Options trading is a standard practice in conventional market. I have done detailed study and developed robust options trading strategy using options data and AI as detailed in My work in the field of Artificial Intelligence - Episode 4 (2015-2017).

Deribit has introduced options trading for BTC and ETH. Those interested in reading details about options can refer to investopedia.

In this article I will briefly touch on how to use the options data from deribit to know what price direction options traders are expecting?

Implied volatility (IV) of options is most important parameter to understand how much an options trader is willing to pay for call option or put option for different strike prices.

Normally traders buy put options to protect their down side and call options to benefit from upside move. Therefore, if traders expect downside move then they will be willing to pay more for put options thereby increasing put options IV and if traders expect upside move then they will be willing to pay more for call options thereby increasing call options IV. Therefore, the bias between put IV and call IV can provide possible hint about what price move options traders expecting. Also sophisticated market insiders moves are also expected to be discounted in options positions which will again be reflected in put IV and call IV bias. Larger the bias -higher the conviction, confidence in insider information, and strength reflected through liquidity - of options players.

By using data from deribit we have computed IV for call and put options across all the traded strike prices for near and mid month for both BTC.

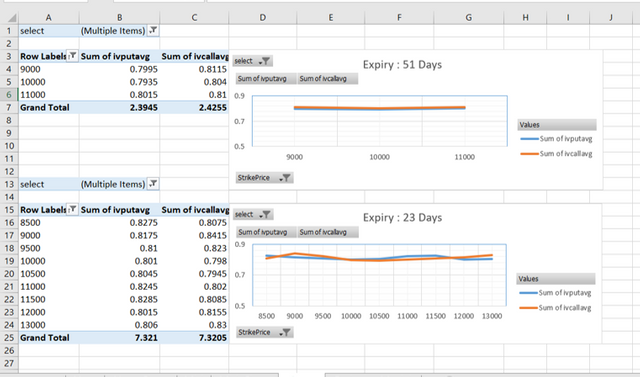

Below Figure show the computations for BTC:

IV for near month (23 days expiry) call and put options across all strike prices does not show any consistent bias. But for mid month (51 days expiry) call and put options across all strike prices do show consistent bias of call IV higher than Put IV. Therefore, we can say that traders are expecting upward price move as far as long term trend is concerned but they have no significant conviction for near term trend.