Advertisement

When the ethereum price crashed by nearly 50 percent during the first two weeks of August, some analysts speculated that last year’s initial coin offering (ICO) boom was to blame for the second-largest cryptocurrency’s decline.

During 2017 and early 2018, cryptocurrency startups raised billions of dollars through ICOs, funds which were predominantly denominated in ether (ETH). This was all well and good while the cryptocurrency market was rising, as already-mammoth ether war chests swelled to colossal levels.

With the ethereum price careening down to levels not seen for more than a year, though, and no end in sight for the bear market, there was speculation that ICO-funded startups would capitulate and liquidate their ETH to maintain whatever runway they had left.

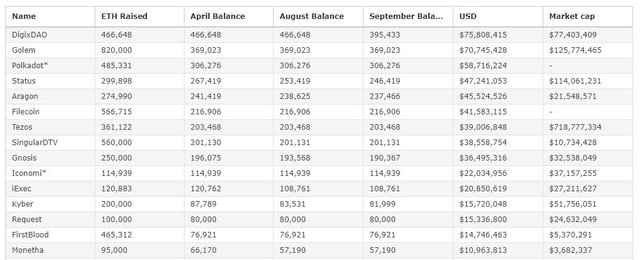

However, according to new research from Diar, ICOs continue to hold an average of 38 percent of the initially-raised amounts in their ICO treasury addresses, while the other 62 percent have either been sold or moved.

ICO Treasury Balances | Source: Diar

While that might initially seem like a large percentage, there are several factors to keep in mind. First, the fact that the funds have been moved does not mean that they have been sold. Second, all ICO balances have a burn rate since projects must use their cryptocurrency funds to pay for operating expenses. Finally, ICO treasury data indicates that most companies have more or less hodl’d throughout the 2018 bear market, and the amounts that have been moved suggest an ordinary burn rate.

Altogether, ICO treasuries currently hold roughly 3.7 percent of the total ETH supply, down from 4.5 percent in April. This means that treasury balances have fallen approximately 20 percent in the past five months.

Source: Diar

Notably, Diar also found that many companies, including Aragon, SingularDTV, and Gnosis, have more ETH in their treasuries than the outstanding market caps of their ICO tokens.

Commenting on the research, Larry Cermak, head analyst at Diar, warned that the fact that companies — few of whom are generating any meaningful revenue — continue to hold so large a percentage of their ICO funds suggests that their operations will place consistent sell pressure on ETH, potentially for years.

“Obviously, a lot of the ICO companies will continue selling ETH to cover operating expenses and to fund their businesses. It’s important to realize that the majority of these projects isn’t generating any revenue. And most likely never will,” he wrote on Twitter. “This in turn creates ETH selling pressures, which are unlikely to go away any time soon. The price is affected not only by the ETH mining issuance but also by ICO companies liquidating to cover their expenses.”

Featured Image from Shutterstock. Charts from TradingView.

Follow us on Telegram or subscribe to our newsletter here.• Join CCN's crypto community for $9.99 per month, click here.

• Want exclusive analysis and crypto insights from Hacked.com? Click here.

• Open Positions at CCN: Full Time and Part Time Journalists Wanted.

Read original article

Posted from our news room : https://news.sye.host/icos-arent-cashing-out-their-cryptocurrency-warchests-yet-research/

Warning! This user is on my black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

If you believe this is an error, please chat with us in the #cheetah-appeals channel in our discord.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This user is on the @buildawhale blacklist for one or more of the following reasons:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit