A loss in momentum brought exhaustion in the upside move.

Divergence in asset price and momentum oscillator has accelerated the odds of a bearish reversal.

A bear cross, represented by the 20-and 50-period (EMAs) adds to the downside filters.

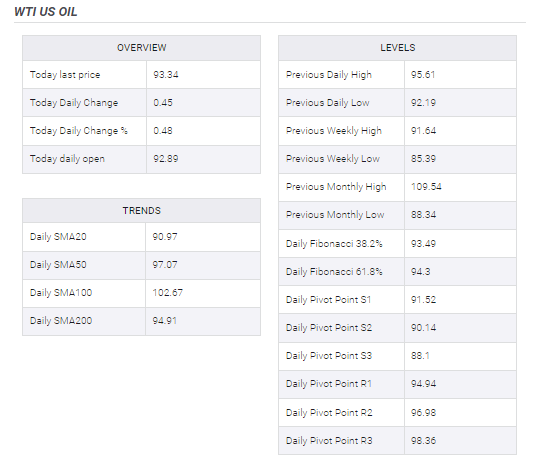

West Texas Intermediate (WTI), futures on NYMEX, has displayed a short-lived pullback after printing a three-day low of $92.16 in the Asian session. The asset is advancing higher right from the first tick on Friday, however, the downside pressure remains favored as the asset has displayed exhaustion signals after a juggernaut rally.

The sheer upside rally from the past week has met exhaustion and a correction mode is undergoing. On an hourly scale, the asset consecutively formed higher highs but with a decline in buying interest, however, the momentum oscillator, Relative Strength Index (RSI) (14) formed lower highs. This advocates a loss of upside momentum as investors are treating the asset as an expensive bet.

A bear cross, represented by the 20-and 50-period Exponential Moving Averages (EMAs) at $93.73, bolsters the case of a steep correction ahead.

Should the asset drops below the round-level support at $92.00, bears will get strengthen further and will drag the asset towards the August 22 high at $90.98, followed by August 17 high at $88.65.

Alternatively, bulls could regain control if the asset oversteps August 24 high at $95.10. An occurrence of the same will send the asset towards July 26 high at $98.4 and the psychological resistance at $100.00.

WTI hourly chart

-637970795555978833.jpg)

i would place a trade maybe . hahaha

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thats correct

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit