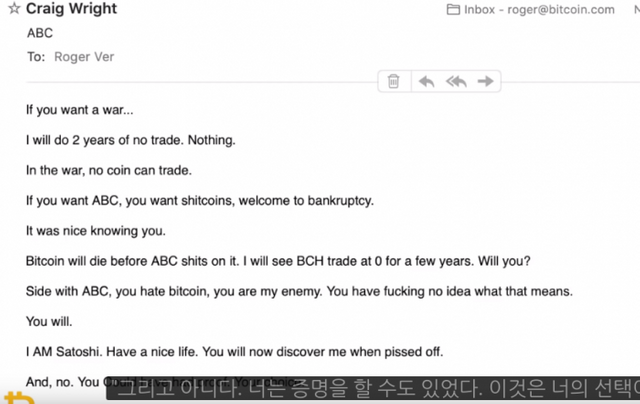

Tron (TRX) seems to be a strong project. That was confirmed more or less this week. It outperforms ETH annd BTC by far when it comes to transaction speed. It published a very usefull manual how to build Dapps on TRON. It had quit an aggressive marketing. That is not uncommon in the crypto space. You just have to see trough it. Even the notable Roger Ver, with his BCH (or BCC as some keep calling it) has some very compelling aruments for his vision. This week that is highly relevant, since the BCH hard fork is about to happen and it seems a big mess already with two competing visions in place. ABC versus Craig Wright. This is from a youtube video of Roger Ver:

Yep: talking about war! In crypto terms: the Hash War. Wright even claiming to be Satoshi... Exactly the kind of lingo investors not like. They are not looking for the holy grail or sacred truth. We have little to no enthusiasm for the coming fork. If you like adventure, Poloniex and HitBTC offer speculative trading on this fork already. What will happen nobody really knows. Seems the ABC project will win the day. All in all BCH did good: the BTC hard fork gave a lot of free BCH and it ran to about 1,200USD. Free money. What it did not: wipe out and replace BTC, despite many mostly good arguments.

So with all of this taking place we took some time to look at NEO and TRON. The question about NEO seems if it will be able to survive. (In some way the same question can be asked considering ETH). The question about TRON is if it will be really used (DAPPS). Even though we do not like the TRON hypo lingo also a lot, we can imagine TRON will go ahead and be a significant factor.

What is great for historians: we might be able to speak about the Hash Wars or Crypto Wars. Never bored if you follow what is happening. Is it all significant? For now, November 2018, it is. The year so far did not go down as most of us expected (for legit reasons). The ICO hype is done and now it is all about exchanges and stable tokens. As we all expected 2018 was the Regulation Year - but instead of finding firm rules, most stays unclear and undefined. We see jurisdictions like Slovenia, Singapore, Malta, Gibraltar and Switzerland picking up on this. It offers them a chance and they grab it. That has old logic: the smaller a country, the bigger it's financial sector. Getting investments in (that is the correct term for it - in fact it is just attracting money from the citizens of other countries in exchange for tax evasive purposes...). A small country has not too many subjects (people) to make tax very lucrative. That is different for big countries with many people around: taxes are their most easy and biggest way to get to money. The incentives in Germany are different from those in Gibraltar...

<br /><center><hr/><em>Posted from my blog with <a href='https://wordpress.org/plugins/steempress/'>SteemPress</a> : https://cryptmove.com/blog/2018/11/13/being-tronned-into-it-trx/ </em><hr/></center>