The venture capital market in Africa is still emerging, and a few years ago there was no Venture capital funding available in Africa

Larger amounts are readily available

I have many friends and business colleague that are able to raise the larger amounts of money. With larger amounts I mean the $50 - $500 Million dollar project funding. I does make sense that the Equity funds and the larger investors base their investment on established projects and only look at 2nd or 3rd round funding. The problem in Africa, is however the initial funding to establish solid business.

I have recently read a report from VC4 Africa, which did a study about the lack of funding back in 2012. An article about the report can be read here

The study quotes research by the International Finance Corporation that estimates that up to 84% of small and medium-sized enterprises (SMEs) in Africa are either un-served or underserved, representing a value gap in credit financing of US$140- to 170-billion.

I very interesting fact that was highlighted in the report is that although more than 70% of the respondents agree that there is many of the new start-ups, are simply not fundable as a result of not very well thought through business plans, lack of quality and feasibility of the business idea.

Various sources of funding

The main sources of financing are personal and family loans (45%), private equity (19%), bank debt (18%), government funding (5%), venture capital (5%), angel seed (4%) and other (4%). “Other” funding sources include corporate funding, lease / receivables financing or stock options. Some entrepreneurs in South Africa claim that their businesses are funded using multiple credit cards because most banks are reluctant to provide a loan to businesses but are willing to increase limits on the entrepreneurs’ credit cards — expensive, but easy.

The emergence of Venture Capital in Africa

The report concludes that venture capital in Africa is still an emergent phenomenon and the majority of survey respondents (67%) agree. Entrepreneurs are forced to pursue bank loans which simply are not tailored for start-ups. Banks see start up investments as high risk, low reward and like to quote statistics that show 9 out of ten start-ups fail within the first five years of operation.

Illustrating a profitable business model is critical to boosting VC activity in Africa says the report. Entrepreneurs need to focus on being rigorous business planners and demonstrating their understanding of a particular sector to investors. Entrepreneurs must “know something about everything , and everything about something,” says the founder of First Rand Group in South Africa, Paul Harris.

Another extremely important factor to consider, is that most of the business do not offer any viable exit strategy for the investors. This is a key aspect that investors always look for.

Using Crypto Currency as initial funding for African Businesses

Let's go back to my earlier statement, where I have stated that we have access to the larger amounts of funding, that is now 2nd and 3rd round of funding in the region of $50 Million +, but most business in Africa, do not need as much. Sure, they will in the future when they are proven businesses with track records and this money will be used to expand the business further.

Is crypto currency not a viable option for initial funding of these companies?

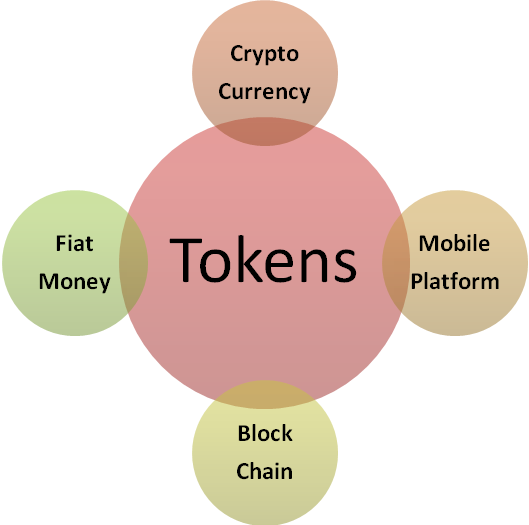

That is now companies with proper business plans, clear business ideas, and road to market and monetisation of these ideas. I am a firm believer that Crypto Currency and the Blockchain will change many African lives in the near future.

“Africa has been recently described as the next economic frontier with the necessary supporting variables to match,” he said. “The key commercial hubs on the continent like Nigeria, South Africa and Kenya not only boast significantly huge populations, but they also boast an emergent, young middle class with spending power; when you throw into this the increasing technological sophistication and consumer brand awareness, you get a demographic that is every investor’s delight.”

When we have real world onramps and inflows of Fiat into the blockchain, based on solid business principles, and also have solid off-ramps or outflows from Crypto Currency back into real world Fiat, I believe we are sitting with a winning solution.

Happy Steeming

If you enjoy my articles please follow me on my blog at @jacor

I am writing a series of articles about problems in Africa, which will be followed with how we can use Blockchain solutions to resolve the problems.

Blockchain WILL solve problems in Africa and other developing countries

Developing countries should embrace blockchain and cryptocurrency

Blockchain in Africa - The Unbanked

Blockchain in Africa - Fraud and Corruption

Resteemed

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks @goldmatters

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

tack

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

huh?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Resteemed!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you @giantbear

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very interesting. Resteemed

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks @mokluc

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted and resteemed.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks and nice to see you around @freiheit50

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @jacor

Great concept, now we need more implementation, which might not be as easy, as a lot of people don't understand the concept of crypto currency

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Writing a good and solid project is probably the first main difficulty to convince investors. But I guess this will be overcome easily with time (more trials and errors). And then, I tend to think that cryptocurrencies will definitely enter into the game in particular due to the too-many-fiat-currencies issue in Africa that you mentioned the other day.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks @jacor have upvoted and followed. Glad that talked about cryptocurrency as a possible funding stream - our crowdfunding platform based on an ERC-20 token (currently at funding stage) will open up crowdfunding opportunities to any country bringing access to funding to many countries that can't currently access major existing platforms. Check out our feed for more information. :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit