Are You A Compulsive Trader?

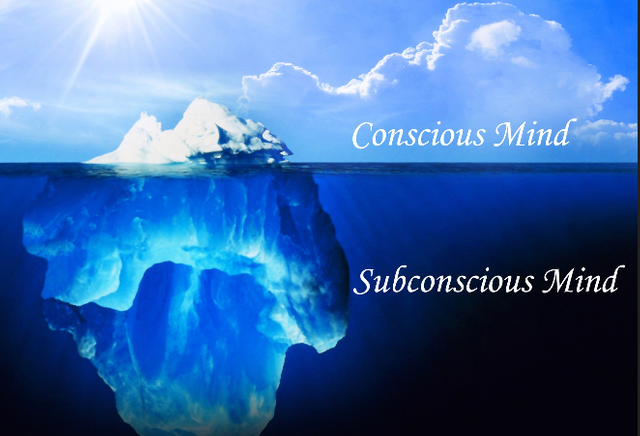

90% of everything you do in your life is determined by your subconscious mind and only 10% of our minds is conscious thought.

The subconscious mind is responsible for the automatically triggered feelings and emotions that you suddenly experience upon facing a new situation.

If you were about to trade then all the fear and anxiety feelings you might experience are in fact launched and controlled by your subconscious mind.

And this is one of the most common reasons traders fail, most of the time people are not even aware of the influence of our subconscious minds, Sugar, coffee, a particular type of food, sex, drugs, success, money, gambling are all types of compulsive needs that we as humans crave repeatedly to get instant gratification, its all additive behavior.

How This Effects Your Trading:

Do you find yourself getting an urge to do a trade no matter what & your searching to do a trade even tho the market isn't in an area that you would normally take on a trade, you see a little green candle that gives you a little buzz, adrenaline kicks in and you jump into a trade with no plan, no stop loss & not knowing your exact risk/reward Ratio, one that is completely against your trading plan, If you do this then you are a compulsive trader & you need to stop now before the market takes your money.

And you don’t even know why you do this. You’ve made that mistake countless times, and yet, you do it again.

The thing is, we do this because we’re addicted to certainty. So we act out that addiction, even though every time we swear to ourselves: ”This is the last time!” But it never is. It’s a compulsion.

How To Prevent Compulsive Trading:

If you look closely at what is actually happening when there’s a compulsion, you’ll see that it doesn’t even matter what the object of addiction is, because the addiction has basically the same root, our additions is to our feelings.

To tackle compulsive trading first you need to identify that your doing it, if you feel an urge to jump in and your heart starts to race your getting compulsive feelings & should walk away for 15 minutes.

Before any trade you need to have a plan that meets your trading strategy rules, no plan no trade!

Traders fail because they are a slave to there emotions, you need to disconnect your emotions in every trade, If you feel the common feeling in markets called FOMO (fear of mission out) then you still are challenged by your emotions.

Successful trading is about being consistent, sticking to your strategy with no exceptions, sounds easy right? but its the most common mistake among unsuccessful traders is failing to be consistent.

Understand what a compulsion is, identify when your doing it, and you can consciously avoid making a compulsive trade, remember no plan no trade!

Author: CryptoFeed

Very useful, since I am a clothing merchant on foot.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post. I think this could be applied to any discipline in life. Being aware of our reptilian brains and having a plan are two simple objectives that will undobtfuly bring about success.

Good work.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you Gueco!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Not addicted, but i sure could see how so many can be. This is a passion for me walking on the tight rope ...... :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

For Sure! It Amazes me that most people are not even aware they have theses habits.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit