1. Cryptocurrencies nonetheless in Correction Mode

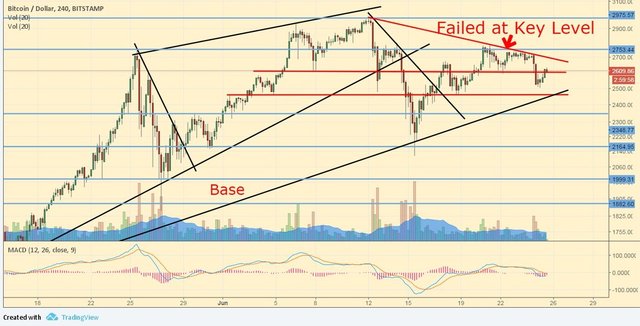

Ethereum, Bitcoin, and Ripple are both still properly under their all-time highs following a uneven sideways week for the crypto market. Litecoin’s ruin-out became the biggest circulate of the week and we assume greater to return from LTC earlier than BTC’s “Judgement Day” in August. The weekend brought every other wave decrease for the majors, but to this point, the damage is confined and the consolidation patterns are intact. The long-term photo remains supportive of extra correction for the cash after the stellar rally of the beyond few months, but it’s a bull marketplace, and surprises normally come at the upside so removing one’s core positions might be no longer a great concept.

2. The relevant financial institution Summit

the ecu relevant financial institution discussion board will take vicinity in Portugal subsequent week, and that would prove to be a game-changer, as the Federal Reserve is in a very one of a kind section of the monetary cycle than its peers, having hiked the interest already twice this yr. the eu important financial institution and the financial institution of the Japan are still inside the center of the “intense easy” territory, and given the recent issues on the global financial the front, a dovish exchange in the Fed’s rhetoric is probably much more likely than a shift from the alternative essential banks. The greenback’s weakness is reflecting this risk already, and the dip in long yields additionally suggests the stress on the Fed.

three. The Qatar Ultimatum

The Saudi Arabia-Iran electricity struggle moved to a brand new technology this week, with the ultimatum despatched to Qatar by way of the dominion and its allies. The surprising move inside the leadership of the united states additionally, the anointment of the brand new crown prince, also placed Saudi Arabia in the spotlight, and the next movements should determine the place’s political landscape, and of course, the surroundings for the sector’s energy region. The ultimatum will expire in a bit greater than per week, however the reactions of Iran and Turkey will surface earlier than, and we would learn what sanctions (or different measures) the blocking nations will apply inside the in all likelihood occasion of Qatar’s “non-compliance”.

four. Gold on the circulate?

The put up-Fed correction in precious metals would possibly have run its direction and the geopolitical tensions together with the greenback’s slide units up a in all likelihood notable week for gold. Gold has been transferring in live performance with the Yen and US treasuries, however the principal bank summit may want to alternate that if we see a new attempt from the heroes of cash printing once more. Cryptocurrencies could also advantage from a shift in the direction of “difficult” property, with in general Bitcoin being taken into consideration a secure haven currency via some. the united states GDP, durable items Orders, and CB customer self assurance reports may want to pose a danger for the steel, as a far higher than predicted string of stories should spoil the greenback’s losing streak.

5. stock Markets still appearance Shaky

market tops are approaches, not occasions. The old announcing appears to be proving proper all over again, as worldwide stock markets are long past due for a deeper correction following the Trump-rally, the symptoms (loss of momentum, deteriorating marketplace internals…) are there for several weeks now, but shares retain to grind better or sideways within the summer environment. Corrections commonly are difficult to precisely expect, however situations are favorable, and what we the market desires is a trigger to begin a promote-off. It is probably the escalation in the center East, further financial weakness, or something unforeseen, but bulls ought to hold the gunpowder dry and anticipate it before jumping in the late-bull-market celebration.

thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit