Trade Copier Software

Foreign currency trading is a very lucrative investment option, but the inexperience and lack of knowledge in foreign currency trading make beginners a little apprehensive about the whole affair. They fumble when it comes to opening and closing trades in the market. Also, they are unable to tell the high-earning positions from the unprofitable ones.

Using a trade copier might be the best option for most beginners until they get a deeper insight into the working of the Forex market and are able to trade independently. In fact, trade copier software has become so popular that they are being considered a necessity for successful trading rather than an optional tool to be taken only by those who need help.

To understand how a trade copier works, it will help to first understand how to copy trading works.

What is Copy Trading?

Forex stands for Foreign Exchange. Forex enables investors to earn by speculating on the value of the currency. Copy trading is an investment strategy used in Forex trading. It involves copying trades or trade decisions made by other investors. This other investor is generally a seasoned investor or one who has a reputation for generating consistent profits in the marketplace. The system is based on a kind of social trading network and the person whose trades you copy is a mentor.

The process of Forex trading starts with setting up an account with a broker. If you choose to copy a trade, a fixed amount of your funds gets automatically linked to the account of the investor whose trades you intend to copy. Each time the investor trades including opening or closing an option or issuing a stop-loss order, your account will copy the movements in proportion to the amount of money linked to the account. Every time the trader profits, you will profit and every time he loses you will lose. The system allows you to profit significantly by not restricting you to a single account; you can link it to different traders' accounts.

Copy-trading differs from mirror trading in the fact that the latter allows you to copy on specific trade strategies and not all. In copy trading, you can copy an entire strategy or mirror individual trades only; the choice is yours. The option of copying several accounts is a better option as it helps mitigate risks. The trade copier software allows you to stop copying others' trades and start trading independently whenever you want. You can close the copy relationship altogether.

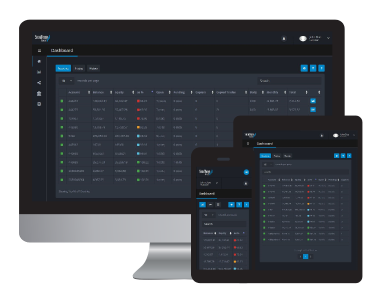

Copy-trading can be done manually or mechanically. There are specially designed trade copier software programs to enable it to be done mechanically. Its ability to copy an indefinite number of accounts gives you all the information you need to make sound trade decisions. Also, it has integrated several other tools to maximize profit and minimize risk.

Learn How This Person Makes Double Profits In the Stock market: tinyurl DOT com/5n983pnx ( Copy And Paste this

In a New Tab Remove DOT and Use Actual dot (.) )

Learn How To Be A Successful Trader: tinyurl DOT com/2cx3f9vr ( Copy And Paste this In a New Tab Remove

DOT and Use Actual dot (.) )