We’re now 8 months into our project and we have seen some big changes in the sentiment for cryptocurrencies as a whole. When we last performed our analysis it was early November and we were in the grip of a massive bull run which seemed like it would go on forever. Since then we have hit new highs, then collapsed and, finally, regained some poise so a number of the Collective Membership have asked for an update to the analysis of Wintermute’s returns compared to holding just a basket of cryptocurrencies or holding an individual cryptocurrency. As before I will look at the absolute return, the sharpe ratio, and the ratio of retuns to max drawdown for each option.

In addition, for this analysis, I have stripped out just the Coin Pool returns – this is the returns that would have been made without the shift of 50% of profits out to the Investment Pool (we assume consistent period returns compared to the returns actually demonstrated by the coin pool for each given period)

I will confine the tables in this Blog Post to the results of each analysis. I will also provide a link to a Spreadsheet (Analysis) where the raw figures are included so you can perform any additional analysis that would be useful (please post any insights as comments so we can all benefit). The data is analysed on a weekly basis. While this provides limited data points it has the benefit of using data points that everyone can validate themselves from published information.

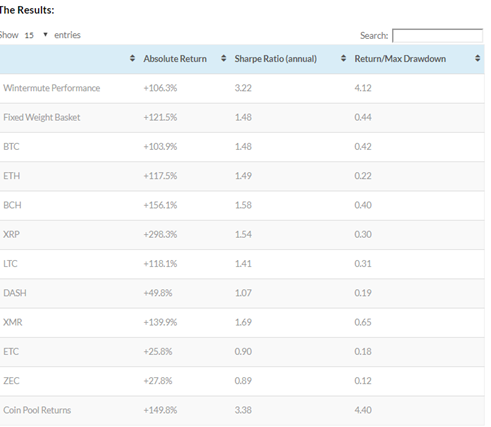

The analysis produced looks at each investment approach in terms of Absolute Return, Sharpe Ratio performance analysis and Return / Max DrawDown.

The first obvious observation is that Bitcoin is no longer storming ahead of the other cryptocurrencies. While a good performer, it is by no means the best – that award goes to Ripple (XRP) which has stormed ahead by 298%. The second observation is that, despite some of the comments out there, the performance of all the major cryptocurrencies since last September has been positive, even the worst performer on our list (ETC) has grown by 25%

It’s also worth highlighting while on the subject of absolute returns that the performance of the Coin Pool alone far exceeded the performance of AICoin, achieving a simulated +150% rather than the +106% actual performance when the Investment Pool is factored in. This is not an altogether unexpected outcome considering that we are only just about to make our first investment from the Investment Pool. So this will have had the effect of dampening the return swings while the money sat in cash.

Moving onto the risk adjusted data we see a repeat of our previous results – a clear out performance by both the AICoin asset returns and the returns of the Coin Pool alone; achieving a sharpe ratio of 3.22 and 3.38 respectively. This compares to the individual coins returning a ratio of between 0.89 for the worst (ZEC) to 1.69 for the best (XMR). Even the fixed weight basket of cryptocurrencies performed relatively poorly, returning a sharpe ratio of 1.47.

On a more basic analysis of returns / max drawdown Wintermute again outperforms the individual coins and a fixed basket. The AICoin asset pool returned a return / max drawdown of 4.12, the coin pool alone an even more impressive 4.40. The individual coins, on the otherhand, are suffering from their post December collapse of 60-70% of their value making the drawdown figure much higher than the net gains.

Now we have a little more data to draw from and more varied market conditions the strength of the Wintermute model is starting to become clear – it has learned the ability to step aside from volatile and uncertain markets. Watching the model trade and you can see that it takes full positions very infrequently and when it does it will hold it for a short period of time while the market is performing well but, as soon as the market starts to stall, it jumps out.

This has resulted in some whipsawing during periods of strength (jumping out only to jump back in at a higher level) but has also resulted in avoiding some of the stomach churning drawdowns we have seen in the major cryptocurrencies at the start of the year.

As always, comments gratefully appreciated; especially if I have made any mistakes with the figures.

Source: https://www.aicoin.io/2018/05/01/analysis-returns-date-2/

This is a copied Source - now my personal opinion, now blockchain has overtaken the world cryptomarkets and banks soon. If I was you look into more about the AICOIN company link below and invest.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.aicoin.io/2018/05/01/analysis-returns-date-2/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Coins mentioned in post:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great news Stay with me to support me

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks :) Enjoy

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit