Source: https://www.altcointradershandbook.com/coin-report-cloakcoin/

In the spirit of full transparency, the following Coin Report on CloakCoin is a Sponsored Post

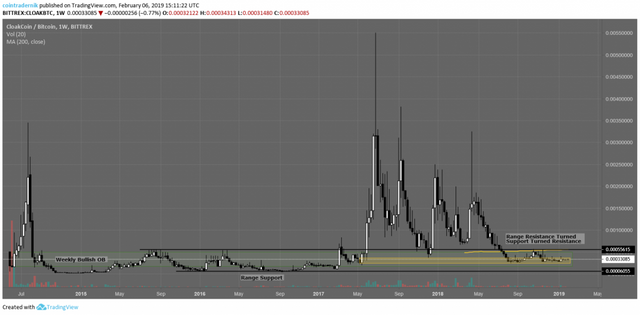

Welcome to the eleventh Coin Report. In today’s report, I will be assessing the fundamental and technical strengths and weaknesses of CloakCoin. This will comprise of an analysis of a number of significant metrics, an evaluation of the project’s community and development and an overview of its price-history. The report will conclude with a grading out of 10. I hope you enjoy the read! CloakCoin may well be the most established coin of all previously reported on, and their decision to approach me for this report led to a great deal of nostalgia. In fact, I fondly (or not so fondly, given the sleepless nights and heart palpitations) remember trading CLOAK on Mintpal. That’s right – Mintpal. For those readers unfamiliar with Mintpal, it was perhaps the greatest exchange in the history of altcoin trading; a prime shitcoin casino. I talk at length about the rollercoaster journey facilitated by Mintpal in my book, but for now it will suffice to say that those were tumultuous times and I had experience trading CLOAK from back then. The project seems to have undergone significant, fundamental changes since 2014 and has undoubtedly cemented itself amongst the minority of strong brands in the space. The purpose of this report is to determine where it stands now; what its strengths are; where it has room for improvement; and, most importantly as speculators, whether there is an opportunity here. I hope this eleventh Coin Report will prove objective where it must be and fair on more subjective matters. For those who’d like to learn a little more about CloakCoin prior to reading on, here are some primary links: Name: CloakCoin Ticker: CLOAK Algorithm: X13 (now pure Proof-of-Stake) Sector: Privacy Exchanges: Binance, Bittrex, Upbit, Livecoin & Mercatox Launch Overview CloakCoin was launched in June 2014, but due to rumours of a pump-and-dump scam and unattended development, it was abandoned. CLOAK then relaunched with a new team from the community in October 2014, operating on the X13 algorithm, with dual Proof-of-Work/Proof-of-Stake consensus mechanisms. The coin is now exclusively Proof-of-Stake. There was zero premine or ICO, and CLOAK is expected to experience 6% annual inflation in perpetuity. This is important to note, as it will play a major part in our future discussions on supply emission. Price-History Overview As CloakCoin has been around for almost five years, there is a huge amount of price-history to dissect and analyse, and the Technical section of this report will reflect that. For now, it will suffice to say that CLOAK made its all-time high against the Dollar of $31.28 (according to CoinGecko) in January 2018. Its all-time high against Bitcoin was ~0.004 BTC in July 2017. Price has experienced multiple market cycles across timeframes, but is currently trading over 96% below its all-time high. Project Overview CloakCoin is a privacy coin through-and-through, with its ultimate goal stated in the first sentence of the abstract in its whitepaper: “CloakCoin is a cryptocurrency designed to facilitate private, secure and untraceable decentralized transfers with Enigma.” We’ll come onto Enigma in depth later on, but it is, in essence, the private payments processor that forms the core of the CloakCoin ecosystem. Now, let’s crack on with some Metric Analysis: Below are listed a number of important metrics, all of which are accurate as of 3rd February 2019. For anyone reading this who has yet to read a Coin Report, it might be worth reading this section of the first report, where any potentially unfamiliar terms are explained. For any terms or metrics specific to this post, I will provide explanations besides the figures. Price: $1.09 (31322 satoshis) Exchange Volume: $97,741 Circulating Supply: 5,250,162 CLOAK Total Supply: 5,250,162 CLOAK Maximum Supply: 7,025,901 CLOAK (calculated as supply in 5 years, as there is theoretically no maximum supply) % of Max. Supply Minted: 74.73% Network Value: $5.721mn (1644.46 BTC) Network Value at Max. Supply: $7.656mn Category: Midcap Exchange Volume-to-Network Value: 1.71% Average Price (30-Day): $1.146 Average Exchange Volume (30-Day): $298,495 Average Network Value (30-Day): $6.005mn Average Exchange Volume (30-Day)-to-Network Value: 4.97% Volatility* (30-Day): -0.0083 Average Daily On-Chain Transactions (30-Day): 57 Average Daily Transactional Value** (30-Day): $344,563 (source) NVT*** (30-Day): 16.60 % Price Change USD (30-Day): -4.3% % Price Change USD (1-Year): -87.9% USD All-Time High: $31.28 % From USD All-Time High: -96.5% Premine % of Max. Supply: 0% Premine Location: N/A Liquidity (calculated as the sum of BTC in the buy-side with 10% of current price across all exchanges): 14.031 BTC Liquidity-to-Network Value %: 0.85% Amount Available on Exchanges: 107,613 CLOAK % of Circulating Supply Available on Exchanges: 2.05% *Volatility is calculated by taking the average price over the given time-period, calculating the difference between it and the highest price and it and the lowest price over that same time-period, and multiplying those figures together. The closer to 0, the less volatility during that period, and vice-versa. Read this for more on volatility. **Transactional Value in $ is calculated by taking the average daily transactional value in CLOAK and multiplying it by the average price for the past 30 days. Of course, as CloakCoin is a privacy-enabled cryptocurrency, this figure cannot be completely accurate, as some transactional value will be obscured by Enigma and thus not included in the data. ***NVT is calculated by dividing the Network Value by the Average Daily Transactional Value. See here for more on NVT. Block Reward Schedule: 6% annual inflation in perpetuity. Supply emission changes with each block. Average Block Time: 60 Seconds Current Block Height: 2440429 Annual Supply Emission: 315,009 CLOAK (98.67 BTC at current prices) Annual Inflation Rate: 6% Circulating Supply in 365 Days: 5,565,171 CLOAK Network Staking Weight: 610,441 CLOAK (source) Staking ROI (Annual): 51.6%* Masternode Collateral Size: N/A Masternode Price: N/A Masternode Count: N/A Masternode Count Growth (30-Day): N/A Supply Locked in Masternodes: N/A Masternode ROI (Annual): N/A Masternode Reward / Block Reward: N/A MNV / Network Value: N/A *To calculate annual staking ROI: (Annual Supply Emission * (Stake Reward / Block Reward)) / Network Staking Weight = 315,009 / 610,441 = 51.6% Address Count: 11820 Supply Held By Top 10 Addresses: 41.25%* Supply Held By Top 20 Addresses: 50.37% Supply Held By Top 100 Addresses: 78.38% Inactive Address Count in Top 20 (30 Days of No Activity): 7 *The richest address owns ~20% of the circulating supply, but is not tagged as an exchange-owned address, as is usually the case on Chainz explorers. Right, there’s a lot here to unpack, but where to begin? Well, given CloakCoin’s prior mentioned primary aims of being used as a means-of-payment, metrics related to on-chain transactions are of significance. As I noted in the footnote to the General sub-section, the usual issue for monitoring on-chain transactions for privacy coins is that the data is never complete by the very nature of the transactions. Despite this, there is a surprising conclusion to draw from the data available on CloakCoin… According to the Chainz explorer, CLOAK is experiencing, on average, 57 daily transactions, equating to ~$344k of daily on-chain transactional value. This is very impressive, considering that it does not take into account Enigma transactions. Such transactional value gives CloakCoin a NVT of 16.6. For context, Bitcoin’s current NVT is 130. Of course, this is a crude comparison, but it serves our purposes of estimating that CloakCoin, at current prices, seems to be of fair value at the very least. So, we’ve established that CLOAK fares well as a means-of-payment, but how does it fare elsewhere? I’ll begin with a run-through of the remaining General metrics, before moving on through the latter sub-sections, concluding with analysis of the CloakCoin rich-list. The first metric that I’d like to highlight is the the Volatility of -0.0083. Of the previous coins that this has been calculated for (MonetaryUnit and Altbet), CloakCoin has been less volatile than both over the past 30 days by up to a factor of 10. This is reinforced by the fact that the average price for the past 30 days has been $1.146 (~5% above current prices of $1.09). This can be indicative of accumulation occuring at this price, but we can only confirm this by examining the rich-list and the chart. Now, CloakCoin certainly seems to be stable of late, but how are its supply-and-demand-related metrics? Well, Liquidity of 14.031 BTC within 10% of current prices equates to 0.85% of Network Value. This is the highest degree of liquidity across