I haven't seen such a bold design for a while, AMPL impressed Blue Fox Note! Regardless of the success of AMPL, it will leave a mark on the history of encryption. At the same time, it will definitely be a highly controversial project, which will accompany it until it finally succeeds or fails.

For this reason, Blue Fox Note will continue to pay attention to its subsequent evolution.

Bitcoin's vision and challenges

The birth of Bitcoin was to build a system completely different from fiat currencies. It tried to change the problems of currency inflation and the recurring economic crises of the credit economic system. This is also Satoshi Nakamoto's original vision: to build a peer-to-peer electronic cash payment system.

In the practice of Bitcoin for more than ten years, it has achieved great success, from when few people were interested in it, it has grown into a cryptocurrency with a market value of more than 160 billion U.S. dollars. In the course of this development, people gradually discovered that Bitcoin presents the characteristics of digital gold. Due to its future rising expectations, Bitcoin holders are more willing to hoard rather than use it for daily consumption and payment.

Bitcoin has gradually occupied the position of digital gold. Its main purpose is not a medium of exchange or a unit of valuation, but a store of value. (Of course, as long as it occupies the top spot in the store of value, it also means that it still has huge space. At present, the value of gold is about 10 trillion US dollars. Compared with the store of value in the form of gold, Bitcoin has its own advantages. Bitcoin. The currency still has a lot of room from its end.)

Bitcoin's current direction is largely determined by its inherent characteristics:

Hard top

There are only 21 million Bitcoins, and it will not be issued. This causes it to become scarce. The scarcity has led to huge expectations of rising prices. But at the same time, this has also led people to regard it as digital gold for storage.

Throughput and speed limitations

Bitcoin's TPS is about 7, which makes it completely unable to become a currency for daily payments. For remittances, this waiting time is acceptable, but if it is a daily payment, it cannot be tolerated.

These inherent characteristics of Bitcoin have their greatness, because it tries to solve the problems of inflation and credit economic system, but from the development of the past ten years, Bitcoin still has a long way to go.

As Bitcoin gradually moves toward digital gold, people gradually expand their perspectives to a larger area. Is it possible to design a stable encrypted native currency that can simultaneously realize the functions of value storage, unit of valuation, and medium of exchange.

There are currently three main schools of stablecoin experiments. One is stablecoins anchored to USD, such as USDC, which can be redeemed 1:1 with the US dollar; the other is stablecoins generated based on over-collateralization of encrypted assets, such as DAI, which anchors the target. For the US dollar, but not hard anchored. The last type is a fully encrypted native decentralized stable currency. Regarding the exploration of stablecoins, Blue Fox Notes has previously published articles such as "The Holy Grail of Stablecoins: Exploration of New Paths", "Meter's Road to Stablecoins: Explorations That Are Completely Different from Libra".

AMPL is one of the boldest explorations of cryptocurrency experiments

AMPL is a continuation of cryptocurrency innovation. It combines some of the characteristics of Bitcoin and legal currency. If an equilibrium can be developed, it is possible to develop new things in the next ten years. Of course, this is also accompanied by huge risks and uncertainties.

At the same time, AMPL cannot currently be regarded as a stable currency. It is not supported by fiat currency or other assets. It is more like a native cryptocurrency, trying to find a certain equilibrium of crypto assets, trying to develop asset types that are not highly related to Bitcoin and other crypto assets.

In the short term, it is unlikely to become a price-stable cryptocurrency. Of course, if it has a chance to achieve a balance of supply and demand in the future, it may form a certain effect of encrypted native stable currency. But this is unlikely to be achieved in a long time. Therefore, in the short term, AMPL is also an encrypted token with certain volatility, rather than a crypto-native stable currency.

AMPL is trying to become an asset that is not highly relevant to other cryptocurrencies in the short term. The medium-term goal is to become one of the basic components of DeFi, such as a decentralized encrypted collateral. The ultimate goal is to become a better Bitcoin that can be used at the same time. It has the characteristics of value storage, pricing unit and medium of exchange, and has the characteristics of encryption native, no inflation, flexible supply, no trust, no dilution, etc.

