SuperEx officially launched its AMM (Automated Market Making) feature on December 24, enabling ordinary users of centralized exchanges to quickly list tokens. Users can also provide liquidity to pools to become market makers and earn trading fee rewards returned by SuperEx.

AMM, or Automated Market Making, calculates buy and sell prices based on a formula, providing continuous quotes for the market. SuperEx combines AMM with an order book mechanism, where the system automatically converts liquidity pools into order books.

The unique “Free Market” feature of SuperEx integrates seamlessly with AMM:

Enhanced Liquidity: Project teams and users can easily create liquidity pools, improving trading efficiency and market depth.

Stable Earnings: By participating in liquidity pools, users can earn trading fees, offering stable returns and convenient operations.

Fair and Open: It provides new projects and innovative assets with a fast entry to the market, supporting the diversification of the blockchain ecosystem.

Efficient and Convenient: The AMM + order book mechanism automatically converts liquidity pools into order books, delivering a better user experience.

Zero Fees for Transfers: Assets between spot accounts and market-making accounts can be transferred in real-time by adding or withdrawing liquidity. Users have unlimited daily additions to liquidity, and the process incurs no fees.

Three Steps to Add Liquidity and Earn AMM Rewards

By adding liquidity to a target trading pair through AMM, users can earn AMM rewards in just three steps:

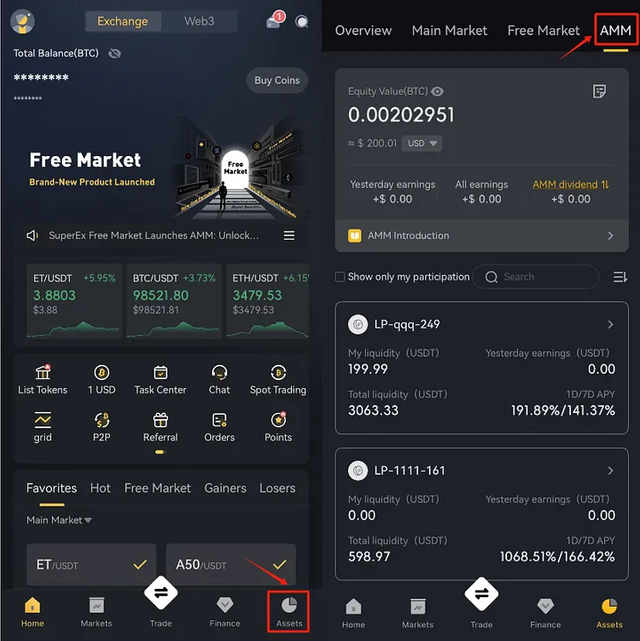

Log in to your SuperEx account.

Select the trading pair you want to add liquidity to.

Navigate through: [Assets]→[AMM]

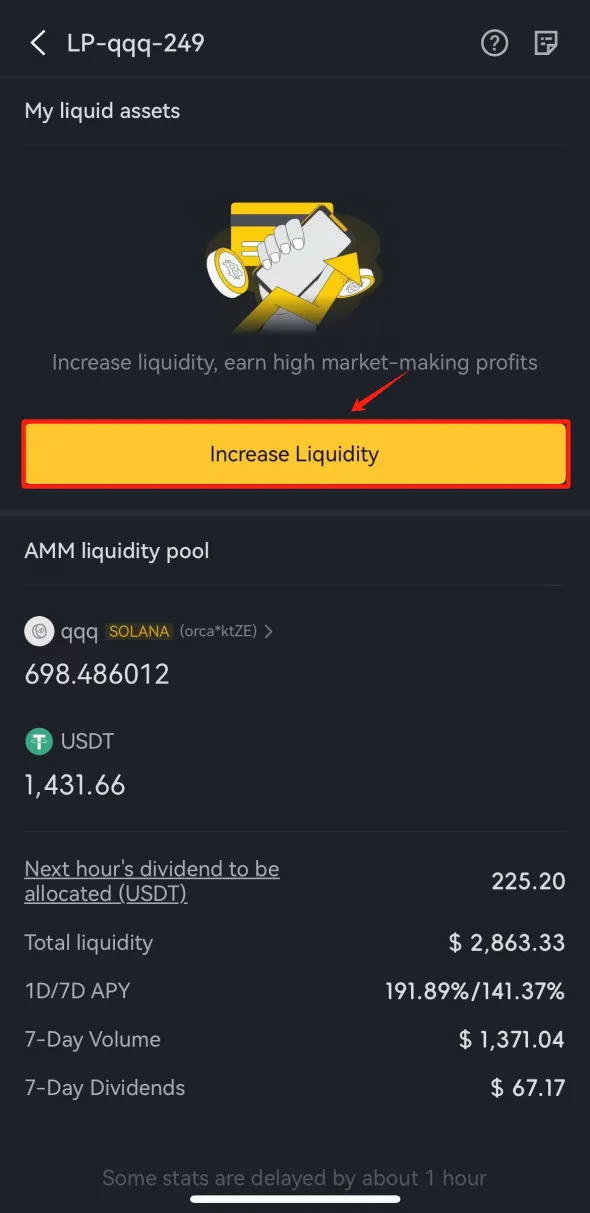

→ view all AMM market lists, liquidity market value, fee income and other information. Select the trading pair you want to increase liquidity and click [Increase Liquidity]

- Add liquidity to the target trading pair.

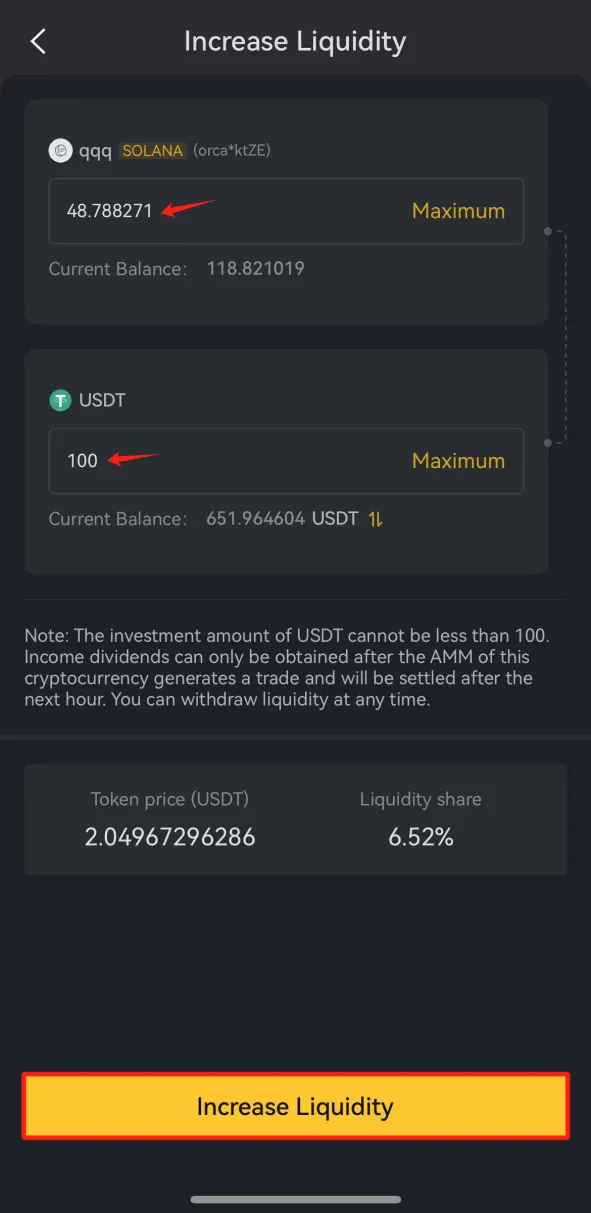

Enter the amount of the target token. The system will automatically calculate the corresponding amount of the other token in the pair. Confirm the details and click Add Liquidity.

Additional Notes

Each addition must include assets worth at least 100 USD.

AMM rewards are automatically credited to your AMM account.

The transaction fee earnings calculation cycle is 1 hour.

Adding liquidity requires depositing a combination of the target token and USDT.

Transaction fees are distributed among all liquidity providers based on their share of the liquidity pool.

The launch of AMM deeply integrates the “Free Market” listing feature with the AMM functionality, marking a new era of more efficient and open trading in the Free Market.