Overview of Decentralised Exchanges

Decentralised Exchanges (DEXs) were created to remove the requirements for any authority to administer and approve trades performed within a specific exchange. Decentralised Exchanges allows peer-to-peer (P2P) trading of cryptocurrencies. They are usually non-custodial, that is users keep control of their wallets private keys. Users can immediately access their crypto balances after logging into the DEX with their private key. They will not be required to submit any personal information like names, addresses, which is great for individuals who cherish their privacy.

Decentralised exchanges rely on smart contracts to allow traders to execute orders without intermediary. On the other hand, centralised exchanges are managed by centralised organisations such as banks or owners of exchanges that are involved in financial services looking for ways to make profit. If you are using centralised exchanges, it is likely that you are not in control of your wallet keys, which means your funds are not secure. That is why decentralised exchanges are more secure.

What is Lacking in Numerous Decentralised Exchanges

In recent times, Decentralised Exchanges are becoming popular. Though, centralised exchanges are more secure when compared with centralised exchanges, however, they are still faced with numerous problems that make people not to patronise them. Most decentralised exchanges especially those that use Ethereum blockchain are very expensive when used to carry out transactions. Most of the exchanges are not user-friendly.

For most decentralised exchanges, the requirements to process orders through smart contracts causes inactivity, a lack of liquidity which leads to slippage and high costs which is a barrier to wider adoption. Most decentralised exchanges do not have products that will enable users earn form the platform. This makes the user move from one platform to another in search of where he or she can invest.

Transaction Speed and Network Congestion Issues

When Bitcoin was designed some years back, about the year 2007, very few people knew about bitcoin, and because of that there were no issues of transaction speed or network congestion. Presently, people have become knowledgeable about bitcoin as well as other cryptocurrencies. The number of people using bitcoin to carry out transaction has increased tremendously. As a result of the increased usage the blockchain capacity required to handle transactions can no longer handle transactions smoothly. This problem has led to increase in the time of transaction as well as increase in the cost.

In order for blockchain to become conventional for our financial transactions, it has to be scalable, that is, it has to be built in such a way that a large number of transactions can be handled per second without compromising the effectiveness or security of the network.

On a normal day, the Bitcoin network still works normally. However, when there is increase in the level of transaction, the transaction is no longer fast as expected. There are reports of transactions taking hours or even days. This is the problem of scalability. It means that Bitcoin cannot handle large amounts of transaction data on its platform in a short span of time. It is related to the fact that records (known as blocks) in the Bitcoin blockchain are limited in size and frequency.

With the increasing number of people using bitcoin, which are in thousands if not millions, bitcoin, in its current state, is unable to process all those transactions fast enough. This is not good enough for our use these days. Ethereum is another cryptocurrency that have scalabilty issues. Ethereum is currently the number two cryptocurenccy when you check the coinmarketcap. Ethereum popularity has grown especially when it started being used for smart contracts and decentralised applications.

Ethereum blockchain is designed in such a way that people can build cryto tokens on the blockchain. As many people started creating coins on the Ethereum blockchain, the level of transaction on ethereum blockchain network increased. As a result, network becomes clogged and the cost required to use the network increases. This cost is commonly called ‘gas.’ That is to say that the blockchain capacity at such point when the transaction is high could no longer allow smooth flow of transaction due to its limited size.

What this means is that the transaction capacities of cryptocurrencies such as Bitcoin and Ethereum are very low and are not able to meet current crypto financial needs. However, to carry out transactions on the two cryptos will require more expenses and waste of time.

Consequently, the present infrastructure of cryptocurrency networks will need to be expanded in a suitable way to absorb increasing transaction volumes along with an increasing number of users.

Acardex: Innovative Solution to Decentralised Exchanges and Slow Transaction Problems

In view of the above problems characteristic in most decentralised exchanges, Acaardex have come to change the narrative. Acardex is a compact decentralised cryptocurrency trading platform designed to help traders and investors have a profitable and satisfying trading experience. Acardex trading platform has all that you need in an exchange.

Acardex is built on Cardano Blockchain. Cardano was created by Charles Hoskinson in 2017. Charles, who is actually one of the co-founders of Ethereum, aims to solve some of the issues of other projects. He wants Cardano to be faster than Bitcoin, more decentralized, and provide cheaper transactions and gas fees than Ethereum.

Cardano (ADA) is an open-source proof of stake blockchain that provides smart contract functionalities. This means that developers can use it to launch decentralized applications, making them globally available. Being open source allows users to use, analyze, modify, change and distribute the software or the code, as per their requirements and needs, for anything without restrictions.

The non-profit organization responsible for Cardano has formed a network of academics and scientists from universities worldwide. In my opinion, Cardano is a product of scientific research.

Cardano is designed to be highly scalable. Presently, it provides over 250 transactions per second, compared to Ethereum’s 15.

Acardex is essentially the first decentralized exchange to be backed by Cardano blockchain. Acardex will be the key to unlock the excellent features of Cardano and that is the main reason of Acardex being built on Cardano blockchain. Acardex will offer numerous beneficial and profitable features on its decentralised exchange which includes the use of Automated Maket Maker (AMM), Increase in Speed of Transaction, Trading, Swaping, Earning, Staking, Low transaction fees, etc.

Acardex is made such that you can connect it to a privately owned wallet of which the owner has access to the keys (non-custodial wallet). The platform offers liquidity pool for its traders, allows its users to participate as liquidity providers. As liquidity providers, users will be entitled to earn commission on every transaction.

Benefitial Features of Using Acardex Platform

The following features are Acardex products that make the platform beneficial to users and investors:

Staking on Acardex Platform: Acardex Staking platform will enable users earn passive income effortlessly. Acardex platform has a staking option where $ACX holders can stake their tokens in the staking pools and get rewards (due to transaction fees). Acaedex staking platform can be a way to generate passive income, as they will offer better interest rates compared to other platforms.

Automated Market Maker (AMM) on Acardex Platform: Acardex exchange is equipped with Automated Market Maker (AMM). This allows digital assets to be traded automatically by using liquidity pools instead of a traditional market of buyers and sellers.

Liquidity Providing Pool: Market makers will be provided liquidity. This implies that when market makers give assets to the platform, they get reward in return which will be in the form of ACX tokens. Most of the time, market makers earn income from the trading fees.

Speed of Transaction and Security: Since the system is decentralised, there are fewer intermediaries and hence, users will enjoy speed, automation and security. Further, when the Cardano chain was first tested in 2017, it was able to process as much as 257 transactions per second (TPS). For better understanding, let us compare it with Bitcoin and Ethereum. Bitcoin can only process 4.6 TPS, while Ethereum process at 15-20 TPS. Clearly, ADA can process a higher transaction volume than Bitcoin and Ethereum, and, therefore solves the issue of scalabilty in Bitcoin and Ethereum.

Since Acaardex is built on cardano network, it will display great speed of transactions to users on the platform. In addition, as a DEX platform, there is no need of KYC. This will enables users who prefer anonymity to trade their assets seamlessly. Acardex will ensure hack-proof platform so that users can carry out trades in confidence.

Holders of ACX Token: In order to assure users that Acardex is decentralized, ACX token holders will have the opportunity to participate actively in taking decisions concerning the project such as proposing or deciding on new offers.

NFT Minting and Marketplace: Acardex will feature a unique NFT minting and marketplace. Users can access the NFT platform for a chance to mint their NFT or get an opportunity to buy their favorite NFT.

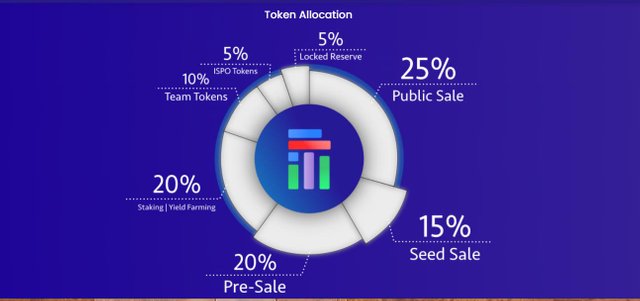

Tokenomics

Total Token Allocation: 1 Billion ACX

Seed sale — 15% — 150,000,000 ACX

Pre-sale — 20% — 200,000,000 ACX

Public sale — 25% — 250,000,000 ACX

Team — 10% — 100,000,000 ACX

Staking / Yield Farming — 20% — 200,000,000 ACX

Locked ecosystem / reserve — 5% — 50,000,000 ACX

ISPO — 5% — 50,000,000 ACX

- At seed sale stage, 1 ACX Token will be sold at 0.00125 ADA

- At pre-sale stage, 1 ACX Token will be sold for 0.0018 ADA

- At public sale stage, 1 ACX Token will be sold for 0.0025 ADA

Cardano Supported Wallets

Acardex is backed by Cardano blockchain, therefore, interested buyers of the ACX token should use any Cardano Supported wallets in the seed-sale which include but not limited to the following:

• Yoroi Wallet

• Daedalus Wallet

• Adalite Wallet

• Nami Wallet

Road Map

First Stage

emergence of idea, project conceptualization, and formation of core team

Second Stage

• design & release of Acardex website

• social accounts creation

• creation of Acardex whitepaper

• tokenomics release

Third Stage

• smart contract development & deployment

• $ACX token minting

• deployment of native tokens

• marketing of project

Fourth Stage

• seed sale to early adopters

• token distribution

• security audit

• Acardex DEX demo release

• pre-sale

• token distribution

Fifth Stage

• AMA

• marketing of Acardex project

• nft marketplace testnet

• mobile app development (demo design)

Sixth Stage

• public sale

• token distribution

• website design V1.0

• listing of $ACX on exchange

• audit

• strategic partnership announcement

Seventh Stage

• marketing of Acardex platform

• nft marketplace mainnet

• staking platform release

• mobile app launch V1.0

• release of exclusive nft collection

• website redesign V1.1

Eight Stage

• improvement of Acardex network

• nft cross-chain interoperability

• social sensitization & more campaign

• governance & voting mechanism for decision-making

• DAO structure

Ninth Stage

• Acardex DEX launch

• IDO launchpad development

• creation of discord account for Acardex

• Acardex pegged to US dollar

• direct token swap

• stop limit & limit orders

• Metaverse: Acarworld

Conclusion

Acardex a unique decentralised cryptocurrency trading platform (DEX) designed to help traders and investors have a profitable and satisfying trading experience. Acardex trading platform has all that you need in an exchange. Acardex is essentially the first decentralized exchange to be backed by Cardano blockchain.

Acardex will be the key to open-up the excellent features of Cardano and that is the main reason of Acardex being built on Cardano blockchain. Cardano (ADA) is an open-source proof of stake blockchain that provides smart contract functionalities like ethereum. This means that developers can use it to launch decentralized applications, making them globally available.

Acardex will offer numereous beneficial and profitable features on its decentralised exchange which includes the use of Automated Maket Maker (AMM), Trading, Swaping, Earning, Staking, Low transaction fees, etc. Acardex exchange is equipped with Automated Market Maker (AMM). This allows digital assets to be traded automatically by using liquidity pools instead of a traditional market of buyers and sellers.

Arcadex will offer a better Speed of Transaction and Security compared to Bitcoin and Ethereum networks. Cardano is designed to be highly scalable. Presently, it provides over 250 transactions per second, which is better than Ethereum’s 15 and Bitcoins’s 4.6. Acardex will offer NFT marketplace for users to mint and trade their NFTs. Arcadex is the innovative decentralised exchange of the future.

For more information about Acardex, please visit the following websites:

Website: https://acardex.io/

Twitter: https://twitter.com/_acardex/

Medium : https://medium.com/@acardex

Telegram community: https://t.me/acardexcommunity/

Telegram channel: https://t.me/acardexnews/

YouTube: https://www.youtube.com/channel/UC1leD8budK_31CAI92jluuQ

LinkedIn: https://www.linkedin.com/in/acardex-1-a335a2230/

Mail: [email protected]

Author’s Information:

Link to Proof of Authentication: https://bitcointalk.org/index.php?topic=5389863.msg59599481#msg59599481

Forum Username: evichi

Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=1717893

Telegram Username: @jaymay

Participated Campaign: Article

ADA WALLET ADDRESS: addr1qy0zkukm6l59ahy2m8cakfjqtjuf5k25xrj2sndhps4dxet4pvm85uayznrrk0nrxm88z8yl6jqlz2jl89fupf496tsqzlysst

E-mail: [email protected]