How to Build a Powerful, Profitable Platform from Scratch

Bezos builds businesses like no one else — and arguably better than anyone. Each of Amazon’s 5 major divisions would be multi-multi billion dollar businesses on its own.

And each followed exactly the strategy.

Let me explain.

Platforms

Amazon is a platform company. They want a small (but ever increasing) piece of all commerce. And to date, things are going according to plan.

(For more on Amazon’s entire business, see this post).

But platforms are pretty damn hard to build — you need to aggregate a ton of users and/or customers. That takes time. And often money, lots of it.

You can’t set out to build a platform. That cannot be your first “product.”

Selling books

In 1994 Amazon launched not to build a platform, instead to build a better, online bookstore. It was super niche, super targeted.

But this wasn’t the end-all-be-all, it was phase one. It was a product, a battering ram into the hearts, minds and homes of consumers. And it worked. It was easy to understand, affordable and offered a better selection than any library or bookstore.

If customers can’t explain what you do in a sentence or two, they won’t try. This is key for any business.

And as you acquire customers and market share, expansion opportunities present themselves.But in the early days Amazon sold everything — ensuring great quality and customer service — their main differentiators today.

That wasn’t scalable.

Amazon couldn’t afford to offer (ie own) everything. That is way too much capital. It was either compromise on growth (and grow very slowly with only Amazon branded products) or open up the platform (likely the original plan)

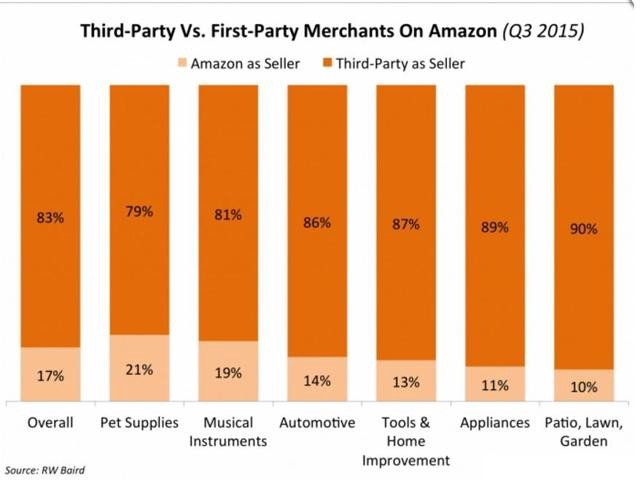

So in 2000 Amazon started allowing 3rd party sellers to sell on their site — it worked wonderfully. Fast forward to today, there are over 2M 3rd party sellers on Amazon accounting for anywhere from ~79–90% of the total products listed on Amazon as of 2015 (Source,Source).

Building infrastructure

As Amazon grew, so too did its infrastructure needs. The bandwidth and storage required to host and display images and information across Amazon.com ballooned as the marketplace grew.

Bezos bet big on in-house and decided Amazon ought to own the infrastructure. Better still, why not follow the existing Amazon.com strategy — internal and then sell externally?

AWS was born out of an internal need and an incredibly well orchestrated, easy to use cloud infrastructure.

That is how Amazon thinks.

Solve it once, then sell it — productization 101.

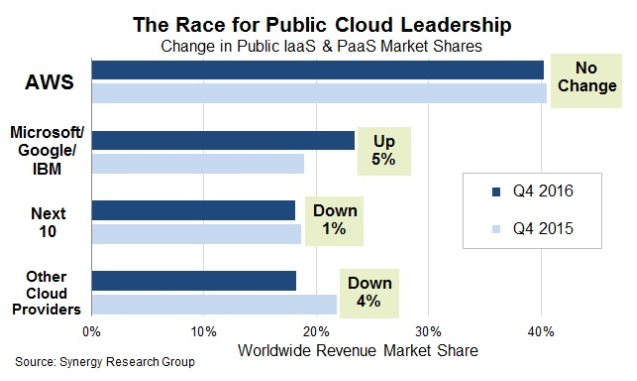

Today AWS is far and away the largest cloud service provider powering ~42% of the web — more than double Microsoft, Google and IBM (combined) and bringing in upwards of $4B per quarter.

Source: Geekwire

Alexa

The way we interact with technology is changing. Amazon (along with many others) wants to own the space/interface.

Today Amazon is winning BIG. Alexa is a cross-functional voice assistant/interface which in typical Amazon fashion is compatible with everything. If you are building a voice enabled device, Amazon wants it to be powered by Alexa — an “open” ecosystem — even if it canabalizes hardware sales.

Amazon gets it — the platform IS the product.

Voice may well be the next search, but it may mean even more. By owning the interaction, accumulating data and controlling the customer experience, Amazon is inserting themselves into each and every value-chain (a little piece of every pie).

In this instance Amazon broke its own rule — they built the platform before the product. And that was okay. Consumers already trusted Amazon’s brand (as did developers), meaning buy-in from both major parties.

In the case of the Amazon Echo and other Amazon branded Alexa products, the goal is attention, not profit. Amazon is crushing Google in terms of smart speakers shipped through a combination of rock bottom pricing and aggressive marketing and PR — flexing their ecommerce (and Whole Foods) muscle to ensure an Alexa device in every home…

The 2nd stage of platforms

As platforms grow and expand, their values and needs change. Google, Apple, and Facebook needed 3rd party developers to build the core experience and “hook” for the platform.

But as we discussed here, building on platforms is like playing with fire…

Eventually platforms reach scale and existing network effects act as a buffer to competition and value add to existing users. This point platforms no longer “need” you like so many startups, clone your product and push it to their user base.

You never know when the ground will shift.

Building a better wedge

You need a use case — “a compelling, have to have this” type use case to build a successful platform. Companies without this will struggle — high CAC (cost of acquiring a customer) and high churn.

Startups seeking funding (as well as investors) need to understand these dynamics.

It isn’t about the destination, it is about the journey. And for platform businesses specifically, planning the “correct” path is the key to success.

So how do you do it?

[LIKE THIS SO FAR?SIGN UP HERE TO GET MORE PLUS FREE GIFTS!]

The 2+ step rule

It takes at least two steps to build a platform from scratch. Even Amazon with Alexa needed both hardware (Step 1) and software (Step 2) to succeed — the Amazon Echo plus 3rd party developer support.

And even then they seeded Alexa with a set of “skills” designed to kickstart the customer experience (Step 2.5).

You only have one chance at a first impression.

If Amazon takes 2.5 steps, startups should take note.

NOTE:This is true whether you are building a social media site like Facebook or an IoT, connected home platform — it always takes longer and requires multiple hops.

This is all well and good in theory but in practice, how does it work?

Part 1: Determine end goal (i.e., build the operating system/platform of VR)

Part 2: Determine everything that needs to happen to achieve scale…

- X number of VR glasses sold worldwide

- Run your software/OS on Y number of glasses worldwide (where Y > ¼ of X)

- Get Z number of apps built-in/usable on your platform

Part 3: Create a logical plan to get from point A to point B

- Example #1:Design OS. Kickstart VR goggles. Begin ecommerce sales. Design enough apps/games. Market like crazy→ owning platform

- Example #2:Design OS. Trial & partner with existing manufacturers (open ecosystem or open source). Build developer support with 3rd party app/game marketplace → owning platform

- Example #3:Kickstart VR goggles. Partner with OS provider. Begin ecommerce sales. Design enough apps/games + onboard new devs. Market like crazy. Design new OS to replace existing one and boot existing OS from your headsets → owning platform

- Example #4:>Design OS. Kickstart VR goggles. Begin ecommerce sales. Design enough apps/games. Launch new VR products: gloves, haptics, foot sensors etc… and force compatibility between all→ owning platform

Part 4:Execute and iterate as necessary

This isn’t an exhaustive list but it illustrates the point. There are a lot of ways to achieve market domination and no perfect path to get there. You have to be able to reach, delight and retain customers/users to build a profitable, defensible platform business.

Each market is different but by-in-large, this strategy works across industries and should be emphasized when strategizing your business.

(Happy to chat more on the topic if you need help, just visitthesyndicate.vcor shoot me an email:[email protected]and lets chat.)

Common platform failures

According to the Harvard Business Review, there are 6 primary reasons that platforms fail. Rather than summarizing a well written article,you can check it out here.

1. Failure to optimize “openness” — Twitter pulled their APIs and busted profitable businesses

2. Failure to engage developers — means having to build all the apps and usage in-house

3. Failure to share the surplus — being too greedy (like Facebook is today)

4. Failure to launch the right side — who matters more: buyers or sellers

5. Failure to put critical mass ahead of money — when do you start advertising or monetizing?

6. Failure of imagination — not realizing that the platform > the products

The 7th platform problem

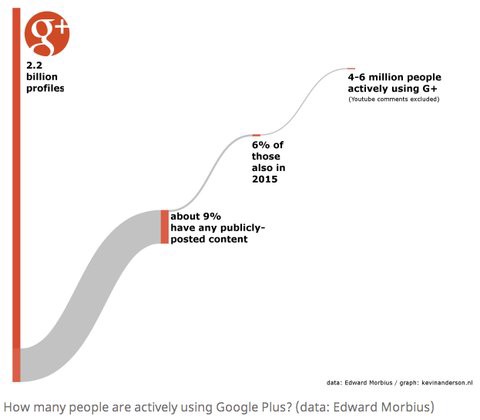

Remember Google+? It was all the rage for a while. But G+ was inherently a boring Facebook copycat. There was no unique value, it was only inferior in every way.

The seventh platform problem is competition. You need to be 5–10x better than existing product to get consumers/users to switch.

G+ never got off the ground. The same is true of any platform without sufficient differentiation and value add. It has to feel organic, not forced. And usually, but not always, copycats feel pretty forced…

Source: Business Insider

Remember, platforms are networks. Network effects matter. For more on the 5 types of network effects and how to hack them, see this post.

Closing thoughts

Facebook, Amazon, Apple, Google — today’s most valuable companies are all platforms. That is no coincidence. Platforms have pricing power and aggregate the majority of value.

And while many debate the merits and morals of such a monopolistic system, it is the world we are working with.

For a more in-depth analysis on each of above companies, seeGods of the Valley,a series of highly technical, highly researched articles on GAFA’s strengths, weaknesses, future ambitions and likely acquisitions.

Part 1 :

Amazon: The Company Consuming Consumers

Part 2 :

Google: The God of the Internet?

Part 3 :

Facebook: The King of Communication

Part 4:

Apple: The Fading Star?

To succeed in a platform world, you need to avoid and/or understand the big boys. Hope this helps.

If you enjoyed this article and learned a lot, please click through to the original Medium post and Clap it up to help reach and educate a larger audience.

Clap 50 times and follow me on Twitter:@itsmattward