Presenting :

The presentation of home loan sponsored securities is to extend , back and sell its sources and bring many-sided quality. It make a situation where sound credit appraisal was casual. This industry conveys imaginative arrangements which are competent to confront complex issues and increment its parency and dependability.

Homelend is building up an imaginative stage that takes advantage of the energy of blockchain innovation and will disturb the home loan industry. This will be finished by opening new P2P subsidizing/venture openings, better overseeing data, and computerizing business forms with the assistance of brilliant contracts

Home loan and blockchain industry :

Blockchain innovation has a colossal potential to address the realities. Attributable to its circulated nature, a blockchain record can essentially facilitate the exchange and access to data for every one of the gatherings engaged with the home loan esteem chain. In addition ,with its special ability to produce put stock in, straightforwardness, and record unchanging nature, it is a successful push toward digitization, of home loan documentation as well as of all related business forms correspondingly , In the following segments, a concise clarification of the home loan esteem chain will be given to bring up the inadequacies of the present framework. As will be watched, a significant number of these issues can be tended to through blockchain innovation.

The home loan esteem chain comprises of three unmistakable stages or stages:

• start,

• adjusting, and

• securitization.

Start is the way toward applying for and shutting a home loan advance. Adjusting includes executing the commitments that emerge from the credit amid its life expectancy (e.g. regularly scheduled installments of important in addition to interests). Securitization is the issuing of monetary instruments called contract supported securities (MBS). Both adjusting and securitization occur after start has been finished.

P2p loaning industry:

Shared (P2P) loaning, otherwise called "elective fund," is the procedure by which people can acquire and take cash from each other without the intruption of banks or other monetary go-betweens. It was made conceivable because of the Internet innovation .P2P loaning stages, for example, Prosper and Lending Club have been in activity for over 10 years in the U.S18. Truth be told, the market has outgrown desires: ten years back, specialists evaluated a US$10 billion market estimate for U.S.19. In all actuality, toward the finish of 2016 the market measure was US$34.5 billion

Work strategy:

By utilizing circulated innovation and savvy contracts it unites

loan specialists and borrowers to a critical stage and actualize a beginning procedure by cutting it into

50 days because of under 20.

Agreeable and reliable stage :

Homelend is likewise in view of a sound and beneficial plan of action, which intentionally connects with address an underserved advertise. From one perspective, Homelend makes a speculation open door for some people, with an answer that joins a customary industry as land, with an imaginative innovation like blockchain. This is a multidimensional stage for its eco-accommodating clients

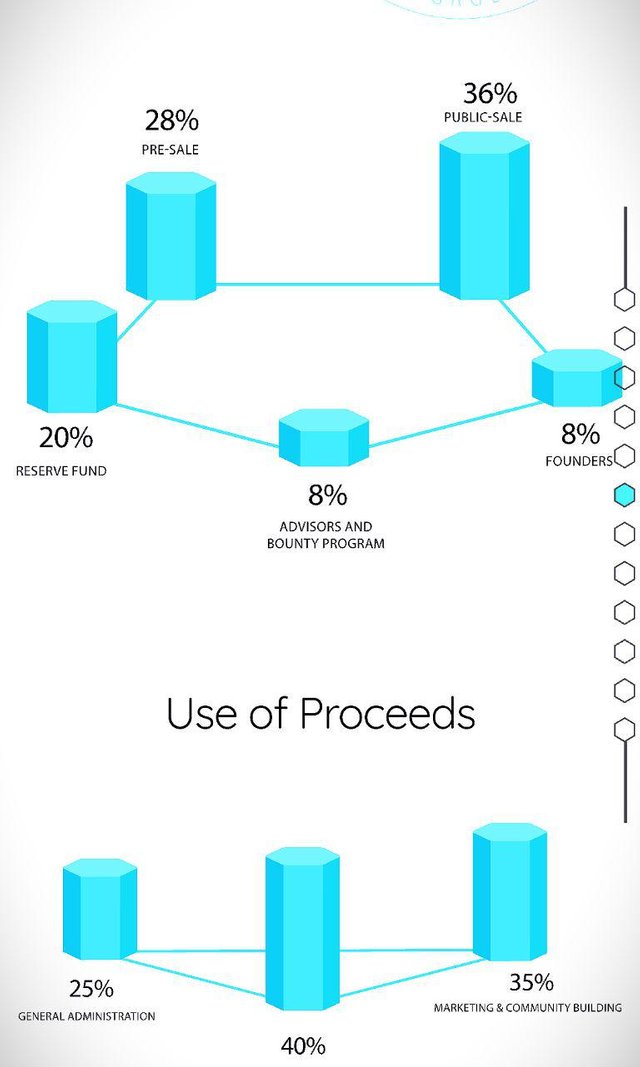

TOKEN :

A key component of the framework is the decrease of grinding costs, and the accessibility of the administration for a wide populace underserved by banks or other home loan moneylenders. The utilization of a token will expand availability to Homelend stage for unbanked or monetarily barred individuals; they will have the chance to gain HDM tokens from their wallets by trading different cryptographic forms of money or computerized tokens

Guide:

OUR TEAM: