information

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Will do.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit