Bitcoin and altcoins are taking the investing world by storm, there's no doubt about it.

But a prudent investor will spread their investments between an array of investment classes. It's simply best to not put all your wealth into just crypto currencies or any other type of investment for that matter.

So, what are some other types of investments that one should consider?

There's the old standby's - Stocks, bonds, mutual funds. You can and should be invested in these. I'd not be so bold as to tell you what percentage you should place into these, but needless to say you should have at least some of your investments in the traditional stocks and bonds market.

But don't forget about another class of investment. It's one that's been around for thousands of years. And though it would seem it's price is being artificially held down at the moment, there is no doubt that precious metals like gold and silver is something I believe everyone should own.

I am particularly fond of silver as an investment. At this very moment, the ratio of the price of silver to gold stands at around 72.72 to 1. In other words, at this very moment you could buy 72.72 oz of silver for the same price as 1 oz of gold.

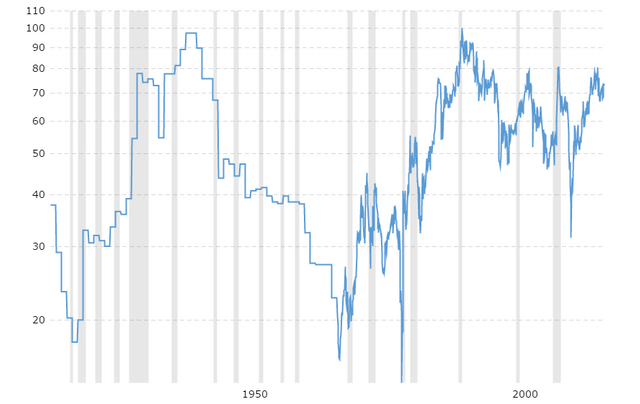

If you look at the 100-year historical record of the silver to gold ratio, however, you may notice a startling fact. For much of the last 100 years the silver to gold ratio was at 50 to 1 or less. It has even gone below 20 to 1 multiple times in the last 100 years.

What does this mean today? Consider the price of gold today is around $1280/oz and silver is at $17.60/oz. So the ratio today is

1280/17.60 = 72.72 to 1

For the price of 1 oz of gold you could buy 72.72 oz of silver.

Imagine that today you bought 100 oz of silver for $1760.00 and then you put it away in storage and forgot about it.

Then imagine that sometime in the next 5, 10 maybe 15 years, the ratio of silver to gold returned back to its historical level of 50 to 1. What would the value of your silver then be?

For this exercise lets assume that the price of gold has risen by 10%. That would put the price of gold at $1280 x 1.1 = $1408. Let's just round it down to an even $1400.

Assuming a 50 to 1 ratio of silver to gold you'd end up with this:

$1400 per ounce of gold / 50 = $28 per oz for silver

What would your stash of 100 oz of silver then be worth?

$28 x 100 = $2800, an increase of $1040.

$2800 - $1760 = $1040

That would represent more than 59% increase in value.

$1040 / $1760 = 0.5909%

That is not an inconsiderable profit by any measure.

Just something to think about.

I'm not sure how often I'll be posting articles on here, but why not follow me just in case? Who knows, I might have another few ideas to help you out down the road a ways. Good luck and have fun!!

I think silver and gold may be ready to start moving up again. Here is an article I wrote breaking down some mining companies, the better of which should outperform the metals themselves by a wide margin. https://steemit.com/money/@motowngold/i-think-gold-and-silver-are-staging-for-a-run-here-are-some-mining-stock-ideas

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Worth thinking about and acting on. Personally, I look at both precious metals and cryptocurrencies as a Chaos Hedge and allocate accordingly - not too much, but definitely a mandatory component in an overall strategy.

Good investing!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

In Business & Investing, Diversification has always been a trusted tactic.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit