Recently, due to the slump in the price of ETH, the mainstream DeFi lending protocols built on the Ethereum ecosystem began to liquidate. Many crypto giants are selling stETH and ETH to overcome the liquidation crisis, and the overall capital liquidity has declined in the DeFi ecosystem. Will DeFi mining revenue be affected?

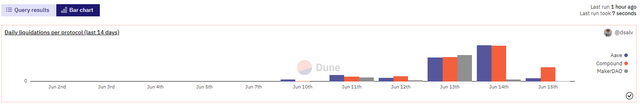

Affected by the continuous slump in the price of ETH, the liquidation of mainstream DeFi lending protocols has recently exceeded $94 million, of which Aave liquidated $46.228 million, Compound liquidated $45.48 million, and MakerDAO liquidated $2.463 million. According to sources, a wallet thought to belong to Singapore-based cryptocurrency hedge fund Three Arrows Capital sold about 33,000 ETH on Aave within 48 hours and a large amount of stETH on Celsius at the same time to repay their DeFi lending debt.

The lending protocol is one of the important infrastructures of the DeFi ecosystem. It provides capital liquidity for the DeFi ecosystem. Users can obtain interest income by depositing, or crypto assets by borrowing, so as to make more complex and profitable transactions such as adding leverage, short selling, arbitrage, etc. A sharp rise or fall in the cryptocurrency price may trigger liquidation.

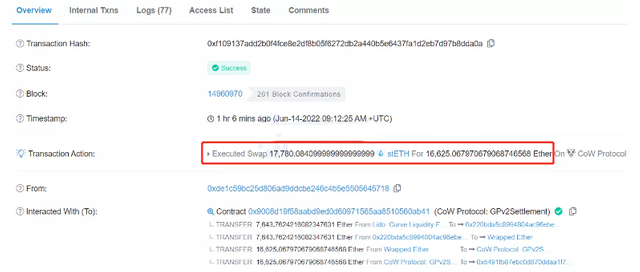

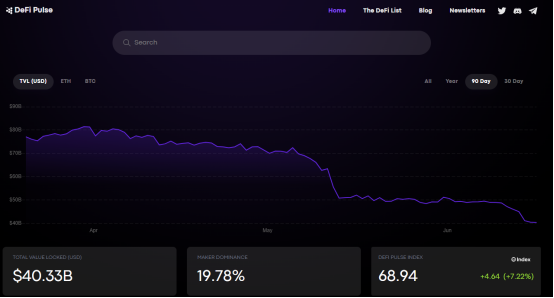

In the DeFi lending protocol, in order to ensure the assets of the depositor(contributor), and avoid borrowers defaulting on the loan, the protocol will automatically liquidate the loan of the borrowers by selling off the collateral (such as ETH or stETH and other cryptocurrencies) to recuperate their costs(such as USDT or USDC). AEX Academy believes that the large-scale liquidation will lead to a domino effect, triggering more DeFi capital liquidation, resulting in a reduction in DeFi TVL and a decrease in DeFi mining yields.

Taking this ETH price crash as an example, affected by the revolving lending problem, stETH de-pegged from ETH and caused the price fall of ETH, which led the holding giants to sell ETH and stETH in a short term to repay their loan debts. In the past 2 months, DeFi TVL has been decreasing, causing the price of ETH to continue to plummet, and so does the DeFi mining revenue.

Don't put all your eggs in one basket. The best time to increase the yield of DeFi mining through high leverage has passed. Trying some other cryptocurrency financial products that preserve capital and interest is the way to survive now.