It’s a known fact when your starting out Trading Forex, Commodities or even stocks, ‘Candlesticks’ are known to be one of the most difficult concepts to grasp. I know, many questions run through your head; Why? What do they mean? Who created them? Why couldn’t there only be simple line graphs like we learnt in school? Too many candlesticks patterns to learn? Which candlesticks do I look out for? etc… And the list goes on.

The truth is, even though you could trade and succeed in the forex market or any market without the knowledge of candlesticks just understand it’s there for a reason. Learning and adding candlestick analysis to your trading strategy will only enhance and diversify your trading knowledge and trading skill.

Imagine having another confluence or an additional confirmation when determining a bias (a formed opinion of trade setup) for your trades. It only adds confidence to your trading and it’s the reason why many Japanese (where it all began) and modern day professional traders from the past have written journals and books outlining the successes you could realise from applying the knowledge of Japanese candlestick analysis.

Japanese Candlestick is an important aspect of technical analysis. We are going to break it down for you very simply. I have chosen the top 10 easiest candlestick patterns that are divided in three different categories.

Let’s Get started….

If you read and apply these candlesticks as part of your technical analysis, then it can reform and create positive results in your trading. All examples of charts shown below are from real historical charts of various major (e.g. GBPUSD, EURUSD & USDJPY) and cross forex currency pairs (e.g. EURJPY, GBPJPY etc.). All the illustrations examples shown below are based on the larger timeframes starting with Daily chart timeframe. These candlesticks patterns are recommended to be used on larger timeframes Daily, Weekly and Monthly. However, you could apply these to all timeframes.

10 Candlestick patterns categorized in three different categories:

4 Candlestick patterns at the end of downtrend or bottom reversal (For Longs, Bullish moves or buying).

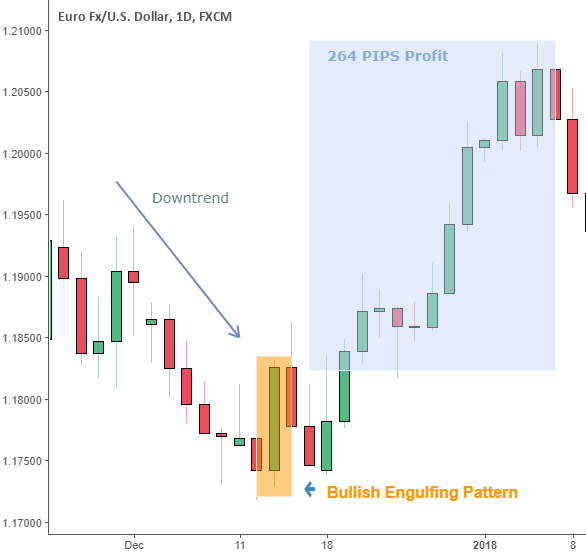

Bullish Engulfing Pattern

No. of Candlesticks in play- 2 (The bullish Engulfing candle (large green candlestick outline) and the previous bearish candlestick)

Occurrence- Common pattern

Signal Strength- This is one of the strongest signal for the end of a downtrend and the start of a potential rally.

How to identify? - This is an easy candlestick to identify and should always been seen at support levels. As it is classed as a Bullish reversal signal the entire body of the Bullish Candle Engulfs or wraps the previous candlestick body. This becomes a sign of a trend reversal after a persistent bearish downtrend. It also shows the buying pressure has overwhelmed the selling pressure or bears (shorts) and has taken over from the bulls (longs).

The main body of the large Bullish candle engulf the main body of the previous Bearish candle, albeit, a stronger sign would be if it engulfs the entire candle including the shadows/wicks. Another stronger sign would be when the bullish candle (green candlestick shown above) engulfs multiple previous candles i.e. the illustration shows the entire body of bullish candle Engulfs almost 5 previous candlesticks.

Useful Timeframes for different type of traders-

Intraday or Day Trading- 30 minute or Hourly Timeframe

Swing Trader- 4 hourly or Daily Timeframe

Long-term – Weekly or Monthly Time Frame (A bullish candlestick seen at major monthly support level is a very strong sign for reversal and an entry of Long/Buy trade)

TIP- Familiarise yourself with looking for Japanese candlestick patterns on multiple Timeframes. Start by Downloading Metatrader 4 demo account for practicing. The best method for applying candlesticks is to choose a Forex currency pair to begin analysing. See if you can try and spot a bullish Engulfing pattern historically (i.e. go back a number of years & months). The trick to remember these is when spot a few number of patterns then snapshot the chart and record it in folder or journal named ‘candlestick patterns’ for future reference. I have found this to be a very productive way to remember these candlestick patterns.

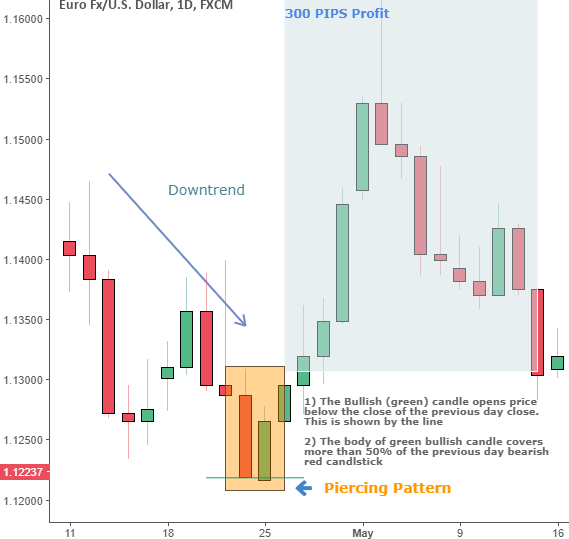

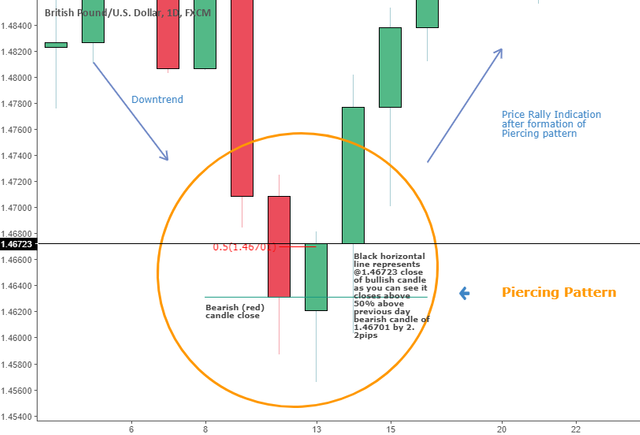

Piercing Pattern

No. of Candlesticks in play- 2 (1st Bearish and the 2nd Bullish candle)

Occurrence- Rare candlestick pattern. This doesn’t occur often but is a powerful signal when it does appear.

Signal Strength- This is amongst one of the strongest signal for the end of a downtrend and the start of a potential rally.

How to identify? – At times this is a difficult candlestick to spot as it requires a more of a mathematical approach to determine its validity. This is a two candlestick bottom reversal pattern that occurs after a substantial downtrend price action. The first candle is normally a large bearish candle with high traded volume (i.e. a large body).

The second candle (Bullish) price opens below the prior sessions close.

However, by the end of the second candlestick session, the market closes by more than 50% of the previous candlestick session. You are probably thinking this is quite confusing but simple maths is required by working out the differences between open and close of the first candlestick session and then find the midway or price at 50% (best mark this with horizontal line). Please see illustration below for further clarification.

For a stronger signal, the bullish candlestick penetrates well beyond 50% of previous day session. In the example above of the GBPUSD chart, the bullish (green) closes by only a mere 2 PIPS (Percentage in points) above the 50% mark of the previous bearish red candlestick. This is sufficient enough but has to close beyond the 50% level.

Many books and traders also consider that the second bullish candle should actually open below the low (the shadow) of the previous candlestick for it to give a stronger signal.

Useful Timeframes for different type of traders-

Intraday or Day Trading- 30 minute or Hourly Timeframe

Swing Trader- 4 hourly or Daily Timeframe

Long-term – Weekly or Monthly Time Frame (A piercing pattern seen at major support level or 61.8% level of a Fibonacci retracement is usually a very strong sign for reversals and an entry point for all long/buy trades). As it’s a rare pattern many professional traders note its significance.

The Hammer Candlestick Pattern

No. of Candlesticks in play- 1 (Only the hammer candlestick to look out for)

Occurrence- Fairly rare pattern in the longer timeframes (e.g. Weekly & Monthly)

Signal Strength- This is a strong bullish reversal signal but has to be specific in its appearance and match its description.

How to identify? – In essence it’s easy to identify but you could easily make an error in identifying a ‘Hammer’ candlestick. The Hammer candlestick can be either bullish or bearish i.e. assume either can be red and green if we use default colour candlesticks. The main body of the candlestick is at the upper end of the trading range i.e. in the chart above, the red body is at the top of the candle visually mimicking a hammer. Also the long lower shadow/wick should be twice the length of the main body. This is very important because sometimes you may see a candlestick that has a main body equal in length to the shadow/wick. It’s vital that a ‘Hammer’ should have no upper shadow (i.e. above the main upper body part). A longer the lower shadow and a smaller real body is a more meaningful version of the bullish hammer pattern.

Useful Timeframes for different type of traders-

Intraday or Day Trading- 30 minute or Hourly Timeframe

Swing Trader- 4 hourly or Daily Timeframe

Long-term – Weekly or Monthly Time Frame (A ‘Hammer’ candlestick seen at major support level is very strong sign for reversal and an entry of Long/buy trade)

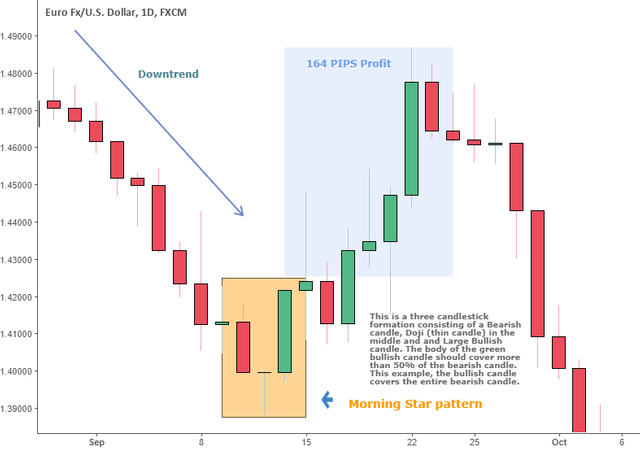

The Morning Star Candlestick Pattern

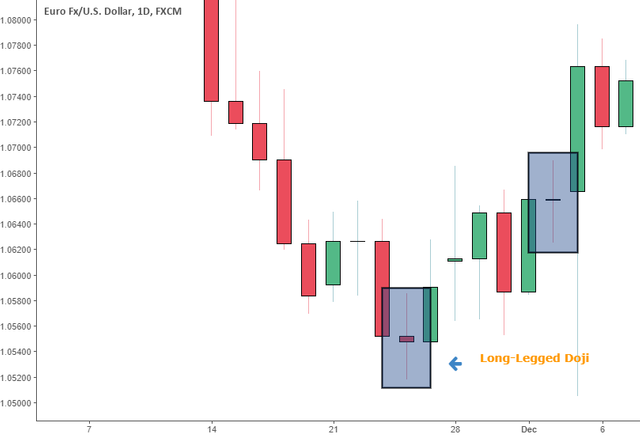

No. of Candlesticks in play- 3 (1st candlestick is a bearish, 2nd a Doji & 3rd Bullish candle, explained later in the article)

Occurrence- Common pattern that has applicability in all timeframes

Signal Strength- This is a fairly strong bullish reversal signal. The Doji (the middle candle in this formation) is classed as an indecisive candlestick and is viewed as a tug of war where neither buyers or sellers have gained momentum during the trading session. A better version of the Morning Star Candlestick formation is dependent on the type of Doji candle seen and the length of Bullish candle that succeeds the Doji. A Morningstar pattern that consists an abandoned Baby Gapped Doji or a Dragon Fly Doji (mentioned later) are the strongest affirmation for a potential reversal. The illustration in the above EURUSD chart shows the pattern with a dragon fly Doji proceeded by a Long Bullish candle that Engulfs the initial 1st Bearish candlestick in the pattern.

How to identify? – This is a three candlestick pattern. All criteria and conditions have to be met for its validity. As it’s a Bullish Reversal pattern the first candlestick would be a bearish candle of any size. The second is integral, which is a Doji candle. This indicates that the downward selling pressure has come to halt and the number of buyers and sellers are equally numbered in the market. The main body of a Doji is very small and thin. Sometimes you may see a Doji candlestick like the ones below which have a much longer wick/shadow (i.e. Long-legged Doji); this would still make pattern credible.

Useful Timeframes for different type of traders-

Intraday or Day Trading- 30 minute or Hourly Timeframe

Swing Trader- 4 hourly or Daily Timeframe

Long-term – Weekly or Monthly Time Frame (A Morning Star seen at major support level or 61.8% of a Fibonacci Retracement level are very strong signs for reversal and a potential entry of Long/buy trade)

4 Candlestick patterns at the end of uptrend or top reversal (For shorts, Bearish moves or Selling)

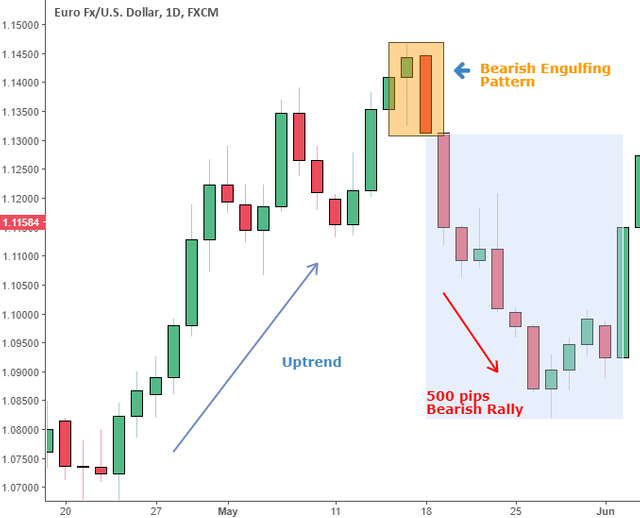

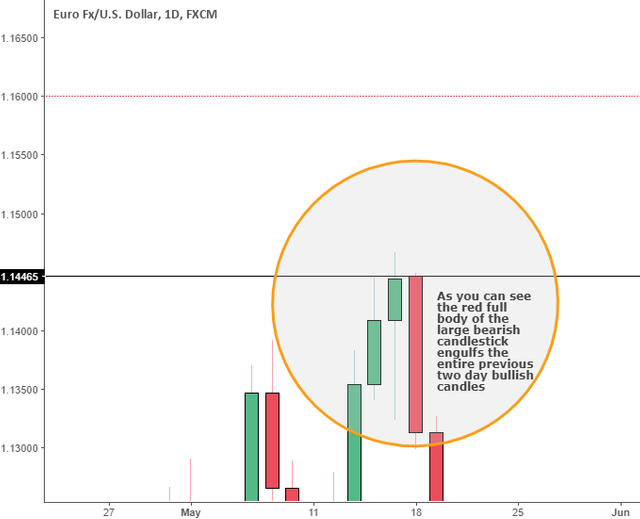

Bearish Engulfing Candlestick Pattern

No. of Candlesticks in play- 2 (The bearish Engulfing candle (large red candlestick outline) and the preceding bullish candlestick)

Occurrence- Common pattern

Signal Strength- This is one of the strongest signal for the end of an uptrend and the start of a potential rally.

How to identify? - As it is classed as a Bearish reversal signal, the entire body of the Bearish Candle Engulfs or wraps around the previous candlestick body. The identification method is exactly same as a Bullish Engulfing pattern but in the opposite direction. This shows buying pressure has been overwhelmed and the selling pressure or bears (shorts) have taken over from the bulls (longs). A stronger signal would be when the bearish candle (red candlestick shown below) Engulfs multiple previous candles i.e. the illustration shows the entire body of Bearish candle engulfs two previous candlesticks. This is a strong affirmation to enter a potential short trade. Even though the rule states; the main body of the large Bearish candle should only engulf the main body of the previous bullish, a stronger sign would be if it engulfs the entire candle including the shadows/wicks.

Useful Timeframes for different type of traders-

Intraday or Day Trading- 30 minute or Hourly Timeframe

Swing Trader- 4 hourly or Daily Timeframe

Long-term – Weekly or Monthly Time Frame (A Bearish candlestick seen at major monthly resistance level is very strong sign for reversal and an entry of Short/Sell trade)

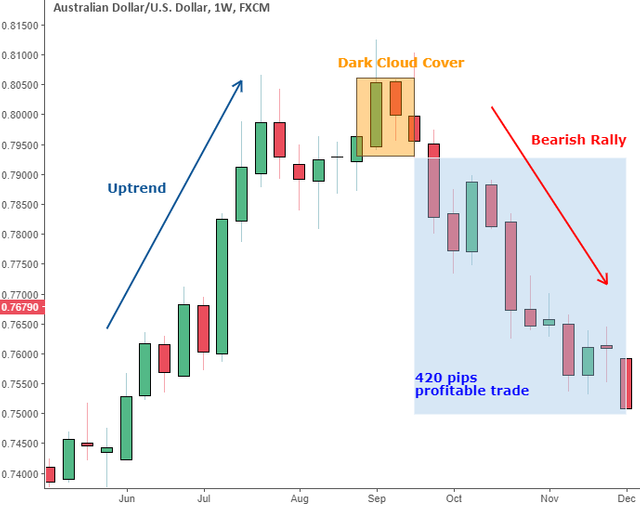

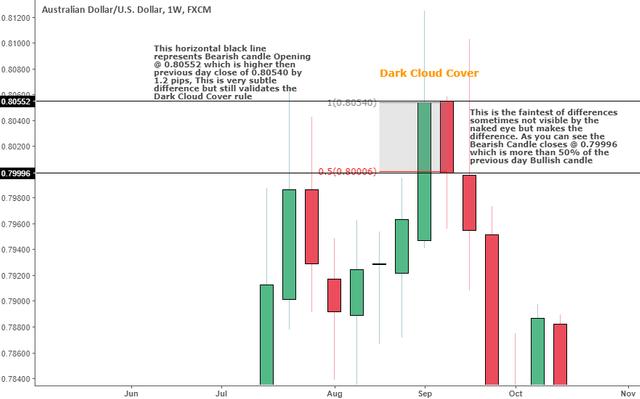

Dark Cloud Cover Candlestick Pattern

No. of Candlesticks in play- 2 (1st Bullish and the 2nd Bearish candle)

Occurrence- Rare candlestick pattern. This doesn’t occur very often but is a powerful signal when it does appear.

Signal Strength- This is amongst one of the strongest signal for the end of an uptrend and the start of a potential rally.

How to identify? – At times this is a difficult candlestick to spot as it requires a more of a mathematical approach to determine its validity. The rule of application is exactly the same as a piercing pattern but in opposite trends. This is a two candlestick bottom reversal pattern that occurs after a substantial uptrend price action. The first candle is a large bullish candle with high traded volume (i.e. a large body). The second candle is bearish candlestick in which its price opens above the prior sessions close. However, by the end of the second candlestick session, the market closes by more than 50% of the previous session. Simple maths is required by working out the differences between open and close of the first candlestick session and then find the midway or price at 50% (best mark this with horizontal line). Please see illustration below for further clarification.

For a stronger signal, the bearish(red) candlestick penetrates well beyond 50% of previous day session. In the example above, AUDUSD chart the bearish (red) closes by only a mere 1.2 PIPS (Percentage in points) below the 50% mark of the previous Bullish candlestick. Many books and traders also consider that the second bearish candle should actually open above the high (the shadow) of the previous candlestick for it to be a more powerful signal.

Useful Timeframes for different type of traders-

Intraday or Day Trading- 30 minute or Hourly Timeframe

Swing Trader- 4 hourly or Daily Timeframe

Long-term – Weekly or Monthly Time Frame (A piercing pattern seen at major resistance level or 61.8% level of a Fibonacci retracement is usually a very strong sign for reversals and an entry point for all short/sell trades). As it’s a rare pattern many professional traders note its significance.

TIP- Familiarise yourself with looking for Japanese candlestick patterns on multiple Timeframes. Start by Downloading Metatrader 4 demo account for practicing. The best method for applying candlesticks is to choose a Forex currency pair to begin analysing. See if you can try and spot a bullish Engulfing pattern historically (i.e. go back a number of years & months). The trick to remember these is when spot a few number of patterns then snapshot the chart and record it in folder or journal named ‘candlestick patterns’ for future reference. I have found this to be a very productive way to remember these candlestick patterns.

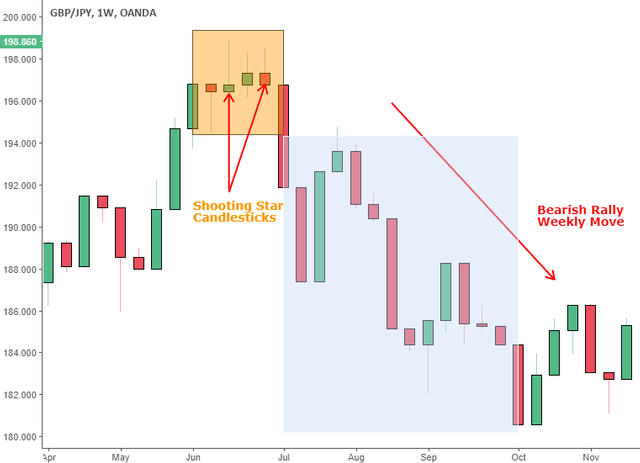

Shooting Star Pattern

No. of Candlesticks in play- 1 (Only the Shooting Star candlestick to look out for)

Occurrence- Rare pattern

Signal Strength- This is a fairly strong reversal signal but has to be specific in its desired appearance and description.

How to identify? – In essence it’s easy to identify an upside down ‘Hammer’ candlestick seen at resistance levels. The Shooting Star candlestick can be either bullish or bearish i.e. assume red and green if we use default colour candlesticks. The main body is at the lower end of the trading range i.e. as shown in the chart above the red body is at the bottom with the wicks/shadows shooting up exactly mimicking an upside down hammer pattern. Also a long upper shadow should be twice the height of the main body. This is very important because it’s common to see a candlestick that has the main body equal in length to the shadow/wick. It should have no lower shadow (i.e. above the main lower body part). A strong sign would the longer the upper shadow, and the smaller the real body the more meaningful the bearish shooting star pattern.

Useful Timeframes for different type of traders-

Intraday or Day Trading- 30 minute or Hourly Timeframe

Swing Trader- 4 hourly or Daily Timeframe

Long-term – Weekly or Monthly Time Frame (A shooting star seen at a weekly or monthly resistance level indicates a strong sign for reversal and an entry for a short/sell trade).

Evening Star candlestick pattern

No. of Candlesticks in play- 3 (1st candlestick is a bullish, 2nd a Doji & 3rd a large Bearish candle)

Occurrence- Common pattern

Signal Strength- This is a fairly strong bearish reversal signal. As noted before, a better version of Evening Star Candlestick formation is dependent on the type of Doji candle seen and the length of bearish candle that succeeds the Doji. An Evening star pattern that consists of an abandoned Baby Gapped Doji or a Gravestone Doji are the strongest versions of the pattern due to their rarity. The illustration above shows the pattern with a long-legged Doji with a Long Bearish candle that Engulfs the 1st bullish candlestick in the pattern.

How to identify? – This is a three candlestick pattern. All criteria and conditions have to be met for its validity. As it’s a Bearish Reversal pattern the first candlestick would be a bullish candle of any size. The second which is a Doji candle (could be any Doji). The main body of a Doji is very small and thin. Lastly, proceeded by a large bearish candlestick where its main body exceeds in length of more than 50% then the first bullish candled of the pattern.

Useful Timeframes for different type of traders-

Intraday or Day Trading- 30 minute or Hourly Timeframe

Swing Trader- 4 hourly or Daily Timeframe

Long-term – Weekly or Monthly Time Frame (An Evening Star candlestick pattern seen at a major resistance level, trend line analysis or 61.8% of a Fibonacci Retracement level is a strong sign for a potential reversal and a potential entry of short/sell trade)

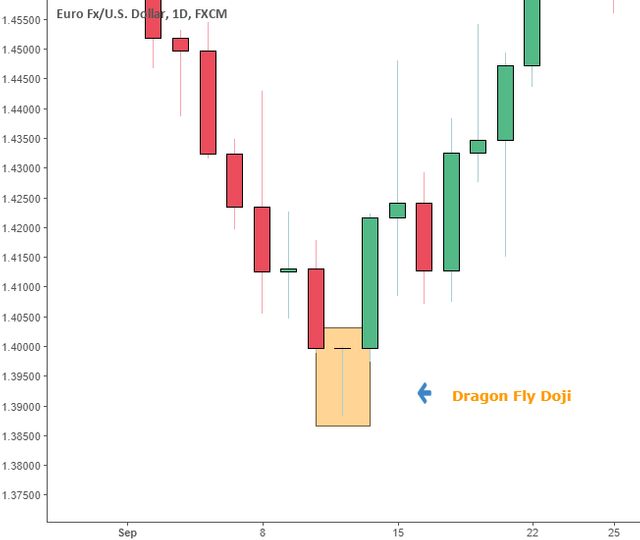

Dragon Fly Doji

No. of Candlesticks in play- 1 (Either Bullish or Bearish candle, mostly seen with other candlestick patterns like the Morning Star Pattern)

Occurrence- Rare pattern

Signal Strength- This is a fairly strong bullish reversal signal seen at the bottom of a support level band. As noted before, a better version of Morning Star Candlestick formation is dependent on the type of Doji candle seen. The best Doji in this case would be a Dragonfly Doji.

How to identify? – In terms of its visual it very much looks like a long shadow with a very thin body. The open and close is seen at the high of the candlestick. This indicates that the point of trend is turning and the bulls (buyers) overtook the bears (sellers) in the session. During a bearish session the close would normally be near the low of the day but as in the case of the dragonfly the close is at the high of the session.

Useful Timeframes for different type of traders-

Long-term – Weekly or Monthly Time Frame (An Dragon Fly Doji candlestick pattern seen at a major support level, at point of Bullish Trend line or 61.8% of a Fibonacci Retracement level is a strong sign for a potential reversal and a potential entry of Long/buy trade)

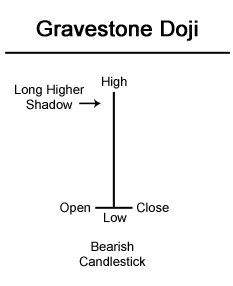

Gravestone Doji

No. of Candlesticks in play- 1 (Either Bullish or Bearish in colour, mostly seen with other candlestick patterns like the Evenstar Pattern)

Occurrence- Rare Pattern

Signal Strength- This is a fairly strong bearish reversal signal seen at the top of a resistance band. As noted before, a better version of Evening Star Candlestick formation is dependent on the type of Doji candle seen. The best Doji in this case would be a dragon Fly Doji.

How to identify? – In terms of its visual it very much looks like a long shadow with a very thin body. The open and close is seen at the low of the candlestick. This indicates that the point of trend is turning and the bears (sellers) overtook the bulls (buyers) in the session. During a bullish session the close would normally be near the high of the day but as in the case of the gravestone Doji the close is at the low of the session.

Useful Timeframes for different type of traders-

Long-term – A strong sign on Weekly or Monthly Time Frame (An Gravestone Doji candlestick pattern seen at a major resistance level, at point of bearish Trend line or 61.8% of a Fibonacci Retracement level is a strong sign for a potential reversal and a potential entry of Short/sell trade)

Thank you for the great content https://9blz.com/bearish-engulfing-candlestick-pattern/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit