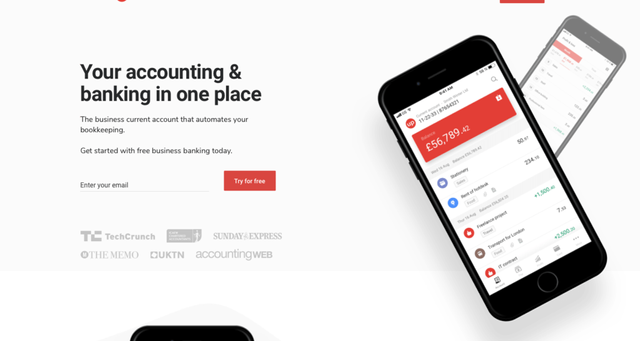

The rise of mobile banking in the fintech market is dominating the economic industries, with more people downloading banking applications than ever before. With handheld devices now becoming one of the most popular platforms for banking, there is certainly a lucrative market gap for digital accountancy services.

We recently caught up with Countingup, a digital business banking account recently released to the public and launched in the UK. In the interview below, we chatted to them about their approach to the startup business process, the fintech industry, and the most rewarding moment of starting your own business!

Q1. What is CountingUp?

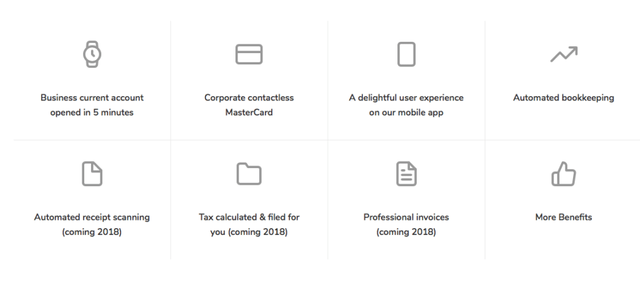

Countingup is your accounting and banking in one place for small businesses. Our smart business current account can be opened in minutes rather than weeks, it automatically categorises transactions to allow for automated financial statements and it will use that information to populate tax and VAT returns to be filed directly to HMRC from the app. It’s the simple, easy, time-saving way to run your business, so you can enjoy your business.

Q2. What inspired you to start Countingup? What was the driving force behind the idea?

Having previously observed thousands of businesses doing their accounts, something became obvious to me. The bank account is the ‘What’ of your business (i.e. the actual transactions), while the accounting is the ‘Why’, (the interpretation of those transactions for tax and compliance). Most people hate doing the tax and compliance because it is quite frankly boring and time-consuming. However, they lose a huge amount of useful insight into their business’ financial health as a result.

It made no sense to me that businesses use accounting and banking as two separate systems. Even worse, most business owners leave it months or right up until the end of the tax year before they access their accounting system to manually do the books. Eventually I started asking lots of entrepreneurs and small business owners about the idea of combining accounting and banking together. Everyone I spoke to reacted in the same way: “This makes so much sense. It sounds like such a simple idea, why hasn’t anyone else done this before?”

Q3. What have you found has been the biggest hurdle in developing a fintech startup?

The biggest challenge any entrepreneur faces is that we always want more. To be growing faster, hiring better, streamlining processes sooner or building our product quicker. These are challenges faced every single day, but the important point to remember is to enjoy the journey!

Q4. What has been the most rewarding moment of expanding your own business?

The first time I used my Countingup Mastercard had me grinning. It was the culmination of months of hard work that marked the transition from an idea to a real business current account that could be used to buy things!

Q5. How do you think the fintech industry can benefit from startups such as Countingup?

There has been an explosion of challenger or neo-banks in recent years. However, most of the best known challengers have focused squarely on the retail current account market. With PSD2 and open banking, smart use of API’s and a continued focus on a great customer experience, there is a potential for fintech companies to disrupt more than just traditional retail banking. For instance, the time saved through automated bookkeeping alone could provide a massive productivity boost to existing UK small businesses and the overall economy.

Q6. What makes your idea unique against others in the market?

Nobody has brought accounting and banking together in one place before. Using two separate systems to do inherently related tasks just doesn’t make sense. There is so much insight and productivity wasted by budding entrepreneurs because they leave it until the last minute to do their books or pass it off to an accountant who has to manually check bank transactions against accounting records, rather than providing valuable advice.

By bringing accounting and banking together in real-time, we allow UK small business owners to unlock the true potential of their business.

Q7. What do you think is the biggest challenge facing technology startups in 2018?

Attracting and hiring the best talent available has always been a major challenge for technology startups. There are only so many skilled people available at any given time and considering that it has never been easier to start a new business, competition for those people has never been higher.

Q8. What would say to potential consumers looking to use Countingup for their own personal banking?

Currently we only provide business bank accounts. However there is nothing stopping you from setting up a new business whether that means expanding your hobby or finally getting started on that idea that has been in the back of your mind for years.

In fact, many people use their personal current account for business transactions which creates a real mess and wastes time. You then need to separate the business transactions from the personal ones. Countingup is a fantastic solution for these people.

Q9. What advice would you give to others looking to develop their own start up businesses in finance or technology?

Getting good, honest feedback is essential. Look for the person who will help you to improve your business by giving honest and constructive feedback.

To find out more about Countingup, you can head to their website https://countingup.com or drop an email to [email protected] to find out what Countingup can offer your business.

We're always on the lookout for innovative and exciting new businesses, start ups and brands to feature on our site, so if you're a tech company looking to connect, drop us an email at [email protected].

Posted from my blog with SteemPress : http://rolleragency.co.uk/blog/guest-post-countingup-fintech-banking/