SAY HUH?!?!? SAY WHAT?!?!? Who would make such an outlandish claim? $10,000 to a mllion?!?!?! BOY GTFO, YOU DONE LOST YO DAMN MIND, SON! There's absolutely no way in hell that will happen! That is riDIRKulous if not impossible ~ is what I'd be thinking to myself if I stumbled across this blog from the beginning on May 27, 2017.

A coworker introduced this blog to me in late-November started by a trader who was aiming for $1 million starting with a $10,000 account. I read through the majority of the blog and was blown away! At the time, the account was already sitting in the $200,000 - $250,000 range and I decided that I needed to quickly act on this in an attempt to ride this thing for 400-500% to a million.

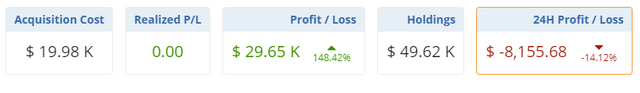

After a few weeks of research through Thanksgiving, I decided on 12/15 that I would allocate funds into cryptos for the long term. I created a portfolio to help with my entries of the positions from @cryptographic's portfolio: ADA BTS SYS STEEM BTS DGB NLG while waiting for my funds to arrive in my trading accounts.

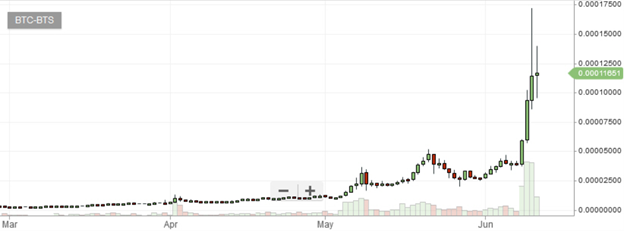

After a day, the account was +25%. ONE DAY. Today, just 3 weeks since I started tracking positions, the account is over 145% gains! Not too shabby! Who am I kidding, these gains have been the quickest I've ever seen in my trading career.

With the recent pops in ADA and STEEM, @cryptographic's account hit $1,000,000+ this week, topping out around $1.2 million. CONGRATULATIONS MY FRIEND ~ You deserve a mic drop.

@cryptographic has been a huge inspiration to me and the reason why I'm here. It would be a disservice of me not to share this with all of you. So without further adieu, here's a CliffsNotes version of the blog and little tid-bits I found to be invaluable not only in trading, but in life. All quotes below are from @cryptographic and links to the OG blog will be posted below as well.

Sharing is Caring

One of the best things we can do is share our knowledge about that and work together to that end. There’s a reason why early adopters are handsomely rewarded: they invested their time, knowledge and money early on. The idea is to sell at fair value . . . after, of course, identifying the winners that will make it there. Yes, I think it’s very possible, and I hope there are as many of us peons as possible who do it!

During the early stages of the blog, @cryptographic clearly detailed his strategy in-depth laying out the criteria for his picks.

"It’s the biggest no brainer I’ve ever seen in my life."

Investment Strategy/Criteria

In a nutshell, I try to find first class projects that are still undervalued and that have very good appreciation prospects. Firstly, that means eliminating everything that is scam “tainted” whether it be true or perceived. For example, all unexplained pre-mines or instamines are immediately discarded. Unproven or doubtful technology is also reason for elimination from consideration – anything that’s been hacked, for example, is for someone else. I’m interested in security above all, and that means documented proven tech. Another thing that I don’t like are one-trick-ponies, or single dev coins, as it were – even where there’s a couple of devs, I think twice because, if it looks like a mom and pop basement operation where you find someone who’s learning as they go with cut and paste coding, it probably is.

Secondly, I look for market confirmation (though sometimes the process is reversed and the market shows me something I hadn’t seen before). The market is never wrong (even when it’s irrational), and being the collective reflection of all participants’ opinions regarding value, it provides me with valuable information. For example, where is the incoming fiat being targeted and with what intensity? Money flow analysis can tell you a great deal. When you can divide markets into emotional and professional trading categories, you gain even more insight into which issues the market thinks are truly long term value and which are possible short term fads based on a lot of hopeful thinking.

Lastly, the potential portfolio candidate has to present good prospects from a technical analysis perspective for potential future revaluation. There also has to be very good risk/reward for me to get involved. Even if they present long term fundamental value, overextended cryptos have to be removed from the selection process, at least until they come back to the mean and present a risk/reward opportunity more in line with what I seek, and only once the technicals have restructured and also support a buy.

It’s not easy to find opportunities that meet all those requirements. The list of “blue chips” is short to begin with, and many, like BTC, are already getting pricy, if not downright overvalued. Some of the supposed “best of the best” don’t meet any of my criteria. I’ll give you two examples: 1) Ethereum’s turing complete code is far from proven safe - as in secure money storage - and in fact has been hacked, has a huge pre-mine set aside for founders, has a very emotional market suggesting that the smart money isn’t too interested, and is extremely overextended; 2) Dash is tainted by a huge controversial instamine that is claimed to have been an accident that no-one is worried about, employs technology that is far from proven, has a very emotional market (that is further worsened by a cultish community making it in my opinion crypto’s high end DOGE) again suggesting smart money avoidance, and is also extremely overdone to the upside. The idea is to find the complete opposites of these two examples and get positioned before the rest of the world gets hysterical about them.

I want “blue chip” crypto with solid dev teams and organizations that are made up of professionals who have working results to show for their efforts, with money flow volumetric market confirmation, and that are still way undervalued and have great prospects for short to intermediate term revaluation.

More on the topic:

The "components" of my portfolio are selected based on best possibility long term survival criteria, which means that I'm picking candidates that I think have an extremely high probability of succeeding long term.

They also need to be somewhat undiscovered and have a very high appreciation potential.

Setting rules like max scalping size per coin, etc., and then following them is essential. Then there’s portfolio management and automatic rebalancing when certain percentages of portfolio are hit. This takes away a lot of the trading risk in that it doesn’t matter if I think a certain issue is going higher or not because the percentage allocation says sell X amount and rebalance. No emotion, theoretically, anyway. There’s still way too much subjective decision making involved, but I try to make it as mechanical as possible.

That’s a generalized summary of the fundamentals, but they also need to be backed by positive assessments of the dev teams, future plans, user adoption, market acceptance, etc., so there's obviously lots more that goes into it. Then, when you see big money going after the same names, that helps to firm up decision making. All these markets trade very technically – the opposite of emotional markets – meaning professionals are highly involved. All in all, we’ve got great technicals combined with great fundamentals in all of these coins, and I would not be bothered in the least if I had to become a temporary bagholder and wait a year instead of a couple of months to reach targets with any of them. As I’ve said before in this thread, the ultimate question I ask myself about any investment is if I would mind becoming a bagholder at the price I’m paying. If the answer is yes, then I don’t go there.

The Trading Grind

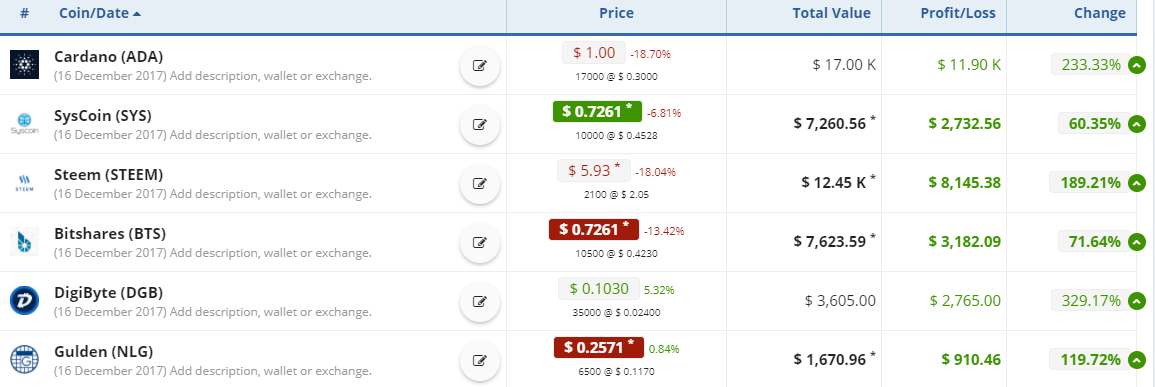

Early on, @cryptographic traded in and out of these coins in order to expedite his portfolio growth. Below are a few snapshots of when he bought/sold:

BUY:

SELL:

See a pattern? Like a true trading professional, he bought weakness and sold strength. An easy concept to grasp, but one helluva hard one to put into practice. BUY LOW, SELL HIGH

All the while, @cryptographic responded to all comments and tried to help everyone out with calming and unwavering advice:

This is the most dog-eat-dog world you'll ever see, and good information of that sort is hard to come by.

Lots of reading and research, patience, resolve and collaboration. Don't get in a hurry. This bull market will last for years.

But nothing goes up in a straight line.

Diversification and a strong stomach are the only things I can really recommend. Everything else is an educated guess.

And remember, don't chase! Be patient. Nothing goes anywhere in a straight line. There will be a major correction! It doesn't take a rocket scientist to see that this is the time to be taking profits, NOT buying.

You can do it! It's just a matter of putting your mind to it.

PATIENCE is a Virtue

BE PATIENT!

You'll have an opportunity sooner or later to buy in at a very nice price. Now is not the time to be getting involved IMVHO….I assure you that it will be one of the most profitable endeavors of your life, but YOU have to do your homework - nobody is going to spoon feed you or do it for you.

There's no such thing as a free ride. Be patient and diligent, and start researching and getting up to speed, and you'll make a lot of money in the coming years - even if you only buy good names (at the right time) and hold until you retire.

On Oct 17, 2017 - All positions were moved off the exchanges.

Everything is completely off all exchanges; there is nothing on any exchange! Everything is in its own wallet and has zero exchange risk.

Shortly after, his account was hacked and a member posted the 'locked portfolio' on Cryptocompare.

The hack of my account comes at a very opportune time – it’s almost too uncanny to be true. I had just taken the model portfolio into a “stagnate” long term phase not too many days before, with the promise to only rebalance in response to major changes and as seldom as possible. Destiny stepped in with a better idea: leave things exactly like they are forever.

Times have changed, and we must change with the times. I believe that crypto has crossed an ephemeral bridge from infancy with limitless dreams and aspirations to maturity with very limited long term prospects where the vast majority will slowly fade away while only a few, most likely in the handfuls, will survive. It’s no longer about discovering how things work and who’s behind the wheel, rather it’s time to make decisions based on what we already know. For example, first generation technology is not going to change. The days of one man POW dev teams are running out. The same can be said for original PoS. I believe that only proven secure, cutting edge solutions with real life applications will succeed, and I think that the model portfolio core consists of representative and extremely viable candidates, along with a couple of “long shots” that have a decent chance of making the transition.

Confidence, Conviction, and Future Outlook

Beating the benchmark is definite. In fact, I want to SMASH the benchmark. What that figure will eventually look like is anyone's guess right now, but if we start seeing some major fiat inflation that should be the eventual outcome of worldwide QE, those $300,000 figures for BTC might not be that far fetched. Imagine what smashing that would look like! One million is really a base figure assuming that the USD, EUR, JPY, etc. hold their current values. I don't place very good odds on that. And that brings me back to where I started from:

"Crypto is not only the best investment currently available to mankind, it's also the best hedge against fiat depreciation!"

@cryptographic - Again, I'd like to thank you for sharing your steadfast confidence in your picks and allowing anyone and everyone to follow along and learn. I hope you get the chance to read this as it should bring back some fond memories. I look forward to learning and growing with you and the community here at STEEMIT!

Remember, I said it will be worth millions. =)

How many millions? Who knows? Another 100x... or maybe...

As promised, here is the epic, OG Turn $10,000 into 1 Million blog. There's a lot more content that I didn't bother to cover, so I'd encourage all of you to go through and read the blog. "HR" is @cryptographic's username.

I had to drive 65 miles and trade 50 ounces of silver to get my Steem! Purchased at 2.75 and so far so good! I am hoping that Steem goes to $1000 USD in the next 5 years. I am also working on a deal to buy another 300 Steem. Hopefully we will get a small dip in the price ! Followed and upvoted !

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks @briandenver for the upvote and follow! I picked up some more steem a few days ago in the 5.50 range. $1000 steem price would be amazing! Even though I wish I got onboard earlier, the blockchain movement is just beginning.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Why not just buy on the exchanges?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks so much for this! More than anything so that I could read some of the highlights again and thereby learn from myself. 😂 Seriously though, I often benefit from re-reading something I wrote, especially with the passing of time and when it serves to bolster my own outlook. That $300,000 BTC target not being too far fetched is a stretch though. I'm sure I was being a little cheeky with that, as a segway back to the million dollar goal for the portfolio actually being a much more "reasonable" goal. When I started the thread I was absolutely convinced that we were witnessing the early stages of one of the biggest bull markets ever seen, what with the massive inflows of fiat and the first class projects like STEEM, BitShares, et al that were in the offering, and I just couldn't help myself from doing everything I could to share that opinion with others. A once in a lifetime opportunity! And I still do expect it to be worth millions, with an "s", someday. Nice recap (one small correction though, the Monaco chart was actually my last sell of MCO, if I remember correctly), and thanks again for the write up - at the end of the day, the idea is to share knowledge, especially when it's a win-win for everyone! 😎

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

No problem! I'm very glad and relieved that you enjoyed the post. I would have to agree with you on getting something more out something by re-reading or re-watching it. Often times I pickup on more subtleties when rewatching TV shows and movies that I didn't process the first time around. I reread your comments from your blog multiple times and picked up on many details I had missed out on initially.

MCO chart has been removed and as far as the 300k BTC prediction goes, who knows, plus there have been more aggressive price targets for BTC up to 500k and even a million. If fiat currencies start crashing, it's a possibility.

Thanks again for the read, upvote, and comment! And a big thank you for your generosity and leading me here to steemit. I wish I had found your blog earlier, even a few weeks earlier would have made a huge impact on my portfolio. Hindsights a bitch, but hopefully when I look back on this a couple years from now, getting involved with cryptos and joining steemit will be one of the best decisions I've ever made in my life.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This was a great post very informative. Thank you for sharing your experiences, you are doing great.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you @road2wisdom I'm trying and learning a lot from fellow Steemians. Appreciate the comment!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Whoever this Dirkboy41 is, he's got posting down to an SEO science. It's like he knows the inner-workings of effective SEO. Amazing.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit