If your dependent children are working in your business, it is possible that the IRS will deny the wage expense; even if the children report the income on their personal taxes.This is an area that is very closely scrutinized by the IRS. Basically, IRS holds that the employer (parent) is making support payments disguised as wages. It is important to keep very accurate, detailed records that show the hours the children worked and the tasks performed. The tasks must be consistent with their ages and ability.If there are other employees doing the same type of work, the wages for the dependent child must be comparable. Typically, a bonus will not be allowed unless there is proof that bonuses would also be paid to unrelated employees.

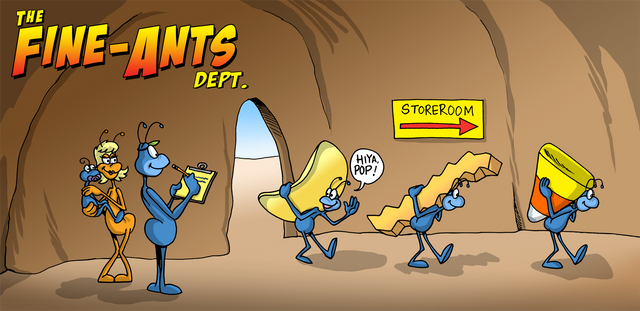

(c) 2017 Carl Stoddard For more information about using the Fine-Ants in your product or service, please contact Carl at [email protected]

Congratulations @drcfo! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPBy upvoting this notification, you can help all Steemit users. Learn how here!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit