Recently, there have been many rumors that stablecoins will crash. We first hear that hedge funds are shorting USDT with hundreds of millions of dollars. Then, a KOL on Twitter said that Circle could suffer a run. On July 6, another Twitter KOL warned people of a potential USDT depeg. Will USDT and USDC crash as they predicted? Today, let’s break down the rumors in terms of the reserve asset, buyback amount, and transaction statistics.

Reserve assets

USDT

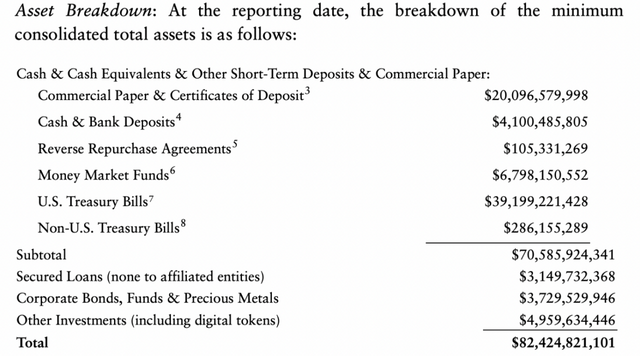

Let’s first take a look at USDT. According to the Q1 2022 assurance report issued by Cayman that we found on Tether’s official website, the company holds $82,424,821,101 in assets as of Q1 2022. In addition, its total reserve assets are worth more than the USDT market cap. Compared with the $78,675,642,677 recorded in Q4 2021, Tether’s total reserve assets have grown by approximately 4.77%.

The specific asset breakdown is as follows:

Source: Tether’s Q1 2022 assurance report

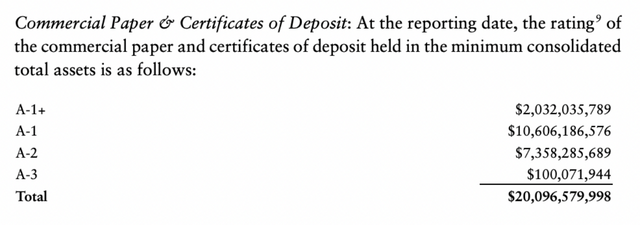

Compared with the previous quarter, Tether has boosted its holdings of U.S. Treasury Bills, but the new Treasuries it purchased are 90-day bonds instead of 120-day bonds, accounting for 47.9% of total assets. At the same time, Tether’s commercial paper holdings make up 24.38% of its total assets, a fall of about 20.25% in Q1 2022. According to the supplementary note, Tether sold all assets rated below A-3 in Q1 and also reduced the proportion of assets rated at A-3.

Source: Tether’s Q1 2022 assurance report

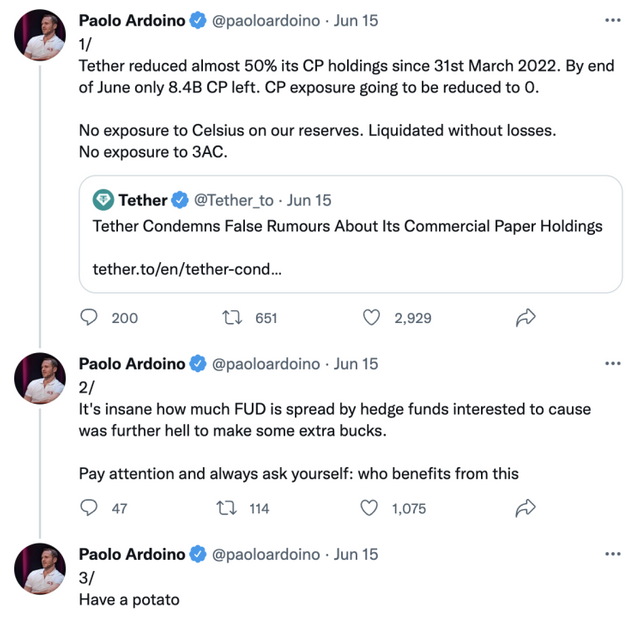

Although the Q2 report has not been released yet, Tether’s chief technology officer said: “Tether reduced almost 50% its CP holdings since 31st March 2022. By end of June one 8.4 billion CP left. CP exposure going to be reduced to 0.” Based on the way their assets changed in the past, we can roughly predict that Tether is likely to convert its CP holdings into Treasury Bills to lower the risks. Moreover, the CTO also stated that Tether did not invest in Celsius or 3AC.

In addition, according to its official website, Tether would slash its commercial paper portfolio by $5 billion after July 31, 2022, bringing its paper asset holdings down to $3.5 billion.

USDC

Data from USDC’s official website shows that this stablecoin’s reserve assets come with an even simpler mix: cash plus short-term U.S. Treasury Bills. In particular, the latter account for 75.45% of the total reserve assets, while the former takes up only 24.55%.

Its chief financial officer, Jeremy Fox-Geen, said in a statement that the company’s Treasuries were purchased by BlackRock and stored at the Bank of New York Mellon. In addition, about 20% of USDC’s reserve assets are cash, stored in a number of banks, including Silvergate, Signature Bank, and New York Community Bank. Jeremy also said that Circle redeemed $14.7 billion worth of USDC for customers in June.

Total market cap & buyback amount

Having checked the reserve assets of the two stablecoins, let’s now turn to the root cause of crypto meltdowns: depegs. USDT and USDC are both stablecoins pegged to a fiat currency, which means that they can depeg from the dollar under two scenarios:

Hit by extreme market conditions, the project team does not have enough funds to pay for massive redemptions. This would result in poor liquidity performance of the stablecoin, which leads to its depeg.

The stablecoin suffers from malicious shorting and scandals, which leads to market panic and causes a run. In the end, the stablecoin depegs due to insufficient liquidity.

That said, let’s first check out the USDT redemption statistics. The most recent massive USDT redemption happened after the UST meltdown when Tether redeemed nearly $10 billion within a short period. Later, the company redeemed another $5.51 billion worth of USDT from June 12 to June 22.

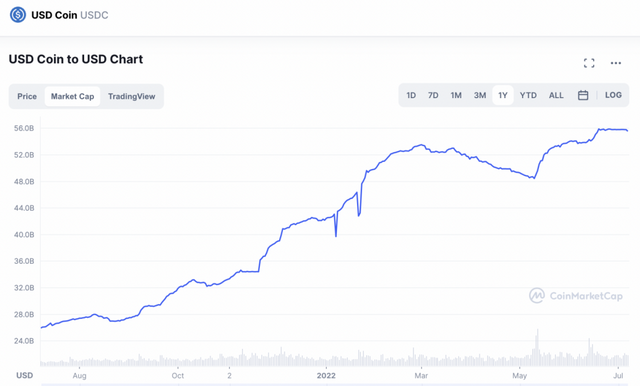

$4.56 billion worth of USDC had been redeemed from March 20 to May 10, and the market cap has been growing ever since.

Of course, based on these charts, we can only roughly guess the buyback volume of the two assets. After all, when the UST crashed, there were market makers who turned about $5 billion worth of USDT into USDC to mitigate the risks.

It is noteworthy that the market cap of USDT has been on a continued fall, while that of USDC has been rising. This might be the case because users have kept exchanging USDT for USDC, which shows that the market is still worried about the security of USDT.

Transaction statistics

Next, let’s turn to the second scenario where the two stablecoins are threatened by malicious shorting, exit scams, or runs. If that were to happen, the on-chain statistics would show a massive withdrawal of funds. According to the on-chain statistics, USDC seems to have been hit by the panics, while USDT has not been much affected.

The on-chain transaction trend of USDT

The on-chain transaction trend of USDC

Conclusion

In terms of market cap, USDT takes a lion’s share of the stablecoin market, which has led to the excessive concentration of funds. Plus, this has also made the market unnervingly vulnerable. In addition, USDT also continues to hold risky commercial papers. Fortunately, Tether has started to reduce its CP holdings.

As a government-regulated stablecoin, USDC does not seem to match the blockchain space, but it is safer, and the most prominent risk threatening USDC might come from a massive run on the banks where Circle stores its cash reserves.

To sum up, a USDT/USDC crash is unlikely to happen. In the present bear market, the market cap of many projects, including stablecoins, has been reshuffled.

Based on these charts, we can only roughly guess the buyback volume of the two assets.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit