Introducing

Centralized exchanges have been the backbone of the cryptocurrency market for many years. They offer fast turnaround times, high trading volumes, and ever-increasing liquidity. However, there is a parallel world that is being built in the form of a trustless protocol. The decentralized exchange (DEX) does not require intermediaries or custodians to facilitate trading.

Due to the inherent limitations of blockchain technology, it is a challenge to build DEXs that compete meaningfully with their centralized counterparts. To a large extent DEX can improve both in terms of performance and user experience.

Many developers have thought of new ways to build a decentralized exchange. As a result of this innovation, MoonDeFi has been created as a project that is part of the Decentralized Finance (DeFi) movement.

Unicap.Finance is a next-gen DeFi platform that continues to see more investor attention in the market. The platform is unique because it incorporates CETFs to maximize returns and flexibility for users. Importantly, crypto exchange-traded funds (CETFs) have long been a desire for investors who see these financial instruments as more secure and less risky than trading cryptocurrencies directly.

What Problems Does Unicap.Finance Attempt to Fix?

At the center of the Uniswap movement is a desire to provide the average person access to a passive income. Currently, the majority of people have no passive income at all. Additionally, their options are limited as most passive income streams require hefty upfront investments. Unicap democratizes the sector via a simplistic and cost-efficient business model.

Intense Workload

Trading cryptocurrencies is not as easy as buying some Bitcoin, and boom, you’re rich. It takes a ton of research, monitoring of market movements, and understanding of technical data to succeed in your endeavors. The problem is that most people lack the time to commit to this level of market management.

DeFi Research

Recently, the expansion of the DeFi sector has put extra stress on investors who seek to improve ROIs via these new era platforms. The problem is that, so far, many of these projects lack substance. Some have only gone as far as to provide future expectations of how successful the project will be and not any information on the technical development aspects. Sadly, this leaves most DeFi investors speculating with a lack of data. Unicap’s strategy streamlines investing and provides users with high returns and low-risk options.

Transparency

Another major issue facing the DeFi sector is a lack of transparency. To tackle this issue, Unicap creates a secure, profitable, and transparent project UNICAP.Finance Fund. This fund provides the DeFi community with additional profit from inactive crypto assets.

UCAP Tokens

Investors can then easily decide what project to jumpstart. Create your CETF and invest in their liquidity via UCAP Tokens. Notably, in the Unicap ecosystem investors collectively invest in the fund by swapping funds into UCAP tokens. These tokens ensure full transparency because they reside on the public Ethereum blockchain.

ERC-20 tokens are the most popular type of token in the market. They enjoy the maximum interoperability. Users have more options in terms of wallets and exchanges than other token standards or even other cryptocurrencies. Notably, when you trade your crypto for UCAP tokens, the initial 90% remains collateralized with real cryptocurrency and liquidity tokens.

How Does Unicap.Finance Work

Unicap creates a fair and transparent investment opportunity for investors. The platform’s CETFs always reflect the proper value because they are priced continuously throughout the 24-hour-trading. To understand how Unicap works you need to grasp the concept of CETFs fully.

CETF crypto exchange-traded fund (CETF)

CETFs are kind of like mutual funds because they hold a basket of assets, in this case, blockchain-based assets. These assets can be anything from cryptocurrency to tokens, and coins. The CETF divides ownership between its token holders.

Keenly, these tokens give holders indirect ownership rights over the fund. As the indirect owners of the fund, token holders are entitled to a share of the profits accrued through the investment. Also, in the event that the fund is liquidated, the token holders receive their percentage of the total sales price. Best of all, there is no human intervention required for these transactions to complete. The entire process relies on smart contracts to remain autonomous.

CEFT provides investors with an attractive alternative when compared to trading cryptocurrencies directly. They are more efficient and provide better asset aggregation as well. Most importantly, investors in CETFs are not exposed to regulatory bite back further down the road.

Currently, the crypto market has no legitimate regulatory framework in place. Institutional investors and other large firms are unable to invest in the market due to these missing protections. CETFs bridge this gap and helps to drive more institutional investment in the sector.

Benefits of Unicap.Finance

There are a lot of benefits one can obtain from using Unicap. For one, it’s very simple to use. The developers behind the concept designed the interface in a way that anyone can find the most important features at a glance. Speaking of features, Unicap is packed with all the classics. Investors can enjoy limit orders, stop-loss orders, margin buying, and other hedging strategies.

DeFi Bank

Unicap shines bright in the DeFi sector thanks to its Cryptocurrency Loan Protocol. This system allows users to deposit and lend out their crypto in minutes. Lenders receive rewards in the form of interest rates for their lent liquidity. The platform currently supports deposits, withdrawals, and borrowing functions.

Loan Quotas - Pay Your Loans Back Whenever You Want

Another unique feature found only at Unicap is this “anytime payback” model. Whenever a user deposits their digital assets in one of these liquidity smart contracts, the system automatically calculates their maximum loan quotas. This quota tells a user how much crypto they can lend out. Best of all, the technical aspects of the system provide both the lender and borrower the ability to pay loans back at their own convenience. Now let’s see you try to pull that off at your local bank.

Loan Interest Rates

Loan interest rates automatically adjust according to Unicap supply and demand. The system evaluates the total size of loans and the amount of the fund supply. When liquidity gets low, loan interest rates increase slowly. This maneuver helps to encourage borrowers to borrow from the loan pool. Reversely, if the lending amount in the loan pool is showing signs of saturation, interest rates will increase. This strategy will encourage lenders to deposit more funds to the loan pool.

Unicap.Finance - What the Future Holds

Unicap is sure to see success with its latest venture. The introduction of CETFs to the DeFi sector may mark a significant change in what basic features investors desire from their DeFi experience. One thing is for sure, Unicap fills a niche market in the sector perfectly. As such, there is no telling how big this platform could get.

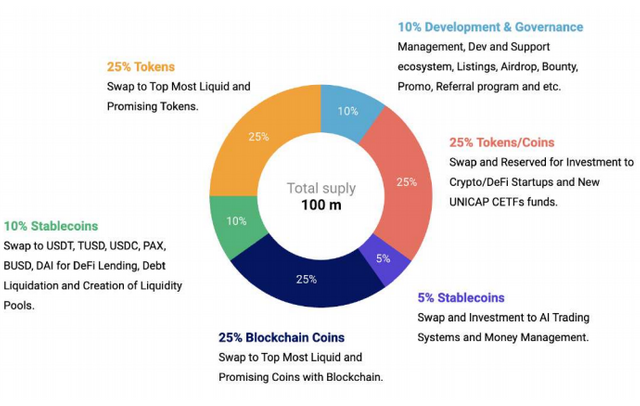

UNICAP Fund DeFi Ecosystem

Pre Public Swap Token Offering 1 UCAP = 1–1.5$

● 10% Development & Governance

Management, Dev and Support ecosystem, Listings, Airdrop, Bounty, Promo, Referral program and etc.

● 25% Tokens/Coins

Swap and Reserved for Investment to Crypto/DeFi Startups and New UNICAP CETFs funds.

● 5% Stablecoins

Swap and Investment to AI Trading Systems and Money Management.

● 25% Tokens

Swap to Top Most Liquid and Promising Tokens.

● 10% Stablecoins

Swap to USDT, TUSD, USDC, PAX, BUSD, DAI for DeFi Lending, Debt Liquidation and Creation of Liquidity Pools.

● 25% Blockchain Coins

Swap to Top Most Liquid and Promising Coins with Blockchain.

Token Address:0xbaA70614C7AAfB568a93E62a98D55696bcc85DFE

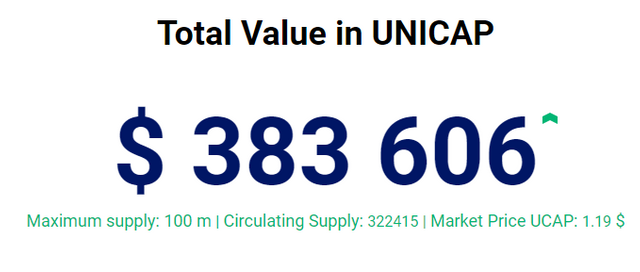

UNICAP Token

● Token Ticker: UCAP

● Token Type: ERC-20

● Blockchain: Ethereum

● Legal Classification: Utility Token

● Total Supply (No. of Tokens): 100,000,000

Roadmap

Q3 2020

Idea Generation. CETF & DeFi product research. Brainstorming. Team forming, Creation of UNICAP.finance

Q4 2020

Site development. Opening of Investor Personal Account (14 languages), Deployment of Smart contract and mining tokens UCAP.

Pre public swap tokens offering. Unicap Global community development. Promo/Airdrop/Bounty.

Q1 2021

DeFi Bank product design and prototype. Swap tokens. Listing token on KuCoin/Bittrex/FTX/Exmo/Lbank. AirDrop for DeFi community. New Funds Develop and Launch. 1st Global community survey.

Q2 2021

UNICAP DeFi Bank v1 Launch, New Funds Development and launch. Swap of tokens. Listing OKEX, HUOBI, BINACE. Acceptance of funding proposals for Crypto/DeFi startups.

Q3 2021

UNICAP DeFi Bank v2 (new protocols) Launch. New Funds Develop and Launch. Listings New Funds.

Q4 2021

UNICAP New Startups Launch. Listings Startups on OKEX/HUOBI/BINANCE.

#ETF #Ethereum #bitcoin #eth #uniswap #defi #gem #investing #altcoins #exchange #money #cryptocurrency #trading #investment #decentralized.

ACCURATE INFORMATION

Website : https://ucap.finance/

Whitepaper : https://ucap.finance/docs/ucap_wp_v1.pdf

Facebook : https://facebook.com/swaprsfair

Twitter : https://twitter.com/unicapfinance

Telegram : https://t.me/unicap_finance

Linkedin : https://www.linkedin.com/showcase/unicapfinance/

Discord : https://discord.gg/BJBA4Yb

ANN Thread : https://bitcointalk.org/index.php?topic=5278941

AUTHOR

Bitcointalk Username: Mahkota dewa

Telegram Username: #romeo_tom

Bitcointalk url: https://bitcointalk.org/index.php?action=profile;u=2199412

Wallet address (eth): 0x72BDCD2E03aAb693c09551612B6F04E5640fce67