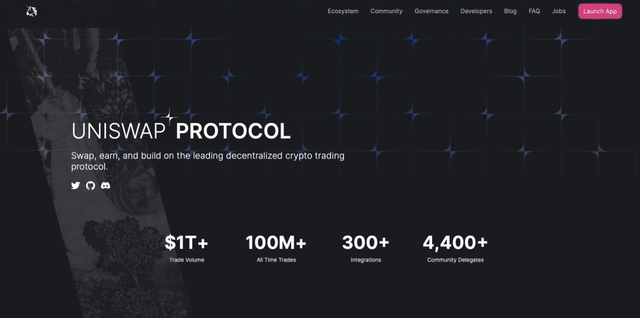

Is Uniswap a big exchange?

Uniswap exchange review

Uniswap is a DEX (Decentralized ERC20 token exchange) that operates under the Ethereum decentralized network and is used to exchange one token of the Ethereum network for another. Example would serve to exchange the ETH token for the UNI token.

What is Uniswap Exchange?

An important difference from other cryptocurrency exchanges is that there is no order book, but the price is determined based on an established mathematical formula. The peers act as automated market makers, ready to accept one token for the other as long as the "constant product" formula is maintained.

This formula, expressed most simply as x * y = k, states that trades should not change the product ( k) of a pair's reserve balances ( xy y). Because kremains unchanged with respect to the reference frame of a trade, it is often referred to as invariant. This formula has the desirable property that larger trades (relative to reserves) execute at exponentially worse rates than smaller ones.

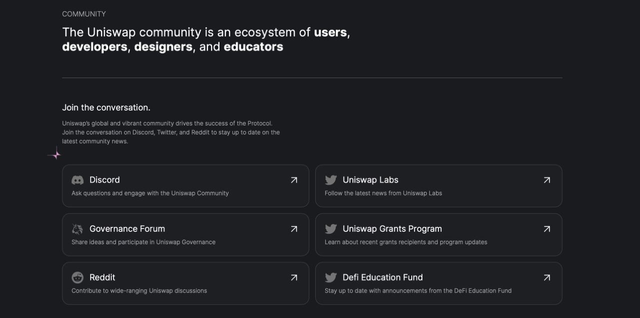

The Uniswap app is part of a larger community.

How do I trade in Uniswap exchange?

An example for the above formula would be a liquidity pool where there are 400 UNI and 7 ETH. Where I swap 1 ETH to buy UNI tokens, how many UNI tokens would I get?

According to the formula xy=K if x is the number of UNI tokens, y is the number of ETH tokens. 4007 = 2,800 this amount is K or the constant (invariant).

If I want to buy 1 ETH I include one ETH to the liquidity pool so now I will have 8 ETH as the constant is 2.800. I divide 2800/8 ETH= 350. That means that now in the pool I have 350 UNI and 8 ETH. Therefore 400 UNI that were there initially minus 350 UNI that are there now have given me for 1 ETH the amount of 50 UNI.

Now the pool will be 350 UNI / 8 ETH. To check that it is correct I multiply 8 ETH by 350 UNI and I obtain the constant 2,800.

In practice, Uniswap applies a 0.30% commission to trades, which is added to the reserves. As a result, each trade actually increases k. This works as a payment to LPs, which is made when they burn their group tokens to withdraw their share of the total reserves. In the future, this fee can be reduced to 0.25%, and the remaining 0.05% would be retained as a charge to the entire protocol or to the owners of the UNI governance tokens.

As a summary we can say that Uniswap serves two purposes:

- Perform ethereum network token exchanges as a swap. I pay 0.3%

- Get revenue for supplying liquidity to a liquidity pool. I get revenue of 0.3 %.

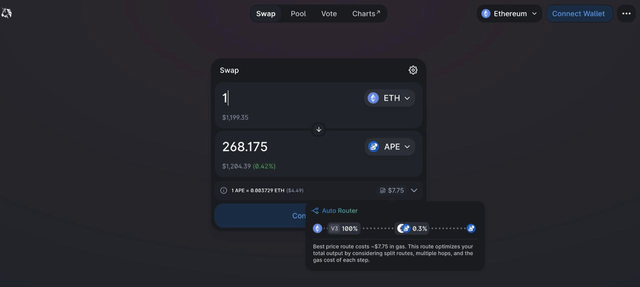

How do I use Uniswap to swap one token for another?

You must use the official Uniswap interface.

№ 1 Go to the website

Source: https://uniswap.org/

№ 2: Once you are on the official website launch the application where it says start application

- Uniswap Interface

- Edit description

- app.uniswap.org

№ 3: Connect your Metamask

№ 4: Start trading with the Swap (Uniswap Exchange), select the tokens you want to swap.

In this example we are going to exchange 0.03 ETH and it automatically shows you the estimated UNI you will receive, as you can see it is 2.04998 UNI.

In addition to this data we have to take into account several issues:

- Minimum received: At the bottom it indicates that you will receive a minimum of 2.039 UNI.

- Price impact: Only 0.02% is indicated, it is the difference between the market price and the price I will be charged in the exchange.

- Liquidity provider fee: 0.0002691 ETH which is the 0.3 % that liquidity providers get in that Uniswap UNI/ETH liquidity pool.

- At the bottom it indicates the route it will use to give you the best price, in this case the route is from wETH to USDC to DAI to UNI.

№ 5: Once we agree on the exchange, press swap, you must keep in mind that now your Metamask will connect and the Ethereum network will charge you an amount of GAS in ETH depending on the number of Gwei at which the GAS is at that moment.

You should note that once you accept your Metamask will be connected and the Ethereum network will charge you an amount of GAS in ETH based on the number of Gwei the GAS is at at that moment.

If you have enough ETH to pay the GAS of the transaction everything will be correct and will connect you with your Metamask to accept, but if you do not have enough ETH to pay the gas you will get this message

How do I use Uniswap to add liquidity and get 0.3% commission every time users use the liquidity pool you are participating in?

Once you are in the Uniswap application, click on the Pool option.

Click on the Add Liquidity option.

№ 6: Select which liquidity pair you want to participate. Keep in mind that to provide liquidity in a pool is 50%, so the first thing you should consider is that you have enough of both tokens.

In the example of the picture the pair we have chosen is ETH/LPT, when you include the number of ETH you want to add to the pool (0.0178 ETH) below it tells you how many LPT tokens you must add (2.07283). If you have enough ETH (0.0527185) and LPT (2.09288) you get the Approve LPT screen.

Before approving the operation, check the prices and participation in the liquidity pool.

In the example it indicates that in that pool you get 116.451 LPT for each ETH or, in other words, with 1 LPT you can get 0.00858728 ETH and that means a participation in the pool of 0.03%.

Once you accept you will receive an LP (Liquidity Provider) token of the LPT/ETH pair.

Important Note: By adding liquidity, you will get 0.3% of all trades in this pair proportional to your share of the pool. Fees are added to the pool, accrue in real time and can be claimed by withdrawing your liquidity.

№ 7: You should note that once you accept your Metamask will be connected and the Ethereum network will charge you an amount of GAS in ETH based on the number of Gwei the GAS is at at that time.

How do I participate in the Liquidity Mining program to get rewarded with UNI tokens?

Once you are in the Uniswap application (interface) click on the UNI button.

Once here, deposit your liquidity provider tokens to receive UNI, the Uniswap protocol governance token. You can choose from those 4 liquidity pools ETH/DAI, ETH/USDC, ETH/USDT, ETH/WBTC.

As you can see the weekly UNI reward that each of these pools will receive, you will receive the percentage corresponding to your weight in the pool.

As you can see it warns you when the rewards end in the case of the example in 58 days, 5 hours, 4 minutes, 43 seconds.

An initial liquidity mining program will go live on September 18, 2020 at 12:00 am. UTC. The initial program will run until November 17, 2020 at 12:00 a.m. UTC and will target the following four pools in Uniswap v2:

ETH / USDT

ETH / USDC

ETH / DAI

ETH / WBTC

UNI 5,000,000 per group will be allocated to LP proportional to liquidity, which roughly translates to:

83,333.33 UNI UNI per group per day.

13.5 UNI UNI per group per block

These UNI are not grandfathered or locked.

Next: Choose the liquidity pool you are going to deposit and add the PAR. In this case we have chosen ETH/DAI.

Once the liquidity is added, you will get an LP token of that ETH/DAI pair and it will show your deposits on that LP token which you will store in your Metamask wallet and in each block, it will inform you of the UNI tokens you can claim.

Conclusion

In the article we have discussed what Uniswap is and what it is used for, it is also explained how to use Uniswap in a graphical way and as practical as possible.

In how to use Uniswap we have talked about 3 issues

- How to make a token swap.

- How to provide liquidity in a uniswap pool.

- How to receive UNI tokens taking advantage of the liquidity program active until November 17th.

It is important that you know the tools where you have information about the different liquidity pools of uniswap