In short, AMPL's mechanism design and vision destined it to be a highly controversial project. People's perception of it will be polarized.

AMPL pursues the scarcity of ownership, not absolute scarcity

Unlike Bitcoin's absolute scarcity, AMPL pursues alternative scarcity. AMPL does not have a fixed supply, which breaks the inherent thinking mode of the encryption field, which is hard-top thinking. But it is different from the traditional fiat currency inflation system. It has no hard cap and can also solve the problem of unlimited issuance and inflation. This is what makes AMPL unique: based on the scarcity of ownership.

Specifically, it incorporates the idea of no dilution of Bitcoin. As long as users have a certain percentage of AMPL, it will never be diluted. Why? Because it can be issued with additional issuance of AMPL, shrink and shrink, it is an elastic supply, but the proportion of user ownership remains unchanged. Of course, if you buy more, it is equivalent to an increase in the ratio.

In other words, the number of tokens may increase or decrease, but it is essentially similar to the fixed supply of Bitcoin. For example, if you own 1btc, then you have a ratio of 1/21 million of the entire Bitcoin. As long as the market value of Bitcoin is rising, the value of 1btc itself will also increase because it will not have additional issuance.

By the same token, in AMPL, after purchasing a certain amount of AMPL, its proportion in the overall AMPL token is fixed (assuming not to buy or sell). When AMPL is issued, the AMPL in the wallet will increase in the same proportion; when the AMPL decreases, the AMPL in the wallet will decrease in the same proportion. If users hold AMPL for a long time, it essentially expects the overall market value of AMPL to rise. This is similar to Bitcoin. Of course, there will also be many users who make short-term quick buying and selling in order to achieve arbitrage.

AMPL applies the logic of supply and demand to elastic supply

As mentioned above, AMPL does not have a fixed supply. The problem is that since there is no fixed supply. So, what is the basis for the increase or decrease of its supply?

The most basic logic of economics is based on the relationship between supply and demand. This is the basis of all transactions and the essence of the market. AMPL applies the logic of supply and demand to cryptocurrency, and regards currency as a commodity based on supply and demand.

Traditional monetary policy is generally an important tool for regulating the economy. The formulation and implementation of its policies involve political, economic and social factors, and often face information asymmetry. This is why Hayek believes that the traditional monetary system cannot operate effectively.

AMPL is relatively simple and rude, and the main logic that determines its supply is the relationship between supply and demand in the market. It will not associate monetary policy with economic or social issues (such as corporate credit crisis, employment and many other complex issues).

Because its logic is relatively simple and transparent, its issuance volume and price fluctuations are clearly visible and expected, which makes it possible to achieve a certain balance through the game mechanism of the market.

How is it done?

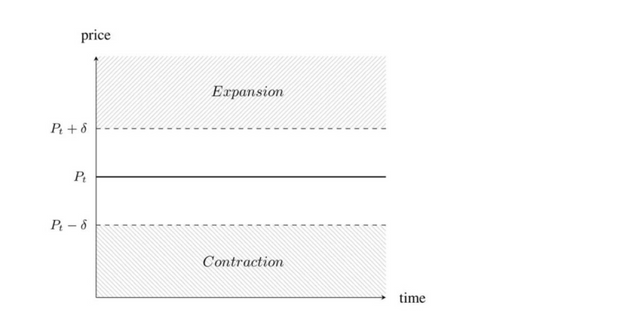

AMPL is a smart contract based on Ethereum. The AMPL protocol can automatically adjust the amount of AMPL tokens on all user wallets. When the market price of AMPL is higher than a certain threshold of the target price, the token balance in the wallet will also automatically increase, which is equivalent to issuing additional issuances to all wallets in proportion; when the market price of AMPL is lower than a certain threshold of the target price, the tokens in the wallet The balance will be reduced proportionally.

This is the most important "token base readjustment" in the AMPL protocol. The token base is re-adjusted every 24 hours (currently at 10 am Beijing time). This adjustment will not cause dilution, but will increase or decrease in the same proportion.

Since the adjustment is related to the price of AMPL, this requires the participation of the oracle. The AMPL protocol uses a market oracle system, including whitelisted independent data providers, who provide a 24-hour average price based on the weight of the transaction volume to the aggregators on the chain.

According to the price of AMPL, if the agreement finds that the total amount of AMPL needs to be re-adjusted, it will adjust it once a day. However, in the implementation process, it has a smoothing process of supply. This is also part of the AMPL protocol algorithm, whose purpose is to avoid overreaction of the protocol.

Specifically, if the exchange rate is 1.2AMPL:1, according to the AMPL mechanism, each wallet balance should be increased by 20% of AMPL tokens. If the exchange rate is 0.8AMPL:1, then each wallet balance should be reduced by 20%. However, this adjustment will not be executed immediately, and it will be over-smoothed for some time.

This period of time is in days, so this period of time can be counted as k days. If it is a deviation of the above 20%, the agreement will update the wallet balance according to 20%/k. If k is 10 days, then the updated balance is 2% of the total. However, the percentage of this numerator is recalculated every day and is executed every 24 hours. This operation is stateless, that is, the agreement will recalculate the supply target according to its latest price every day, and calculate the target for the next k days accordingly. To adjust the supply.

In summary, AMPL has a target price. If its target price is $1, then its nominal exchange rate is higher than a certain threshold, and the agreement will increase the number of tokens for all users year-on-year; if the AMPL price is lower than the target price by a certain amount Threshold, then the agreement will reduce the number of tokens held by the user.

AMPL encourages people to play games and arbitrage through the transmission of exchange rate price information

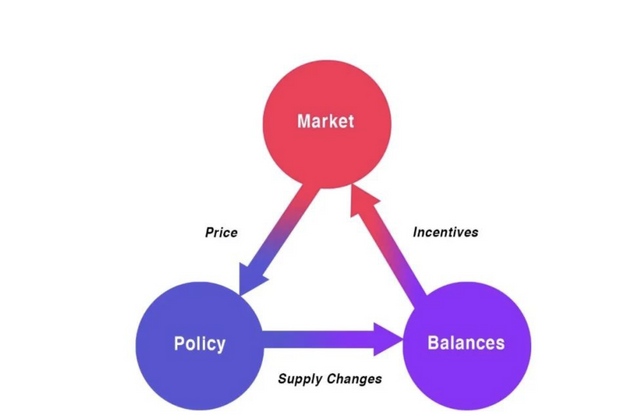

The balance of supply and demand is transmitted through price information, and it promotes people's game and arbitrage to achieve. This is the key point for AMPL to achieve its price balance.

Through the timely transmission of AMPL price information, the daily increase or decrease of AMPL can be expected. These are transparent and predictable. This will drive the user's decision and behavior. It is a completely decentralized network composed of many different participants. What motivates participants to make decisions is AMPL's price information and its supply increase or decrease information. Participants' response to supply and price information will in turn affect prices and supply, and ultimately achieve a certain equilibrium.

(AMPL’s feedback mechanism, SOURCE:AMPL)

If it is a long-term holder, the number of tokens will change daily according to the ratio, but the corresponding ratio will not change. For short-term traders, they will carry out arbitrage through short-term trading to achieve a balance between price and supply.

Assuming that the target price of AMPL is US$1, a short-term trading user Xiaolan initially held 1AMPL. Due to the increase in demand, its market price rose to US$1.2, which was 20% away from the target price. The agreement will issue additional tokens. At this time, Xiaolan owns 1.2 AMPL and the price remains at 1.2 USD. This means that Xiaolan can sell for arbitrage. When the AMPL price pulls back to the target price, that is, when the 1AMPL target price is $1, if Xiaolan has no short-term operations, Xiaolan still owns 1.2 AMPL, and the overall proportion remains unchanged. And if Xiaolan sells and buys in a short-term, he will have the opportunity to obtain more AMPL, and the overall proportion will rise. Of course, this also involves grasping the timing of the transaction, and there is a certain degree of difficulty. According to the current situation, as of the writing of Blue Fox Notes, the price of AMPL was US$2.669, and its target price was US$1.009. As demand has been rising, this will lead to continuous additional issuance of AMPL until the demand drops, and the price will be pulled back to the target price.