all previous Coin Reports, as can be seen in the spreadsheet comparison of these metrics. So, we can be sure there is demand at current prices, but what about supply? Having surveyed the orderbooks across all listed exchanges, there is around 107,613 CLOAK available to buy, which equates to 2.05% of the circulating supply. This places it in the middle of the pack relative to other coins for which this metric has been calculated, despite the fact that, unlike many of those coins, CloakCoin does not operate with a masternode network, and thus there are fewer incentives to hold. In light of this, I feel that both metrics relating to supply and demand are very promising. Next, we should take a look at the all-time high of $31.28, as calculated by CoinGecko. This puts the current price of CloakCoin at a 96.5% discount, which, if all other fundamental and technical analyses deems the project promising, is a serious speculative opportunity. We shall soon see… Now, let’s take a look at what is usually the meatiest of subject matter within these metrics: Volume. CloakCoin traded $97,741 of volume on exchanges over the past 24 hours, equating to 1.71% of its Network Value. Further, its Average Daily Volume for the past 30 days has been around $298k, equating to a massive 4.97% of its Average Network Value across the same period. This is highly indicative of significant interest. In fact, this is the highest Average EVNV of any coin I’ve previously reported on. Given current market conditions, I am impressed. That concludes the General metrics. Now, let’s move onto Supply Emission & Inflation, taking a look, in particular, at the relationship between supply emission and volume: The supply emission of CloakCoin is as straightforward as it gets: 6% annual inflation, in perpetuity. This is the 4th-lowest inflation of all previously reported on coins, behind only ALQO, GeoCoin and Covesting. It equates to 315,009 CLOAK over the next year, which is around 98.67 BTC at current prices. Using these figures, we can calculate that average daily supply emission is 0.27 BTC at current prices, or a little under $1000-worth. CloakCoin’s Exchange Volume of ~$98k covers this emission by over 9800%. Further, its Average Exchange Volume of ~$299k covers the daily emission by over 29900%. In short, there is absolutely zero indication that CloakCoin cannot sustain current prices, even if all newly-minted supply was dumped at market daily. Lastly, we take into consideration the Liquidity of over 14 BTC, daily supply emission is covered almost 52x by buy support within 10% of current prices. Moving onto metrics related to staking, thanks to the transparency of the Chainz explorer, we can determine Network Staking Weight for CloakCoin to be 610,441 CLOAK. Using this figure in conjunction with the annual supply emission of 315,009 CLOAK and the fact that supply is minted purely via Proof-of-Stake, the annual staking ROI can be calculated at 51.6%. This is a huge incentive to stake CloakCoin, given that annual inflation is only 6%. To conclude this lengthy section, let’s take a look at Distribution: Well, whilst CloakCoin seems to have shown immense strength thus far in almost all metrics, they do fall short of their decentralization aim. The top 10 richest addresses, according to the Chainz explorer, possess 41.25% of the circulating supply, with the richest of these owning ~20%. The top 20 own 50.37% and the top 100 own 78.38%, despite there being 11,820 individual addresses on the network. Now, usually these larger address are tagged as being exchange-owned on Chainz, but this isn’t the case here and so we cannot be certain. It is, however, likely that this is cold storage for either Binance or Bittrex. Let’s dissect these top addresses: Of the top 20, 7 addresses have been inactive for over 30 days. Of the remaining 13 addresses, zero are distributing, with the vast majority either staking their positions or actively adding to positions. This is revealing, and confirms earlier suspicions that there is accumulation taking place at current prices. That concludes the Metric Analysis; onto the CloakCoin Community: There are two primary aspects of community analysis: social media presence and Bitcointalk threads. I’ll begin with the former before moving on to the latter. Concerning social media presence, there are four main platforms to examine: Twitter, Facebook, Telegram and Discord. CloakCoin is present on all platforms except Discord. To begin, let’s look at the various social metrics that I calculated from the CloakCoin Twitter and Facebook accounts: Twitter Followers: 18084 Tweets: 1294 Average Twitter Engagement: 0.23% Facebook Likes: 7282 Facebook Posts (30-Day): 38 Average Facebook Engagement: 0.07% As usual, I will be using RivalIQ‘s social benchmark report for evaluation purposes. Twitter: As is expressed in this report, the average engagement rate on Twitter across all industries is 0.046%; CloakCoin has an engagement rate that is 5x greater. Further, the average engagement rate for the Media industry (the most similar industry in the report) is 0.013%; CloakCoin’s is 17.69x greater. This is despite CloakCoin’s relatively large following of over 18,000. which is the largest of all coins previously reported on. However, whilst impressive relative to global benchmarks, CloakCoin’s Twitter engagement isn’t particularly impressive against other cryptocurrencies: in fact, it is the 3rd-lowest level of engagement of previous Coin Reports. Facebook: Regarding Facebook, it is great to see that CloakCoin do not neglect their page, unlike many projects that focus their social efforts exclusively on Twitter. The page has a strong following of over 7,000 and the team post at least once a day. That said, the engagement rate is a measly 0.07%, which below the cross-industry average of 0.16%, below the Media industry average of 0.08%, and equal-lowest with GeoCoin of all coins reported on (that actually have a Facebook page). These levels of engagement are underwhelming, especially given that CloakCoin has been around since 2014. Telegram: Now, moving onto Telegram, CloakCoin has 2658 members in its group, and seems to use Telegram as the community’s primary place-of-discussion, where other projects seem to rely on Discord. Over the past week, there have been over 50 members involved in discussion, equating to an engagement rate of around 1.88%. The discussion occurs daily and is fairly active but, given that this is the primary forum for discussion, I am surprised it is not more active. There is a lot of conversation around Enigma and its privacy advantages; support queries are responded to within minutes, usually; important resources are linked and tend to be posted daily, ensuring accessibility for new users; there is a separate Telegram group for price discussion (good idea); and there is some talk on the Fake Stake vulnerability and the fact that CloakCoin is unaffected. With regards to interesting information discovered in the chat, I found promotional videos for the coin translated in over 10 languages; a partnership with OpenSubtitles, who now accept CLOAK as payment; the team travelled to the Binance Blockchain Conference to further awareness for the project and network; and a lot of smaller, independent retailers seem to be accepting CloakCoin on a near-daily basis. Overall, the group is solid but a little underwhelming, given the scope of the CloakCoin audience across platforms and the fact that it is a well-established brand in the space. I would have liked to have seen more community-led discussion around the development and future of the project. The CloakCoin BitcoinTalk thread was created on October 14th, 2014, and has since generated 10572 posts spanning 529 pages in 1575 days. This equates to 6.71 post per day, on average. However, in the past 90 days, the thread has had 65 posts via 16 individual posters, giving an average of 0.72 posts per day; a massive decline in engagement of late. This is perhaps a symptom of the bear market, as the thread shows no evidence of a lack of commitment on the part of the CloakCoin team in keeping the community informed. In fact, most of those 65 posts in the past 3 months have been team-led, with regular, detailed updates provided by the numerous ‘Cloak Co-ordinators’. These are individuals who work on tasks for the CloakCoin project in different regions across the globe; I like that this is the approach taken, as there are undoubtedly different marketing requirements in different locations. The slight worry is that there is so little community-led discussion in the thread of late (a recurring theme). Regarding the content of the thread, I found that CloakCoin have partnered with CoinTree, facilitating payment of household bills in CLOAK for Australians. There is a high level of commitment evident to growing adoption of CloakCoin as a means-of-payment, with weekly updates on new vendors; most of these are small, but this is good to see. The obvious next step would be landing a larger, perhaps publicly-known retailer to accept CLOAK payments. As a side note, CLOAK is also now available for purchase from General Bytes ATMs, which are available worldwide. The thread also cements the brand identity of CLOAK, with reference made to CloakTV (the project’s YouTube channel), CloakWiki, DownUnder The Cloak (a blog series led by their Australian co-ordinator) and other such forms of content creation. I love the commitment shown here to keeping people informed in as many mediums as possible. CloakTV is a particularly good idea. The channel currently has 530 subscribers but I believe there is a lot of potential here if the project was to go ‘all-in’ on creating video content here. Video garners greater engagement and thus enables greater community growth. Consider, at the extreme, what Gary Vaynerchuk has done with his YouTube series DailyVee; people love to watch engaging content that focuses on the daily goings-on of the things they have a passion for. If the CloakCoin team could commit to perhaps producing weekly updates (as opposed to the current monthly videos), comprising of camera footage of the team going about the development and propagation of the project, I believe this would be a winning strategy for improving their current engagement. For the following Development analysis, I will be evaluating project leadership, the website, the roadmap, the whitepaper, the wallets and finally providing a general overview: Regarding project leadership, there are 23 core members listed on the website, plus an additional 4 advisors. There 4 Github contributors. Of the core team, there are a vast array of positions, with particularly strong experience in development and programming, as would be expected of a privacy-focused project. But there are also over 10 co-ordinators from different countries, including Australia, Italy, Russia, Netherlands, Brazil, Turkey and Vietnam. There is experience is graphic design and marketing, also. Overall, there is little to dislike here, as the team is large, strong and balanced. The first thing I’d like to say about the CloakCoin website is that it features strong branding, which is great to see. The copy is generally concise and highly informative, and the UI/UX is smooth and easy-to-navigate, with all relevant resources and social channels clearly linked (though, if the latter were also linked in the navigation menu, that would be even better, in my opinion). There is a native IRC chatroom, a Wiki featuring all frequently asked questions (again allowing for ease-of-access) and a live chat for support queries (great idea, and not something I’ve seen on a website for a cryptocurrency before). Further, the website can be translated into numerous languages. All of this serves to ensure accessibility for all kinds of users. The coin specification, key features and project overview all feature on the homepage, and there are separate pages detailing the various partnerships forged by the project and the near-80 different vendors currently accepting CLOAK. There is also a merchandise store – again, great for brand identity. https://www.cloakcoin.com/en/roadmap One thing I’d like to flag before I get into dissecting the roadmap is that the introduction reads as broken English – perhaps revise this. The roadmap itself, however, is everything one could hope for: It is detailed without being overbearing, but with a full history of events all the way back to 2014. The goals are split by quarter each year and then split again within these by month, with more detail available for each specific goal with a link to further information. The checklist design also allows users to measure progress. As the roadmap spans almost five years of material, I won’t run-through the whole thing here; instead, I’ll focus on Q1 2018 to the present day: Q1 2018: In January 2018, the project was audited by a third-party, NASDAQ-listed security firm, Cognosec, and the website was translated into multiple languages. In February, the whitepaper was revised and CLOAK was listed on OpenLedger, plus the Enigma wallet was updated. In March, the promotional video was released. Q2 2018: In April, CLOAK was listed on Binance and CryptoBridge. In May, multiple partnerships were announced and new co-ordinators joined the project. In June, there were more exchange listings, more co-ordinators onboard, a revised roadmap released and the Android wallet was updated. Q3 2018: In July, the