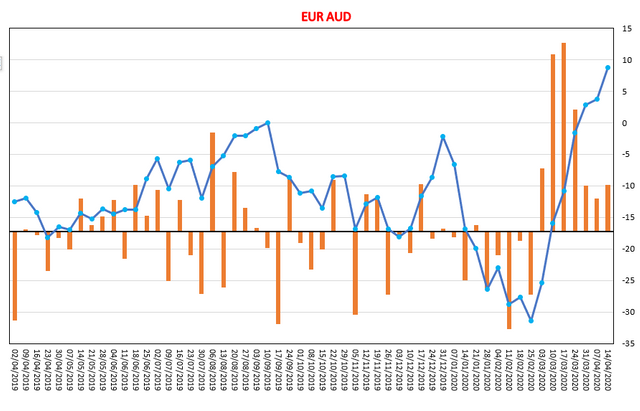

The speculative positions of the Cot Report on the Euro continue the upward trend that began in March, characterized above all by a large decrease in short positions by large investors.

Also the number of traders positioned on the upside is now greater than those which are still bearish.

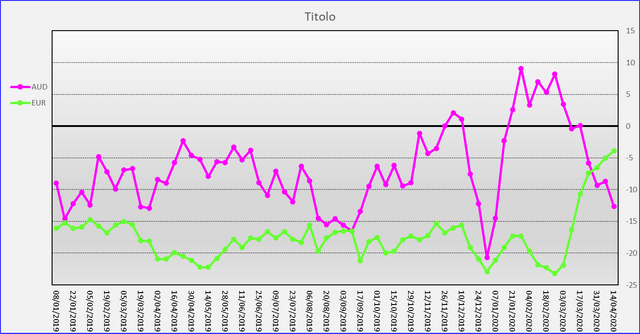

On the other hand, the movement of the Australian dollar appears completely opposite, with a progressive reduction in open interest starting from the end of February. Also in the last week we have seen a reduction of about 4600 long contracts.

Let's see on a graphic level how the movements of the open interest variations of the two currencies in question are presented: As you can see, the relative strength of the euro against the Australian dollar is clearly evident.

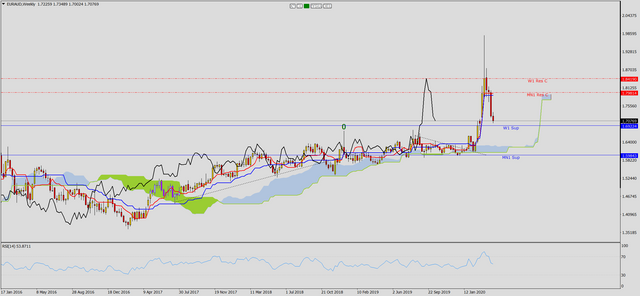

Prices, after the highs reached on March 19th, underwent a deep retracement until they reached a support zone in the 1.70 zone.

Especially on a weekly basis, we note that an imbalance has been created with a sharp shift in prices from the tenkan and kijun averages, which being positioned horizontally could act as an attraction for prices.

We therefore await a reversal signal that could trigger a rise. Possible targets for a movement of this type can be found just below area 1.80