I provide several strategies on Collective2.com for people to subscribe to, and I often get questions about my strategy Volatility IRA. Questions can range from what is Volatility to more detailed questions like what would happen to this strategy if the stock market crashed. Here I want to take the chance to answer some of these questions.

1. What is Voatility trading?

Volatility trading has been a hot topic in recent months because betting against volatility in the stock market has been extremely profitable over the past couple of years. For those that are completely unfamiliar with trading volatility there are essentially two positions you can take.

- Going short volatility: Markets will remain rather calm in the immediate future and therefore it is an advantageous time to sell insurance for stock portfolios.

- Going long volatility: Markets will experience quick and sudden run ups and down in price. Due to the unpredictability it is not a good time to sell insurance on stocks, for fear that there will be many insurances claim. Instead it is better to go to cash or to purchase insurance on stocks.

Just like your car insurance provider, the insurance provider seeks to make sure that they collect more in policy premiums than they pay out in claims. So, just like a car insurer who only collects $1 million in policy premiums, but pays out $2 million a year in car wreck claims, a volatility trader will lose money if they payout more than they pay in premiums.

2. When do you sell insurance (go short) and when do you purchase insurance (go long) on stocks?

Just like I don’t see the insurance industry going away ever, I do think that on average shorting volatility will not go away. However, it will experience times where it is a very bad time to be an insurer. For example, take the example of the almost extinct local car insurer located in Houston, TX during a hurricane like Harvey in 2017. If a small insurance company had many policies covering cars for floods in Houston that insurer would have been nearly whipped out do to the high number of claims they would have had to pay to their clients.

Knowing when the next sever hurricane will hit Houston or the next severe financial hurricane will hit the markets is a questions for God, because I have no idea. However, I do believe there are signs that show when a financial hurricane could happen.

Think if a insurer was able to cancel all insurance policies at the beginning of hurricane season an reactivate them after hurricane season, or cancel them right when a hurricane is forecasted. If this was legal and it didn’t destroy the customer base this would be a huge boost to the profits of any insurer.

Well when you are selling insurance on a stocks you can cancel and reactivate that insurance in a matter of seconds, and unlike the analogy you are not treating your customer poorly. As all metaphors the idea of insurance on a car or house is not a direct connection to shorting volatility.

Unfortunately, I will not share exactly what I use as my hurricane radar or when I think hurricane season is. That is proprietary.

3. How quickly do you know when to get in or out of the stock insurance business?

During regular market hours I have a computer in Minnesota that checks every 3 seconds to see if the multitude of indicators I use indicate that it is a good time to go short or long volatility. As soon as this computer gets a signal to buy or sell it sends it to my broker and collective2. If the internet or power were to go out at this location I have several backups. My first backup that is constantly running is a cloud computing algorithm managed by a third party that will immediately send text alerts to my phone allowing me to manually trade from my phone. My third backup is a second computer running in Oklahoma that will notify me via text and email of any changes to my system. This computer can also be set up in a matter of minutes from anywhere in the world to start live trading should the computer in Minnesota not have power or internet connection.

4. What does this strategy buy or sell?

This strategy currently only buys either XIV or VXX or holds cash. When it is an advantageous time to sell insurance on stocks I buy XIV which is an exchange traded note. By doing this I am not directly selling insurance on stocks. It is more analogous to me giving money to an insurer and they sell the insurance and pay me profits. By doing this and not selling insurance directly I know that the worst thing that can happen is that the insurance company goes broke and cannot pay me the full amount back. While losing my money does not sound fun it is far better in my opinion than the people who sell insurance on stocks directly and can actually stand the chance of losing 10 or a 100 times the amount of money in their account.

VXX is also an exchange traded product and is similar to buying little pieces of thousands of insurance policies on stock.

5. How often do you hold each item?

I buy XIV or VXX when my algorithm says it is advantageous to do so and do not sell until it says otherwise. About 50% of the time my algorithm will hold XIV, 10% of the time VXX, and 40% of the time cash. This strategy tends to make money on big swings in XIV or VXX that can last for months at a time with no signals to buy or sell. However, there are other periods of uncertainty where the strategy will move in and out of these exchange traded notes in a matter of minutes, hours, or days. Over the past 10 years had I been trading this strategy I expect that it would have about 300 trades total.

6. Can this strategy be traded in an IRA?

I know without a doubt that this strategy can be traded in an IRA because I use my own IRA to trade it. In fact the strategy Volatility IRA on collective2.com simply matches what my own IRA does.

7. What kinds of returns and drawdowns do you expect?

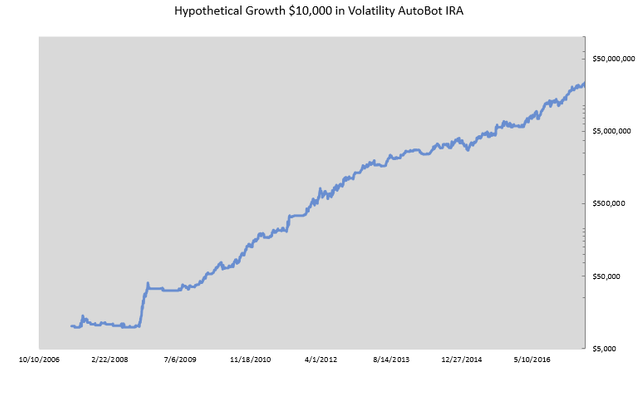

I have backtested this strategy to 2007 using different available data for my backtesting.

- 2007-2010 data quality 7/10

- 2010-2013 data quality 8/10

- 2013-Early August 2017 9/10

- Mid-August 2017 to today data quality 10/10.

8. What kind of protections does this strategy have if it goes wrong?

8. What kind of protections does this strategy have if it goes wrong?

This strategy is meant to be a piece of a portfolio not the entire portfolio. For example, I currently have this strategy as about 30%-40% of my liquid assets. That is still a rather high percentage. As I am able to save more and do not want to take as great of risks I want Volatility IRA to comprise only 15% of my portfolio. My strategy Total Asset Allocation also trades volatility just like Volatility IRA, but the volatility portion of Total Asset Allocation comprises only 15% of the strategy. This means that Total Asset Allocation does not grow as quickly, but remains more diversified and able to weather all market conditions.

9. Can you trade this inside an IRA?

Yes, I trade this in my own IRA. In fact the signals you see are the exact same trades I place in my IRA. C2 is actually connected to my broker and can see my trades. C2 can immediately notify you or automatically trade for you if I make a trade in my own brokerage account.10. What else do you want to know?

I am happy to help in any way I can. If you have more questions you want answered, let me know and if it is a common question I will add it to this description.As some of you know, I do actively trade the markets of cyrpto currencies and stocks. If you would like to find more information like this I encourage you to follow my blog, twitter, steemit, or Collective2.