The AmerG Stablecoin System & The GwaySBC Protokol Platform

In the current age of digital finance, cryptocurrencies have come into existence as an alternative to fiat currencies. However, cryptocurrencies like Bitcoin and Ether are too volatile to be used as everyday currency, and hence cannot achieve widespread adoption. This is where stablecoins come in as a solution to the volatility problem. Stablecoins are cryptocurrencies whose value is pegged to a stable asset like the US Dollar or gold, and hence, their value remains relatively stable.

The AmerG Stablecoin System is a collateral-supported cryptocurrency that preserves its value relative to the US Dollar and is based on real assets and community belief. It is a unique solution to the volatility of cryptocurrencies like Bitcoin and Ether. This whitepaper explains the limitations of existing stablecoin systems and presents AmerG as a necessary innovation for ensuring financial stability and maximizing the potential of blockchain technology.

AmerG is collateralized against real assets like Bitcoin and Ether, and its value is maintained by community consensus of 1 AmerG = 1 USD. AmerG is generated through a Collateralized Secure Loan (CSL) smart contract on the GwaySBC Protokol Platform, which is an Ethereum smart contract platform. GwaySBC Protokol uses a series of CSLs to maintain the stability of AmerG value.

The GwaySBC Protokol Platform is revolutionizing the world of Ethereum assets by allowing anyone to generate AmerG on the platform, which can be used like any other cryptocurrency - to make payments, send it to others, or hold it as savings. Generating AmerG also creates the necessary components for a reliable decentralized margin trading platform. The CSL smart contract on the GwaySBC platform allows users to generate AmerG by depositing their collateral assets, and then paying back the equivalent or partial amount of AmerG to cover the debt.

The AmerG Stablecoin System is a unique way to ensure stability and financial health in the cryptocurrency world. It is based only on real assets and community belief, making it more secure and reliable than existing stablecoin systems. The GwaySBC Protokol Platform facilitates the stability of AmerG value, creating a decentralized margin trading platform, and providing a means for anyone to generate AmerG on the platform.

Features of AmerG

Collateralized Secure Loans (CSLs):

The GwaySBC platform allows users to deposit collateral assets and generate AmerG by using Collateralized Secure Loans (CSLs). These smart contracts effectively lock the deposited collateral assets inside the CSL until it is later covered by paying back an equivalent or partial amount of AmerG.

Generating AmerG:

To generate AmerG, a user first sends a transaction to GwaySBC to create the CSL, and then another transaction to fund it with the amount and type of collateral used to generate AmerG. The CSL is considered collateralized at this point. The user then sends a transaction to retrieve the amount of AmerG they want from the CSL, and in return, the CSL accrues an equivalent amount of debt, locking them out of access to the collateral until the outstanding debt is paid back an equivalent or partial amount of AmerG.

Repaying the debt:

When a user wants to reimburse their borrowed AmerG, they can do so at any time by reimbursing AmerG, which will be burned and retrieved from the available total supply in the system. The responsibility variable annual fee can only be paid in AmerG. Once the user sends the requisite AmerG to the CSL, paying down the debt and responsibility variable annual fee, the CSL becomes debt-free.

Refinancing collateral:

When a user wants to refinance, they have to pay back an equivalent or partial amount of AmerG the debt in the CSL. The refinance variable fee is 12% for the debt balance in the user's account.

Collateral assets:

If a user has collateral items, the GwaySBC protocol can help them take advantage of them to create and receive AmerG. The protocol provides a full transparency system and ensures that every one of the user's assets is invested into the blockchain in a verifiable manner. The asset will be safely stored within the smart contract, even when it’s not being used. For safety reasons, after a 3-month cycle, all assets will be transferred to a cold wallet.

Responsibility fee:

The responsibility fee is a monthly fee rate that a user has to pay for borrowed AmerG. This innovative approach maintains balance by entrusting the user with paying back their monthly responsibility fee rate; otherwise, the protocol will proportionally decrease its asset depending on how much debt is left unpaid.

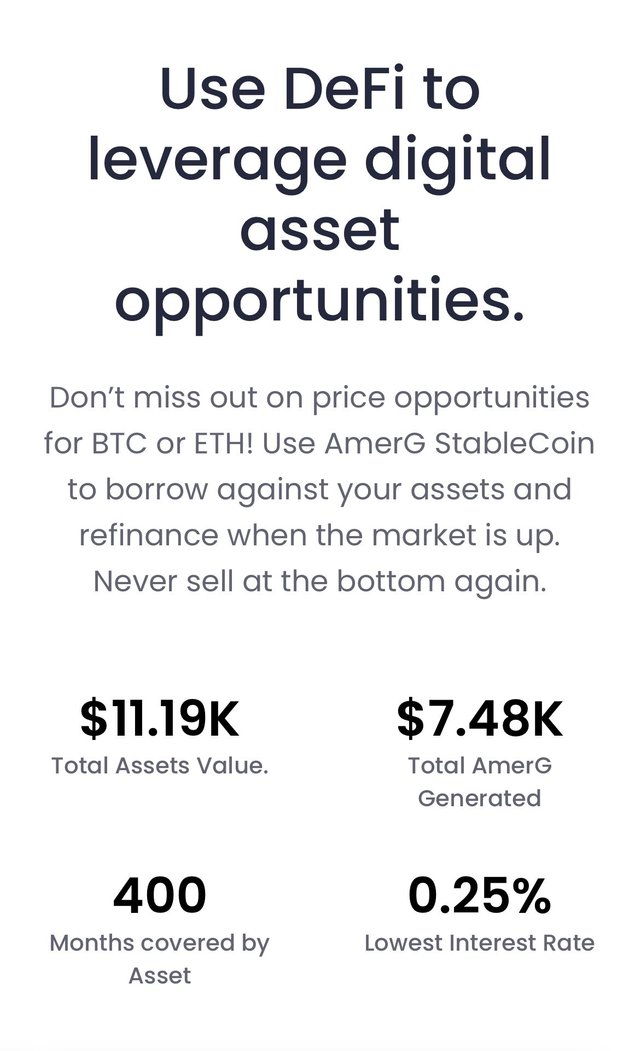

About Gwaysbc.app Dashboard

With AmerG, you can borrow against your assets and refinance when the market is up, avoiding the need to sell at the bottom. This DeFi platform offers a range of features and benefits, including a low interest rate of 0.25%, simple management tools and analytics, and a high level of transparency regarding fees.

Here are some key stats to consider:

- Total assets value: $11.25K

- Total AmerG generated: $7.48K

- Months covered by asset: 402

- Lowest interest rate: 0.25%

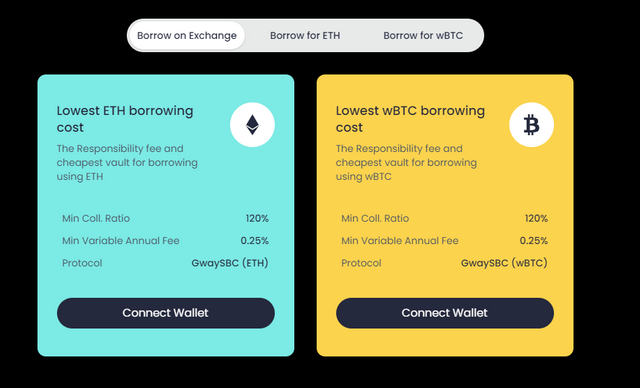

- Lowest ETH borrowing cost

- Responsibility fee and cheapest vault for borrowing using ETH

- Min coll. ratio: 120%

- Min variable annual fee: 0.25%

- Protocol: GwaySBC (ETH)

- Lowest wBTC borrowing cost

- Responsibility fee and cheapest vault for borrowing using wBTC

- Min coll. ratio: 120%

- Min variable annual fee: 0.25%

- Protocol: GwaySBC (wBTC)

But that's not all. GwaySBC.app also offers an asset dashboard, governance, and a PinkSale Launchapad for GwaySBC DAO (GSBC). Plus, you can generate passive income from your existing cryptocurrency holdings.

GwaySBC DAO (GSBC) Tokenomics:

Token name: GwaySBC DAO

Ticker Symbol: GSBC

Total Max Supply: 1.000.000 GSBC

Ethereum Blockchain: 0x69187f50317048147d32f0482774300e2255c73a

Audit: SpyWolfNetwork

Ready to get started? Explore the functions and terminology of GwaySBC.app, and check out their roadmap, support, and contact information. Don't miss out on the latest news and updates - subscribe to their newsletter today.

Conclusion:

AmerG is a stablecoin that is backed by collateralized secure loans on the GwaySBC platform. The platform's unique features, including collateralized secure loans, transparency, security, and responsibility fees, make it an innovative and reliable solution for stablecoin users.

WEBSITE: https://gwaysbc.app/

ROADMAP: https://gwaysbc.app/roadmap

TELEGRAM: https://t.me/GwaySBC_Channel_Official

TWITTER: https://twitter.com/GwaySbc

DEXTools: https://www.dextools.io/app/en/ether/pair-explorer/0xa4aca6750a7060c19cbb5149f9ae2abfda15c348

Writer content:

BTT Username: Valerio Candreva

BTT Profile Link: https://bitcointalk.org/index.php?action=profile;u=3425028

BEP-20 Wallet Address: 0x517Cb14829bCa427783299ae2806992c302f0072