CloakCoin audiobook was released, there were more exchange listings, the merchandise store was launched and the wallet was updated. In August, the first episode of Around The Cloak aired, the website was updated and the servers were relocated. In September, Netcoins listed CLOAK and more co-ordinators joined the project. Q4 2018: In October, there were even more exchange listings (recurring theme here) and a partnership with NEM was announced. In November, there were wallet updates, a new co-ordinator, video updates and, most importantly, integration of CLOAK into General Bytes ATMs. In December, CloakCoin partnered with CoinTree and MyCryptoCheckout, was listed on CryptoWolf and produced further video updates. Unlike everything prior to 2019, the current year’s roadmap is split mostly by category of goal rather than by quarter, with all General and Marketing tasks in progress and several tasks from Development underway, including: the creation of a development fund and subsequent governance system; updates to the Enigma codebase; Android wallet development; web wallet development and migration to the v0.17.0.1 Bitcoin codebase. The tasks to be begun include: hardware wallet integration; mobile wallet staking; iOS wallet development; a new security audit; UI/UX updates for the wallet and other general updates. Overall, this is all quite impressive and there seems to me to be no gaps to be filled in here. Perhaps the only thing I can suggest, given the ambitions of the project, is to consider funding R&D for a CloakCoin own-brand hardware wallet; not only would it cement the coin amongst the leading projects in privacy, but it would provide an additional revenue stream to supplement the upcoming development fund. https://www.cloakcoin.com/user/themes/g5_cloak/resources/CloakCoin_Whitepaper_v2.1.pdf The whitepaper is around 24 pages in length and was revised in February 2018, so is perhaps a year out of date. The primary aim is stated in the first sentence of the abstract: “CloakCoin is a cryptocurrency designed to facilitate private, secure and untraceable decentralized transfers with Enigma.” The document goes on to discuss the Enigma system at length, describing it as a payments system that facilitates private transactions on CLOAK’s network. It functions as a mixing system, incentivised by rewards given to those that enable ‘cloaked’ transactions. Section 2 of the document goes into far more detail about this process, and though the material is somewhat technical, I was glad to find that it is written in mostly jargon-free, accessible prose, which breaks down the concepts and makes them understandable for less technical users. The whitepaper then brings in the concept of CloakShield, which ensures data shared between nodes remains encrypted. This works in conjunction with Enigma and Onion Routing to ensure ultimate privacy for users. Section 5 of the document talks about where Enigma will likely be heading in the future, with aims of improvement in the Proof-of-Stake system via removal of Coin Age and the possibility to use multiple Enigma transactions cloaked within one ‘super-transaction’, rather than the single transactions currently enabled. Section 6 is a FAQ page, and within this you can find all relevant fees for operating using Enigma. The document concludes with references. Now, whilst highly informative and accessible regarding the core Enigma system, I am surprised that the whitepaper contains little else concerning CloakCoin, the project. I would have liked to have found more detail on the future of the project, as well as more general information about the coin itself, as one would expect from a whitepaper. There are Windows, Mac and Linux wallets available, as well as a paper wallet generator. There is also an Android wallet. A web wallet is currently in development and an iOS wallet will begin development this year. In general, there is much to be excited about in CloakCoin, with particular strength residing in the team’s commitment to creating a cohesive brand identity and ecosystem that combines strong marketing with equally strong development. Usually, with privacy-focused projects, the development is great but the marketing is lacklustre. This is not the case here. I want to talk a little more about the security audit mentioned earlier. You can find a copy of the report here. In the report, Cognosec identified a major issue with transaction anonymity in January 2018. What’s important about this is that CloakCoin evidently care enough about the legitimacy of the coin’s underlying technology to have it vetted and have any issues publicly flagged. This issue with the anonymity of transactions was later resolved, as were the majority of other found issues (though these were of less severity). That concludes my fundamental analysis of CloakCoin. Onto the charts: CLOAK/BTC: Weekly CLOAK/BTC: Daily I have provided three charts here for CLOAK as there is quite a lot of price-history to analyse. Beginning with the Weekly chart, we can see that CloakCoin has experienced perhaps 5 or 6 full market cycles, of varying extremities. Most importantly, however, is the fact that CLOAK is currently trading inside the range in which it traded in its first week of launch on Bittrex; a historically significant orderblock that led to the coin’s first bull cycle in 2014. Following this cycle, price formed a huge range between 6000 satoshis and 55,000 satoshis, in which two smaller market cycles played out. Price then broke out in the summer of 2017, leading to an all-time high being set above 500,000 satoshis, with several subsequent lower-highs over the course of a year. As of winter 2018, price returned to the original range from the earlier years. Looking at the first Daily chart, we can see an accumulation range that preceded the mega-bull move in spring 2017; this is where price is currently trading. In general, the minimum peak for each bull cycle has been ~190k satoshis; over 500% from current prices. Further, we can see the Daily 200MA flattening. Looking now at the final Daily chart, I have zoomed in here on more recent months of price-action. The range resistance is at ~53k satoshis, with range support at ~23k satoshis. There have been several buyups on significant volume – as confirmed by our earlier rich-list analysis. Within this larger range from last August, we have formed a more recent range since late November, between 27-36k satoshis. Price is currently floating underneath the Daily 200MA, flirting with a close above it for the first time since May 2018. Overall, for longer-term speculators and investors, I couldn’t think of a better opportunity for an entry into CloakCoin. We are at historically low prices; prices that people paid for CLOAK almost five years ago, prior to any of the present developments. There is also roughly 30-35% of downside risk, as a higher timeframe close below the range support at 23k satoshis would signal further downside. Contrast this with a statistically probable move to at least 190k satoshis in bull cycles, and you have a a roughly 16:1 reward-to-risk opportunity. This report is now approaching 5,000 words, and it is time to draw it to a close. My final grading for CloakCoin is 9 out of 10. If it wasn’t for the weaknesses in community engagement, this would have been my first Coin Report awarded a grading of 10. Lastly, here is a link to a Google Sheets file with any significant data from previous reports compiled for cross-comparative purposes. I will keep this updated as I continue to write these reports. I hope this report has proved insightful and that you’ve enjoyed the read! Please do feel free to leave any questions in the Comments, and I’ll answer them as best I can. If you’ve enjoyed this post and want to receive new posts straight to your inbox, I’ve set up a RSS-to-Email feed that will be sent out weekly; every Monday, 12pm. Just submit your email and I’ll make sure you’re included in the list. Cheers.Introduction

Fundamental

General:

Metric Analysis:

Metrics:

General:

Supply Emission & Inflation:

Staking & Masternodes:

Distribution:

Analysis:

Community:

Social Media:

BitcoinTalk:

Development:

Project Leadership:

Website:

Roadmap:

Whitepaper:

Wallets:

General:

Technical

Conclusion

Hello,

We have contacted you on Twitter to verify the authorship of your Steemit blog but we have received no response yet. We would be grateful if you could respond to us via Twitter, please.

https://twitter.com/steemcleaners/status/1094974493754306561

Please note I am a volunteer that works to ensure that plagiarised content does not get rewarded. I have no way to remove any content from steemit.com.

Thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @cloak.blog! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

!cheetah ban

Failed ID Verification.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Okay, I have banned @cloak.blog.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit