As the government and regulators decide whether the current Wild West situation is allowed to continue, or whether they are going to introduce regulation, consumers remain unprotected,"

- UK Treasury Committee, Leader Nicky Morgan

Hey User

"Wild West Situation" - I love this term, and even the UK government is using it! In this bear market, everyone's talking, but nobody is doing anything. What does this mean for investors?

Well a lot of talking, and not much ACTION (in anything)! It turns out, it's impossible to BUILD, and LISTEN (to your users) when you're talking. So we took a break and stopped talking, and starting DOING.

Check out our Q3 recap, and be ready for a HUGE Q4 next week. Have questions? Ask me in the AMA on Token Talk, our new discussion forum!

- Emmie Chang, CEO

[ FEATURED THIS WEEK! ]

*Superbloom Q3 Recap

*Auction Feedback: Token Talk

*AC3 Announcements

*Crypto News You Need to Know

Superbloom Q3 Recap

We beta launched our dashboard on June 26th and since then have been updating every 2-3 weeks. We had a whirlwind of activity, while we staffed up, adjusted our back-end systems, and came up with more 'product' to get users excited. Here's some of the team on the night of launch!

[ Some Features We Launched ]

*Automated KYC with Jumio

*Super Rewards Support

*Eth Wallet Snapshots

*Token Talk for Discussions

*Integration with Tangem

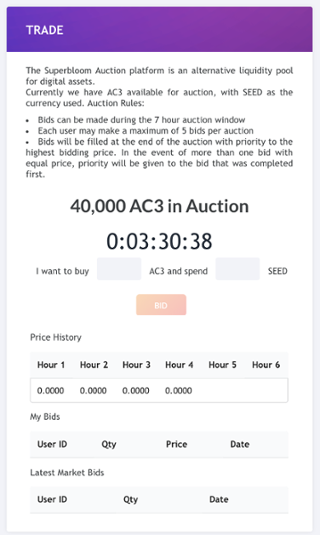

Superbloom Auction: Call for Feedback!

BETA Auction next week on Tuesday September 25, 2018

Angel and VC funded startups typically take 8-10 years to have a liquidity event! Y-Combinator's first investment to go public, Dropbox, just IPO'ed this year. Blockchain and crypto markets condensed this timeline from 10 years down to 1 minute! That's a HUGE jump-- and often times, these companies are no more than just an idea and a team.

Whereas, being 'public' is great for investors, and token speculators, this may not be the best course of action for founders, who are building a company. Just look at the erratic world of Elon Musk--and his battle with Short Sellers in a public market with Tesla--and that's worth BILLIONS!

How does a startup deal with this type of volatility and how does it bode for the investors, supporters and customers? We've seen the problems (this bear market) but how are we solving it? Superbloom is soon launching an auction based 'dark pool' liquidity market to help solve some of these pains. Please chime in with your comments and suggestions as we solve this problem together. In return for feedback, we'll give you EARLY ACCESS TO TRY IT!

AC3 is Super Reward 2- Learn More!

AC3 is a public blockchain founded by John Fields, CEO and Steve McGarry. Previously, they sold a company to AFFIRM, a Silicon Valley Unicorn (>$1B valuation) who's CEO is Max Levchin (he started a company called Paypal, with a well known Solar Car Company founder). They're focusing on the multi billion dollar education content market, partnering with some of the industry's largest enterprise partners.

This Week in the Crypto-Superbloom

YAY! You made it this far. Now, let's get the community talking about some interesting news.

I didn't make it to Consensus, hosted by Coindesk in Singapore this week, but it seems like everyone was still buzzing around. Check out this fancy party hoste dby these funds and exchanges. The big question of the week (and quarter is)

*SEC seeks more info on ETF evaluation -- will this end the bear market?

*Another $60M hack, how will it affect the Japanese and global markets?

*Ripple's flying ~40% up , how their using XRP

*Finally, exchanges are exposed for what they are.

Superbloom Network SEZC 3rd Floor,

31 Warwick Drive PO Box 2496,

George Town Grand Cayman

KY1-1104 Cayman Islands

You received this email because you are subscribed to General Information from Superbloom Network SEZC.