ADSactly on ADSACTLY - part #38

ADSactly - Taxation of Crypto - Part #1

Once upon a time there was a bunch of children playing on a beach. They've decided to collect pebbles and then exchange them for shells and snails gathered from the sea. A group of boys came by, saw what the children were doing and decided to take the 'value' away from them just because they didn't like the game. Grown-ups observed but didn't react, as they couldn't understand why would the big boys need pebbles at all. A huge amount was lying right there on the beach, anyway. The grown-ups missed a fact that the big boys weren't really interested in pebbles as a proof of value but they prefered to take away children's pocket money, instead of pebbles. If the grown-ups understood, they would have stopped it, right?

Source

This analogy speaks volumes about crypto taxation. Taxation of crypto is a hypocritical joke, executed by the elites for to exercise their dubious justice on 'free' people. How can something that doesn't exist be taxed? How can state tax something that has no public proof of ownership and is not legally verified nor accepted as a legal tender? That's the first issue. The second one would be the mechanism of taxing. How is it possible to tax a virtual currency that constantly fluctuates, unless the revenues are converted into fiat money? What they are doing right now is trying to tax casino tokens before a person has left the casino...

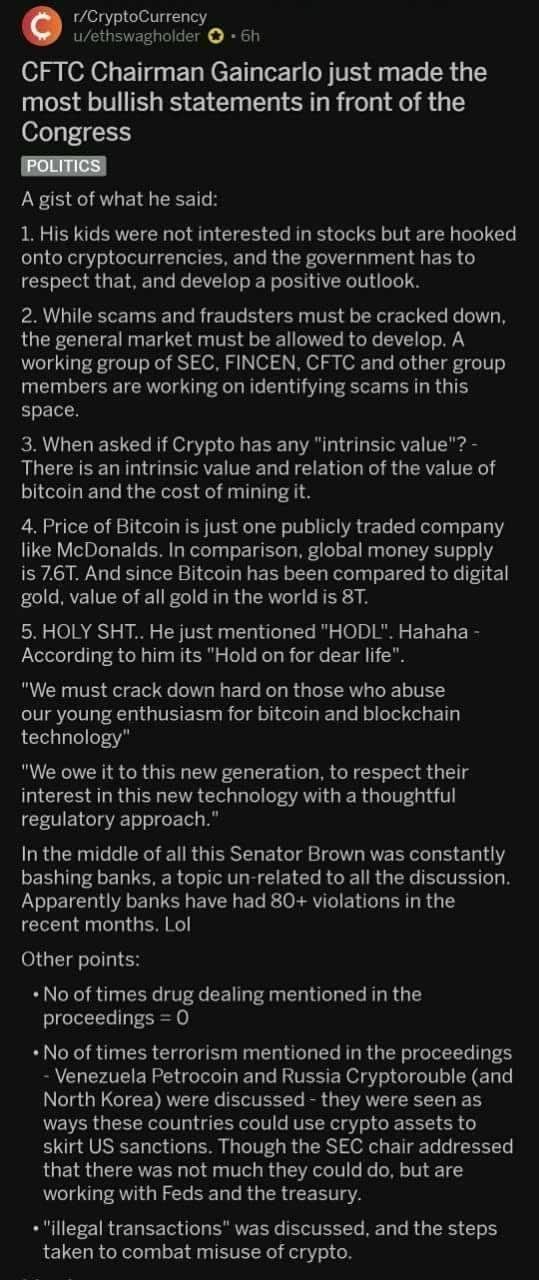

Source

We can understand the fuss regarding ICOs. Selling virtual tokens for fiat money and making a profit is a process that can make people rich in just a few days and it deserves to be taxed. If one's collected a mountain of fiat money, paying tax is alright and fair. But, we are not sure that the same should apply to ICOs which collecting crypto instead of fiat. These are still pebbles. Make fiat money - pay the taxes. Keep pebbles - play with them. If someone leaves all the gains in crypto, why should the person be taxed at all? Crypto is not recognized as legal tender, right? The law should understand that crypto, stashed away in the deregulated market environment, is only pebbles on a beach.

Source

If a person pays for goods or services in crypto, it's virtually untraceable and will remain so in a foreseeable future. Nothing can be done before crypto is legally accepted as regular money. A beautiful conundrum. They cannot recognize crypto because it would change the current financial system from the grounds up. But, without a full legal recognition, there are no effective means of taxing it. This is also why, my friends, crypto is here to stay.

One way or another.

Source

Each of us has a decision to make.

One can take the submissive route, giving away pocket money to the bullies or one can stash crypto in a paper wallet where nobody can ever prove its ownership in any way. The decision is entirely up to each individual. But, whatever you decide to do, don't give in to fear. They are deliberately creating it, through various heavily controlled media outlets, out of a sheer realization that there can be no upper force imposed on the matter. The omnipresent ruling elites haven't felt like that in ages.

Poor them.

Where are the grown-ups? :D

To be continued...

If you are interested in joining the ADSactly society, please read the blog series on ADSactly from the beginning. Have all of your questions answered in advance.

ADSactly on ADSACTLY - Part # 1 Open-Value Network / Co-opoly

ADSactly on ADSACTLY - Part # 2 Do-ocracy / Value Network

ADSactly on ADSACTLY - Part # 3 Open Stewardship

ADSactly on ADSACTLY - Part # 4 Society's Value Contribution System

ADSactly on ADSACTLY - Part # 5 The Value of Our Time

ADSactly on ADSACTLY - Part # 6 Cooperation and fair benefits

ADSactly on ADSACTLY - Part # 7 Support local production

ADSactly on ADSACTLY - Part # 8 Cooperation vs Competition

ADSactly on ADSACTLY - Part # 9 Sustainable Social Model

ADSactly on ADSACTLY - Part # 10 Blockchain Technology

ADSactly on ADSACTLY - Part # 11 Support for Decentralization

ADSactly on ADSACTLY - Part # 12 The Importance of Bitcoin

ADSactly on ADSACTLY - Part # 13 ADSactly in Discord (1)

ADSactly on ADSACTLY - Part # 14 ADSactly in Discord (2)

ADSactly on ADSACTLY - Part # 15 ADSactly in Discord (3)

ADSactly on ADSACTLY - Part # 16 ADSactly in Discord (4)

ADSactly on ADSACTLY - Part # 17 ADSactly in Discord (5)

ADSactly on ADSACTLY - Part # 18 ADSactly Clubs

ADSactly on ADSACTLY - Part # 19 ADSactly Tokens (1)

ADSactly on ADSACTLY - Part # 20 ADSactly Tokens (2)

ADSactly on ADSACTLY - Part # 21 ADSactly Tokens (3)

ADSactly on ADSACTLY - Part # 22 ADSactly Tokens (4)

ADSactly on ADSACTLY - Part # 23 ADSactly Tokens (5)

ADSactly on ADSACTLY - Part # 24 ADSactly Tokens (6)

ADSactly on ADSACTLY - Part # 25 Full Stack Startup

ADSactly on ADSACTLY - Part # 26 Artificial Intelligence Government Pt. I

ADSactly on ADSACTLY - Part # 27 Artificial Intelligence Government Pt. II

ADSactly on ADSACTLY - Part # 28 ADSactly Steemit Blog

ADSactly on ADSACTLY - Part # 29 The Future Of Crypto

ADSactly on ADSACTLY - Part # 30 ADSactly on Globalization

ADSactly on ADSACTLY - Part # 31 Blogging on Steemit

ADSactly on ADSACTLY - Part # 32 Social P2P network

ADSactly on ADSACTLY - Part # 33 Projects in ADSactly Society

ADSactly on ADSACTLY - Part # 34 ADSactly - Medium Blog

ADSactly on ADSACTLY - Part # 35 ADSactly - Environmental Protection

ADSactly on ADSACTLY - Part # 36 ADSactly - Sharing of Ideas

ADSactly on ADSACTLY - Part # 37 ADSactly - Centralized System vs. You

Every honest individual with good intentions is invited to join and offer their skills, knowledge, energy, time or resources to various ongoing projects within ADSactly society. The channel is here: ADSactly and you are welcome!

Click on the coin to join our Discord Chat

Witness proposal is here: https://steemit.com/witness-category/@adsactly-witness/adsactly-steemit-witness-proposal

In the bottom of the page type: adsactly-witness and press vote.

Use small letters and no "@" sign. Or, click here to vote directly!

Thank you!

I think taxing crypto only when you sell back into fiat has a problem, which is many people don't cash out into fiat. I can just leave it as USD or USDT or any currency on an Exchange, I can even privately sell my bitcoin into cash or goods and services. This negates taxes from BOTH parties which isn't fair to a normal tax payer.

In Australia, everyone with an income should pay tax, otherwise they can claim income benefits for people who don't make much money or make none. It isn't fair on normal tax payers to be supporting people with income but aren't taxed on it. Plus, tax helps keep the country running.

However, taxing crypto while you're buying/selling is dumb considering the volatility of crypto. This just isn't practical nor fair, as it benefits hodlers and fucks with day traders.

I think the best way is to be taxed when you BUY crypto into fiat AND taxed when you sell crypto back into fiat. This may be unpopular but I think it gets rid of all the problems I mentioned above.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Taxation was bound to happen. You don't reach these levels and not get noticed.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Recommend me @nasir83, I am free writer. I'm new to steemit and still need to learn from experienced people, if you please follow me and help vote some of my posts, thank you. https://steemit.com/indonesia/@nasir83/level-44-is-full-of-meaning

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Allow me to play Devil's advocate.....if they only taxed crypto on conversion to and from fiat, most people would circumvent that by never cashing out. They would use crypto as a currency and use it to purchase goods and services without ever cashing out.

I know it sucks, but look around. All levels of govt are scrounging around for any new sources to tax. Do you really think they are going to ignore an asset that went from pennies to $20K???

Bite the bullet, pay the taxes, avoid any unnecessary hassles.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So, you would tax people for buying the pebbles. Not even governments do that... :D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's better than taxing while holding the pebbles! Plus, if you only tax after you swap your pebbles back to money, it creates a whole list of problems I listed before. So only capital growth tax on crypto isn't gonna work, and taxing cryptos while buy/sell is not practical, I see taxing when coming in AND out as a fair compromise!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Buying and holding shouldn't be taxed because pebbles are not legal tender. Only legal tenders can/may be taxed. We would accept taxing of revenues when sold for fiat and will continue with our thesis in the next post. Thank you for your contribution to the discussion!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Litecoin, will you be my Valentine?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That is funny!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Exchanging your cryptos into USD on an exchange is a tax event and you may have to pay capital gains tax if there were gains.

You can buy stuff with cryptos directly but that's a tax event, too. If the tax authorities catch you, you will have to pay your taxes and a fine, too. And they often will at least if you're not buying OTC.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ordinary But Great

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So what benefit do you receive in exchange for paying tax to the government for buying crypto? Does your government spend that tax revenue for your benefit or for their own benefit? Does your government really protect you?

Does your government really care about you?

I have paid taxes for over 20 years and, sadly, feel robbed. My government does not even try to do a good job of respecting its own citizens, much less respecting its obligations to them.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi there @cryptoeater - I was only wondering today if there would be tax implications for earning income in the cryptocurrency world and I was going to ask #teamaustralia .

Do you know how the ATO currently views cryptocurrencies? As in are you expected to declare the income? And if you did have to declare the income are you allowed to claim the related expenses ( internet costs, travel etc).

I appreciate this is fairly new for governments to make rulings but have you or anyone you know declared this income or been challenged about the income and expenses.

Thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have a great point regarding tax on crypto. Here in the US you do have to pay taxes on crypto the same way you pay taxes on property. That being said, the best way to minimize is to buy and hold for more than a year. Short-term capital gains are taxed at your normal ordinary income tax rate while long-term gains are taxed at a reduced rate Of course, given the volatility, it still might be in your best interest to lock in the profit now and take the tax hit, but that is up to you to decide. However You don’t pay any taxes if you hold yourcrypto regardless your profits.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

While I agree taxing it as property is extremely difficult to calculate (on both sides), I see where they are coming from. If you only tax crypto when it's converted to fiat, all of the purchase paid for in crypto will go untaxed. I'm not defending it, I'm just saying I understand their POV.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

We will comment the "property" insanity in the next post. Thank you!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That’s gona be very interesting!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The only way to tax crypto that makes any sense is to tax any capital gains when your sell them for fiat. In Finland, Steem rewards are taxed as income tax because they are rewards for work. And they are taxed only when you exchange them into euros. I don't know whether you need to take fluctuations of STEEM and SBD value into account.

Working out how much you owe in taxes is a bitch. Maybe we should just move to a crypto tax haven after retirement and cash out only then...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree! That’s one of the main reasons I buy crypto and hold it long therm. I invested only what I’m prepared to loose. This way I avoid potential stress due to volatility.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Although I love the message conveyed by the text and I totally agree with it, I think that it is not considered the position of the minnows or, to continue with the analogy, what the children think.

Yes, we are the ones who have the power to say "NO" to the predatory governments that want to squander the economic revolution that Nakamoto started, but if in the end the big investors don't do the minimum enough to ensure that those governments don't come close, how we do the little ones?

I plan to open a fast food establishment and be the first establishment in my country that accepts Steem and SBD as a payment method, because here, in Venezuela, Steemit has had an unprecedented growth; but how do I do when I'm required to pay taxes? I tell them that I will not answer for those products that I was paid in SBD? Who will support me? Who is going to say: "leave him alone, he only made a transaction with a virtual currency and that's why you can not impute it"?

Big investors can. They have to be the basis to build a "free" corruption economy (we know that FIAT is the best means to corrupt any entity or official), through cryptocurrencies.

I can continue collecting pebbles in the sand, but when they want to remove them I need the support of the largest pebble collectors, otherwise I will always feel alone and afraid of the big governments.

As often happens with @adsactly, this is another enriching text; not only for the information, but for the "pedagogical" way of transmitting it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is a smart and encouraging post!

Just yesterday, a friend of my community, a steem witness, decided to leave steemit and all of the crypto world after a meeting with his lawyer and hearing what the government expect him to do in regard to taxing - he described a pretty insane proccess and requirements. I'm not sure he is entirely correct but there is a large degree of truth in what he told for sure.

People are worried about taxing and legality, but I think - like one can also understand from this article, that regulation aren't totally bad as it will force the authorities to accept crypto as fully legal which will boost things fast, we can see it already happening in some places in the world.

I hear that here in Israel, at least for those not trading but getting paid in crypto - taxing will be only when converting to fiat and it would be considered just like any other salary regarding tax matters.

I just hope people in the authorities that are open minded and freedom lovers will act from the inside to advance normal and fair solutions to this whole issue.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Folks are always going to try to find away around taxes. It's the eternal struggle.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If they accept crypto as a legal tender, and accept taxes to be paid in crypto - all good from this end ;)

This is also being discussed in the following part.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

In my opinion also, the Cryptocurrencies should become legal tender money on global level so that we all can enter into the new age of digital money with smooth, because now Cryptocurrency is becoming an great freedom.

Stay Blessed.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I don‘t think that you have to leave crypto just because of taxes. There are possibilities to handle it within the actual Tax law. Maybe there is some work to do (for example: how to find out the correct taxable amounts). I have tried to get closer to this issue for German Tax law, since I am a German Tax Advisor. Have a look at my Blog, if you are interested.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The taxation of the crypto currency is nothing more than an attempt to establish control, an attempt to prove to themselves that they are still running the game. What does it say? This shows that the government understands the whole significance of the crypto currency and understands to what it can lead in the foreseeable future. They can not lose control. Therefore, the attempt to regulate this market will continue. I'm sure this is the beginning of an invisible war, which will be won by cryptography.

The best strategy is to keep crypto-currency assets in purses for a long time. It is time that plays a decisive role. All who believed in the new digital economy will be rewarded as a result.

Thank you:)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Never the less, it was bound to happen. You don't have the kind of run-ups we've seen an expect to get away scott-free!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very much so!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

taxation = legal?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

could be debated...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @adsactly ! This is an excellent explanation about whats going on with crypto legally and your analogy with the casino is great.

If people want to keep the casino tokens and not cash out, they can go home with any color of token and not pay a dime! Next day when they come back they can use it (if not expired) and only once they cash out, they pay taxes.

Very well explained for anyone to understand!

By the way, I made a post the other day about STEEMER.NET app that @cryptomonitor is creating and mentioned you at the end!

https://steemit.com/adsactly/@gold84/an-amazing-app-steemer-net-project-app-for-windows-and-android-wallet-account-creation-price-alerts-to-your-email-an-exchange-toLooking forward to your thoughts on it when you get the chance.

Regards, @gold84

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If legal system ban crypto - we can make another type of casino, like in Japan did.

You play casino, but can't cash out in money equvalent in Japan - it's illegal. What casinos did? They made system, when you buy special casino money, play with them, and then you can buys some fancy toys with thiscasono money. After you go to street, and there you can find special pawnshop. Here you can exchange this toy for real money - it's legal))

This pawnshop related to casino))

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If I begin a session of poker at the Commerce Casino with $100 US Dollars, then buy $100 in casino chips, and then win and leave with $600 in casino chips, I still have a profit for the session of ($600 - $100) = $500. I owe tax on the $500 of income, whether I cash out the chips or not.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

❤️❤️I love this topic so much! Same happens in Russia. There they want to make crypto currency equivalent to property, thus property tax.

I feel like politicians just don't know what to do. They definitely don't want to allow this free (not taxed) "money" circulation... But also, in reality they have no idea that this can change everything for us and for them.🤔

More power to us, less to them and I think with every year they will feel how they will loose power & money. Important thing is that people don't trust media when they try to put crypto currency in bad light.👊

STEEM on

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Really a nice analogy...But you should pay your fees :p

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

yes :P

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice analogue it is. These crack-downs are just unecessary @kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey @adsactly

I’m currently trying to help a minnow start a contest for other minnows. He is giving away SBD for a reward and resteeming the submissions for the contest. But he needs help in getting noticed so he can run his contest successfully.

He is trying to create a network of minnows who will follow resteem and upvote each other so they can all grow together and not remain a small account for years. But again, he cant really get this done with his current account status being so small and unnoticed. So if you could help in any way, here his post about it:

https://steemit.com/minnow-contest/@average-joe/enter-the-minnow-contest-and-win-some-sbd-getting-minnows-and-all-users-involved-contest-1

Please check it out. Thanks for your time

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Really nice post I really liked the images they are really beautiful

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is such a great article, it was like a breath of fresh air after reading , resteemed thank you for contents like this

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Here are few tips I know about in US.

Trading cryptocurrency to fiat currency like the dollar is a taxable event,

Trading cryptocurrency to cryptocurrency is a taxable event

Using cryptocurrency for goods and services is a taxable event

Giving cryptocurrency as a gift is not a taxable event

A wallet-to-wallet transfer is not a taxable event.

Buying cryptocurrency with USD is not a taxable event. You don’t realize gains until you trade, use, or sell your crypto. If you hold longer than a year you can realize long-term capital gains

if you hold less than a year you realize short-term capital gains and losses

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The bottom line is that the elites did not make any money on crypto so now they must tell their friends in government to tax and then they will go back and lobby the goverment and get it back. Or create another market crash so they can get it back.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for sharing such information

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Chae na milie ni keheen ...zihintini...#minimum..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You can upvote it

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Na keheeni karai ni.......myaen marzi......aazi wadnawath.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yei khoesh kari

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very nice writing. Some posts are really great and we can learn a lot @adsactly

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

good but some new comer put mistake

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Crypto currencies are better because they donot need a middle man to transact it is a direct transaction which is good because its taking us to greater levels

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

My favorite line of your article "Taxation of crypto is a hypocritical joke" taking something away from someone is called theft, taking it away by force or by threat of force is robbery. but i enjoy my freedom and i will succumb to paying my share of taxes.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

good post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice information, you are good idea

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting postings and strong character mister

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is the logical story to understand about cryptocurrencies. Really this is perfect article to gather knowledge more.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I didn't really think there was any taxation on crypto. Anyways I think it's better to hold your crypto for long. In this way you have to pay less as the taxes.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Exactly friend. Crypto is defo here to stay. Tax is only a form of slavery and nothing more. If we all decided to never pay tax again there is nothing whatsoever they could do.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Taxation is not slavery taxation without representation is. In other words if you don't like the laws you change them. And if you do not pay they throw you in jail and if enough

people did not pay, many of the services many of us enjoy would go away. Simple.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Helpful as always, please never stop

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

nice analogy...thanks for sharing...i am new in the steemit..i am looking forward to your post...thank u...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You can take out the word crypto and put in any asset and make the same argument. The bottom line is the government wants their money. So you either pay or you become a criminal. I think people have to built this into their investing which is what it is at this point. If not the tax man will come calling with the police and then they will take it all.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Fear is strong in you, our young padawan! :D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good times his post stories can be inspired for other children and adults.

Nice nice post of her

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great article, learned alot from it keep up, great work buddy,

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Verry beuitiful

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

we are the grown up

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Just move to Eastern Europe where crypto is not taxed (yet).

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The information you provide helps us a lot.

Thnx for sharing

I always following u

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree If you keep your money invested and don't cash out then no taxes, paying a high fee to Coinbase for buying BTC should at least count towards something! I am holding on to all my coins until the future so I am buying buying buying I already get taxed on the money I make to buy in the first place. If I cash out for fiat then they will get the taxes.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks that's usefull as all your posts.i love your content, keep up the good work

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I’m new in crypto world, and posts like this are useful for me, I can learn how to grow up and how to be another man,

learn new things that can help me in the future. Thanks !! You really help me.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

from the past years of my existence in this world, this is the time that i have liked cryto currencies.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Governments in all countries are going to implement taxation on cryptocurency, but there is couple of pro crypto countries, like Belarus for example.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice post ..use full info.. tq for sharing... Resteem

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow interesting information it is people out there surely need to know about all this

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very informative article with a great start from childrens which were playing beside a beach @adsactly

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

good story and it reflects the problems with taxation on crypto

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

https://steemit.com/bitcoin/@lifeisfun/interesting-comparison-of-bitcoin-ethereum-and-reliance-industries

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That is definitely really interesting to be aware of with thanks for any recommendations..Resteem done

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

paper-ize everything!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have a great point regarding tax on crypto. Here in the US you do have to pay taxes on crypto the same way you pay taxes on property. That being said, the best way to minimize is to buy and hold for more than a year. Short-term capital gains are taxed at your normal ordinary income tax rate while long-term gains are taxed at a reduced rate Of course, given the volatility, it still might be in your best interest to lock in the profit now and take the tax hit, but that is up to you to decide. However You don’t pay any taxes if you hold yourcrypto regardless your profits.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have a great point regarding tax on crypto. Here in the US you do have to pay taxes on crypto the same way you pay taxes on property. That being said, the best way to minimize is to buy and hold for more than a year. Short-term capital gains are taxed at your normal ordinary income tax rate while long-term gains are taxed at a reduced rate Of course, given the volatility, it still might be in your best interest to lock in the profit now and take the tax hit, but that is up to you to decide. However You don’t pay any taxes if you hold yourcrypto regardless your profits.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

All this is new to me, but I like the comparisons you make. There seems to be some difficulty in deciding what is legal or not ...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I won a huge hand playing poker in a Casino, suddenly I had an incredible taxation before I even think about leaving the Casino. My reaction: immediately left because the tax was already paid. - Small analogy

This Taxes before you convert into fiat money are ridiculous, and the objective is to make people leave the Casino of cryptos.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

point if full of points

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @adsactly i am new steemian .Can you help me grw my blog by upvoting or resteeming maybe . any help will be much appreciated. Thanks .

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I like your post can me reblog this post @adsactly

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good written post.

They always want our money no matter what..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I like informasion and post you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

nice post We will comment the "property" insanity in the next post. Thank you!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is why some form of ONLY a sales tax should exist. I could be wrong, but that seems like the only way to tax fairly. The more money you have, the more you typically spend. That takes care of the whole equality thing. And it can take care of paying for things in crypto too. Pretty easy to have a markup

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your information I like your idea....

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post, i will resteem you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm gonna go with your view to an extent.

It's totally impossible to tax that which cannot be seen or has no proven value.

That being said, crypto has already been legalized and used as means of payment in some countries and that means they (government bodies and firms) to an extent have eyes where the money went and who it went to hence the ability to tax without error but the idea of general taxation is not right as the funds being held in crypto accounts have no actual value in fiat form as it is still fluctuating and can't be quantized unless a method is developed to calculate the average (maybe) based on previous fluctuations and future predictions of the price and even if this is achieved, how trustworthy would the method be?

I was led to believe that the entire system of crypto is designed to keep the government out as such if taxation is brought in then this aim is already defeated.

If I were to say, taxing crypto is a giant mess and will cause certain issues.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @adsactly, this post is the most rewarded post (based on pending payouts) in the last 12 hours written by a Superhero or Legend account holder (accounts hold greater than 100 Mega Vests). The total number of posts by Superhero and Legend account holders during this period was 58 and the total pending payments to posts in these categories was $5209.19. To see the full list of highest paid posts across all accounts categories, click here.

If you do not wish to receive these messages in future, please reply stop to this comment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Recommend me @nasir83, I am free writer. I'm new to steemit and still need to learn from experienced people, if you please follow me and help vote some of my posts, thank you. https://steemit.com/indonesia/@nasir83/level-44-is-full-of-meaning

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I am impress with this post because it has enlightened me the more on crypto.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I love the post, great job! I find it rather disgusting how the government thinks they can just extort our profits because they see the little people are making money!

I find it rather disgusting how the government thinks they can just extort our profits because they see the little people are making money!  That's why I think we will see a huge demand for anonymous type coins such as bytecoin, this year! Fuck the gov, and the crooked banks, they are in cahoots with!

That's why I think we will see a huge demand for anonymous type coins such as bytecoin, this year! Fuck the gov, and the crooked banks, they are in cahoots with!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree with much of what was said here, but taking money by force/threat of force, no matter the amount made, or type of money, is always immoral.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post series

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your articles are always educating. You take your time to explain analogies.

I really appreciate the way you have been carrying us along.

Nice one.

Pls post more

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @adsactly!

Your post was mentioned in the Steemit Hit Parade in the following category:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks for the awesome post. i think i can help you to find out great facts about your related industry or catagory @sumaanraina

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

maybe he flagged you to improve steem? I have no ideas.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit